Avantis (AVNT) Price Recovers 25%, But Are Whales Supporting The Altcoin?

Avantis (AVNT) has gained over 50% this week, but its broader trend remains weak. On-chain data shows limited whale activity and mixed technical signals. For a sustainable rally, Avantis must reclaim $1 and attract large-money inflows — without these, the recovery risks fading as quickly as it began.

Over the past month, Avantis (AVNT) has dropped more than 60%, extending its broader downtrend. The token hit an all-time high near $2.66 in September but has since struggled to reach even half that level.

While it has bounced more than 50% this week, the rebound may not be enough. For Avantis to shun month-on-month bearishness, it needs two things — whale support and a clean reclaim of the $1 level. This piece discusses why and how.

Whales Remain Absent as Key Money Flow Metric Stays Weak

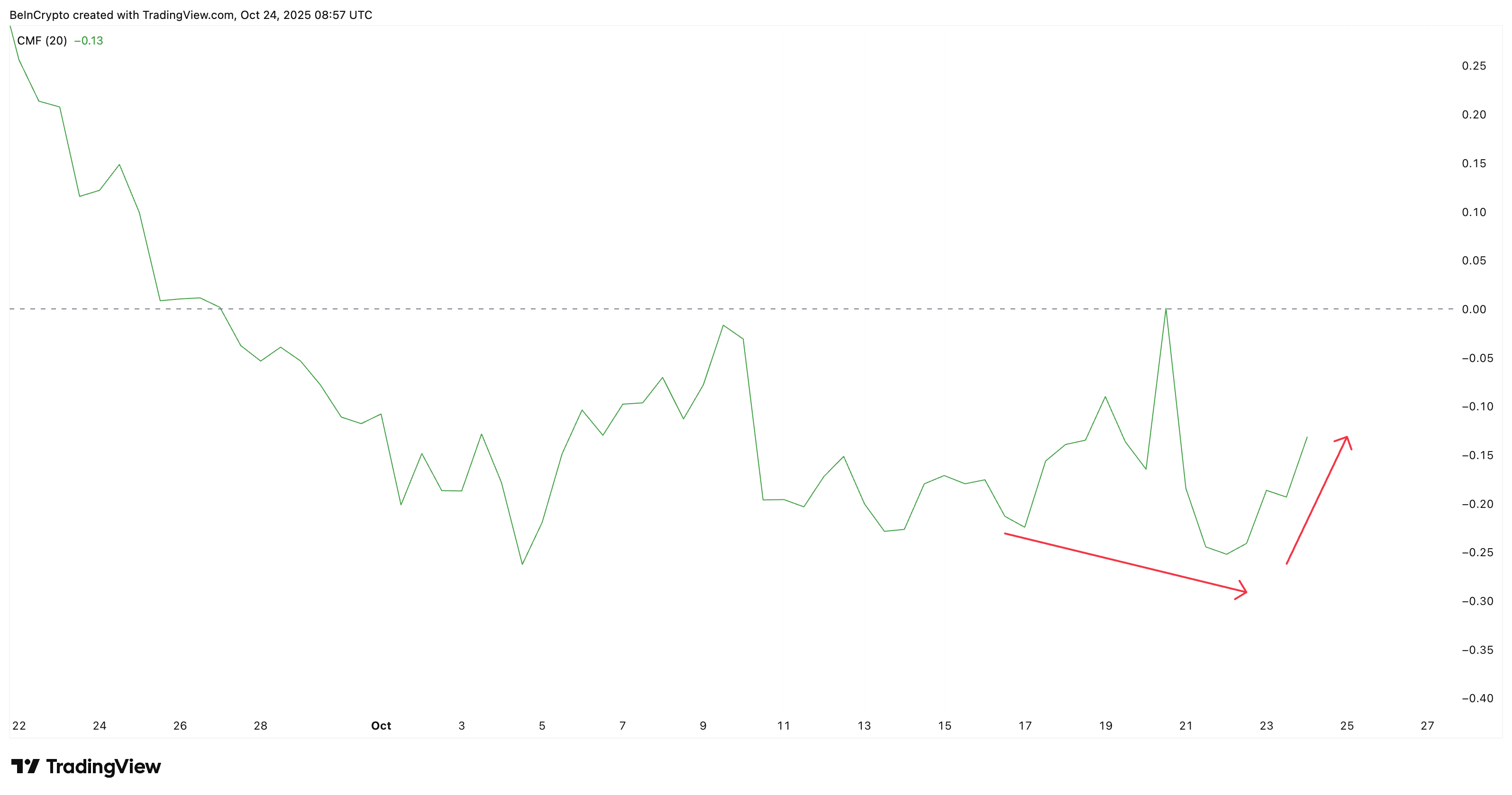

The Chaikin Money Flow (CMF), which measures whether large (supposedly whale) money is entering or leaving a coin, still signals weakness.

The last time CMF was above zero was between mid- and late-September, when the Avantis price rallied to its all-time high. Once CMF dropped below zero on September 26, the token started its month-long slide.

Now, CMF continues to show limited inflows. Between October 16 and 23, it made a lower low, signaling that large wallets are still not accumulating. Although CMF has curled up slightly, the move remains weak.

Avantis Whales Aren’t Putting In Large Sums:

Avantis Whales Aren’t Putting In Large Sums:

For the AVNT price to show true strength, CMF needs to cross above the zero line — something it failed to do during its October 20 attempt, which led to another short-lived price bounce.

