Bullish Industries Support FLM, Yet Core Fundamentals Remain Uncertain

- Flamingo Finance (FLM) gains traction amid bullish trends in renewables, aerospace, and crypto sectors, driven by technical indicators and sectoral capital inflows. - Market optimism is reinforced by First Solar's $286 price target and FTAI Aviation's 16–97% upside potential, highlighting durable competitive advantages in infrastructure and margins. - Crypto regulatory shifts, including Crypto.com's U.S. bank charter filing, signal maturing digital asset ecosystems that could enhance FLM's tokenomics int

Flamingo Finance (FLM) has caught the eye of market observers as it navigates a generally optimistic environment spanning major industries such as clean energy, aerospace, and digital currencies. Although FLM’s underlying fundamentals are still being evaluated, current market trends indicate that a breakout could occur if liquidity and technical signals converge favorably.

Part of this positive sentiment stems from a wave of bullish outlooks in adjacent sectors. For example, Needham recently assigned a Buy rating to

Digital asset markets are also adding to the overall bullish tone. Crypto.com’s application for a U.S. National Trust Bank Charter with the Office of the Comptroller of the Currency (OCC) marks a regulatory development that could help legitimize digital asset banking, as noted in a

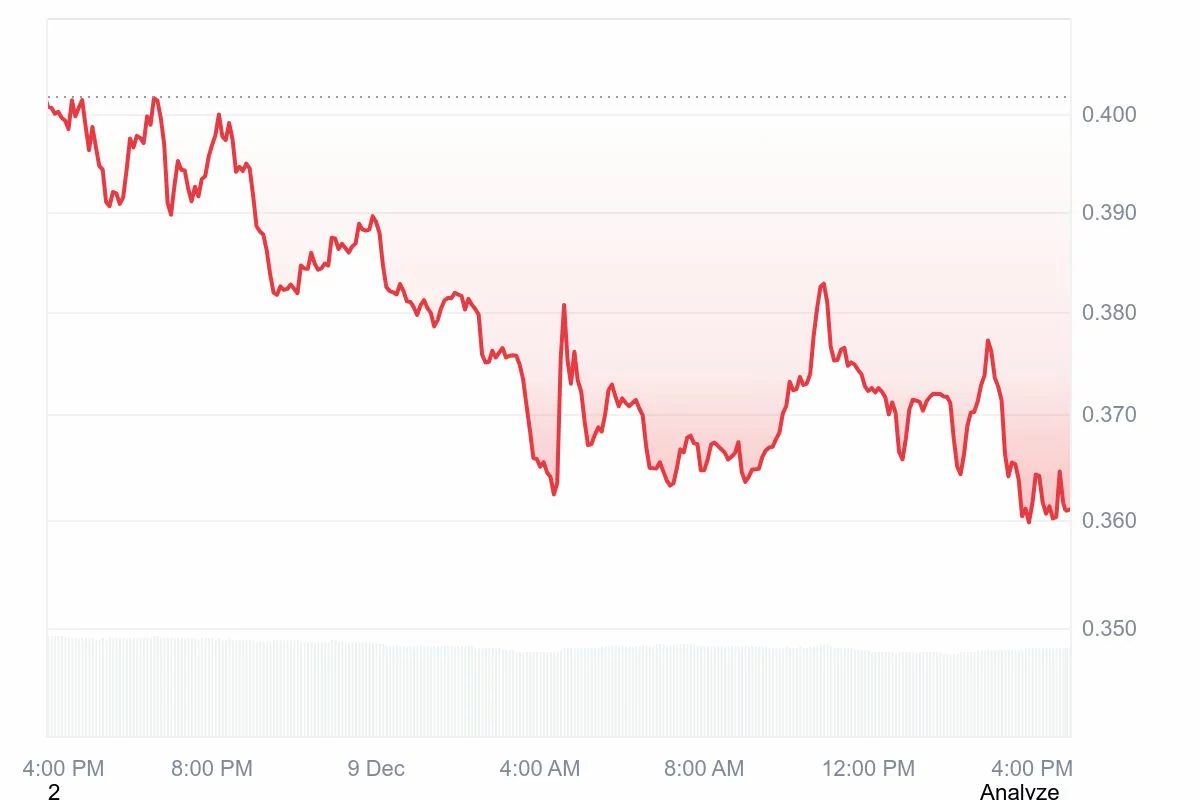

From a technical perspective, FLM’s price movement has recently broken through important resistance points, potentially setting the stage for further gains. Market participants are now looking for signs of a sustained rally, with trading volume and blockchain data being closely monitored. The lack of immediate negative factors, combined with widespread market optimism, has made

Still, the absence of comprehensive financial information about FLM has led some experts to be cautious. Unlike FTAI, which reports a 35% margin and a clear, asset-light growth plan, or First Solar, which benefits from U.S. tax incentives and improving cash flow, FLM’s business case is less transparent. This lack of clarity could slow down institutional interest, which is often key to sustaining long-term rallies.

Additionally, broader economic factors like U.S. Treasury repo rates and international demand for solar energy are shaping investor sentiment. For instance, the Yahoo Finance article mentioned that Orchid Island’s third-quarter results underscored how sensitive leveraged mortgage investors are to interest rate changes—a risk that could also affect FLM’s liquidity. On the other hand, Investing.com reported a 66% year-over-year increase in Chinese solar exports, indicating strong global appetite for renewable energy infrastructure, which could benefit FLM if it aligns itself with these trends.

To sum up, while FLM’s technical outlook is promising, its future performance will depend on addressing core business uncertainties and syncing with larger industry movements. Investors should keep an eye on regulatory shifts, liquidity data, and cross-sector trends as they await confirmation of a breakout.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fartcoin price prediction: Momentum builds, but breakout pending

Can Bitcoin Rise Above $100,000 Again? Billionaire Novogratz Weighs In

Major Banks Share Their Latest Forecasts Regarding the Fed’s Interest Rate Decision Tomorrow

Proposed ‘AfterDark’ Bitcoin ETF Would Skip U.S. Trading Hours