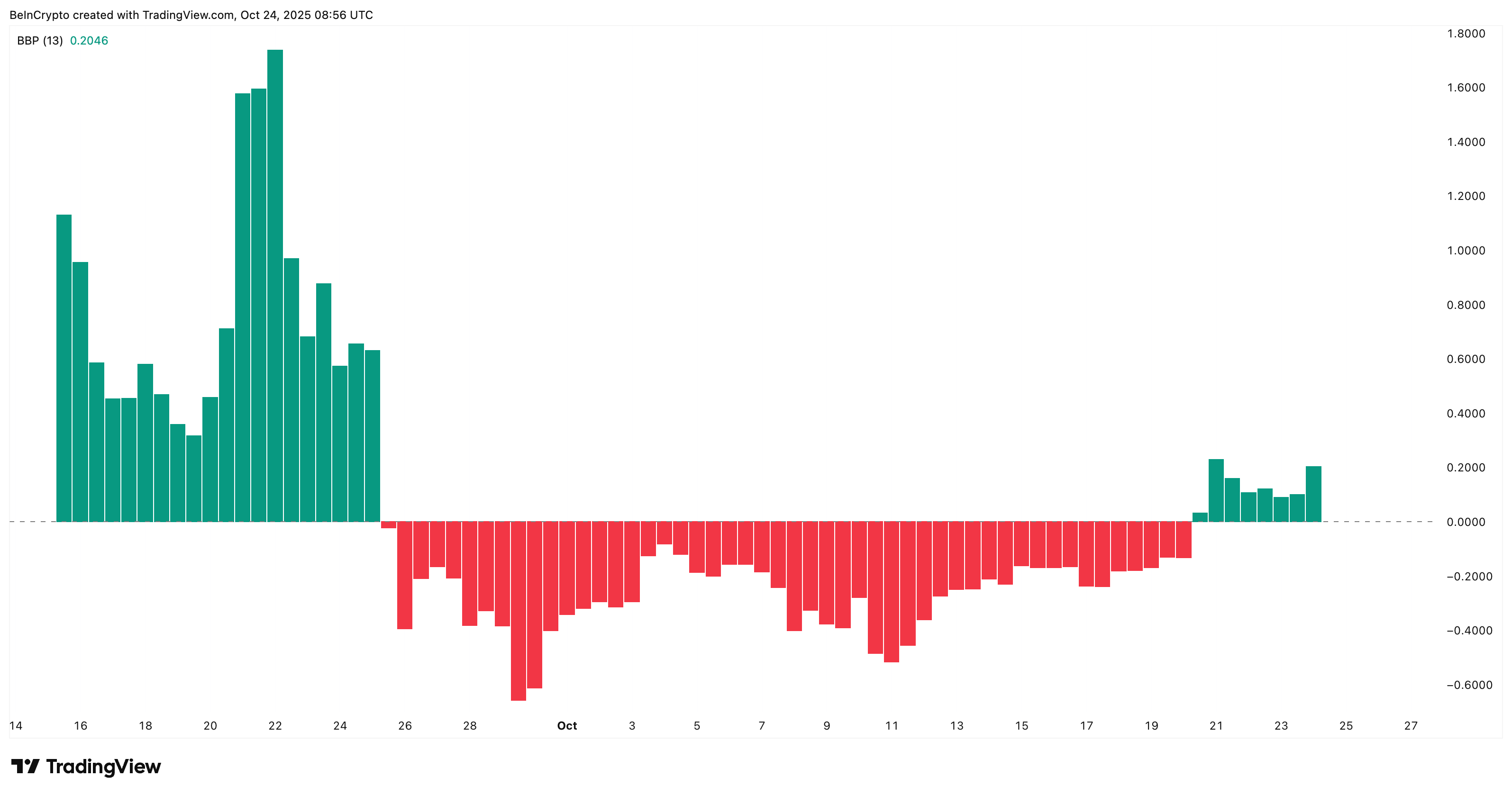

The Bull Bear Power (BBP) indicator, which compares buying and selling pressure by tracking how far prices move from their average, has turned green since October 20.

The green bars have been getting stronger with each session, all thanks to Avantis’ growing DeFi presence. Yet, there lies a catch to this bullishness.

AVNT Bulls Gaining Partial Control:

AVNT Bulls Gaining Partial Control:

BBP must rise further while CMF turns positive for both small and large investors to be in sync. Until whales join in, the bullish recovery remains speculative. Even the stronger BBP candles might mean partial bull control and not be able to break the month-long bearishness.

Avantis Price Pattern Looks Bullish, but Divergence Suggests Caution

On the 12-hour chart, the Avantis price trades within a falling wedge — a bullish setup where prices form lower highs and lower lows inside narrowing trendlines. This usually shows that sellers are losing control.

But under the surface, a hidden bearish divergence has emerged between October 10 and 21. During this time, prices made lower highs, while the Relative Strength Index (RSI) — which measures buying and selling momentum — made higher highs.

This pattern often appears during short-term rebounds in a broader downtrend (monthly from the AVNT price). It is a warning that the upside price move could lose steam.

To break out of this structure and invalidate the divergence, the Avantis price must close above $1.00. That would confirm renewed buying pressure and open the way to $1.32. This is a key resistance that once served as strong support during the earlier decline.

Avantis Price Analysis:

Avantis Price Analysis:

Reclaiming $1.32 could even prime the AVNT price for a broader rally toward $2.66, near its previous high.

On the downside, the token needs to hold above $0.57. A drop below that level could expose $0.46, where the wedge’s lower trendline sits. The trendline itself has only two touchpoints, meaning it’s relatively weak — and any break could trigger a rapid correction, especially if CMF stays negative and BBP turns red.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.

JPMorgan Chase issues Galaxy short-term bonds on Solana network

The three giants collectively bet on Abu Dhabi, making it the "crypto capital"

As stablecoin giants and the world's largest exchange simultaneously secure ADGM licenses, Abu Dhabi is rapidly emerging from a Middle Eastern financial hub into a new global center for institutional-grade crypto settlement and regulation.