Opinion: Uniswap’s Additional 0.15% Fee Doesn’t Seem Wise

The author believes that charging fees to Uniswap Labs instead of UNI not only confirms that UNI is indeed a "meaningless governance token," but also highlights the team's continuous large-scale sell-off of UNI. Despite having sufficient funds, they are sacrificing growth for revenue at this particular point in time, which is truly a puzzling move.

The author believes that charging fees to Uniswap Labs instead of UNI holders not only confirms that UNI is indeed a "meaningless governance token," but also, given that the team has been offloading large amounts of UNI and funding is not an issue, choosing to sacrifice growth for revenue at this point is truly a puzzling move.

Written by: CapitalismLab

Uniswap adding a 0.15% fee does not seem wise. Simply put:

- It only applies to trades made on Uniswap’s official website or official mobile wallet frontends

- It only targets mainstream trading pairs like ETH, WBTC, and stablecoins

- The fees go to Uniswap Labs and are unrelated to $UNI holders

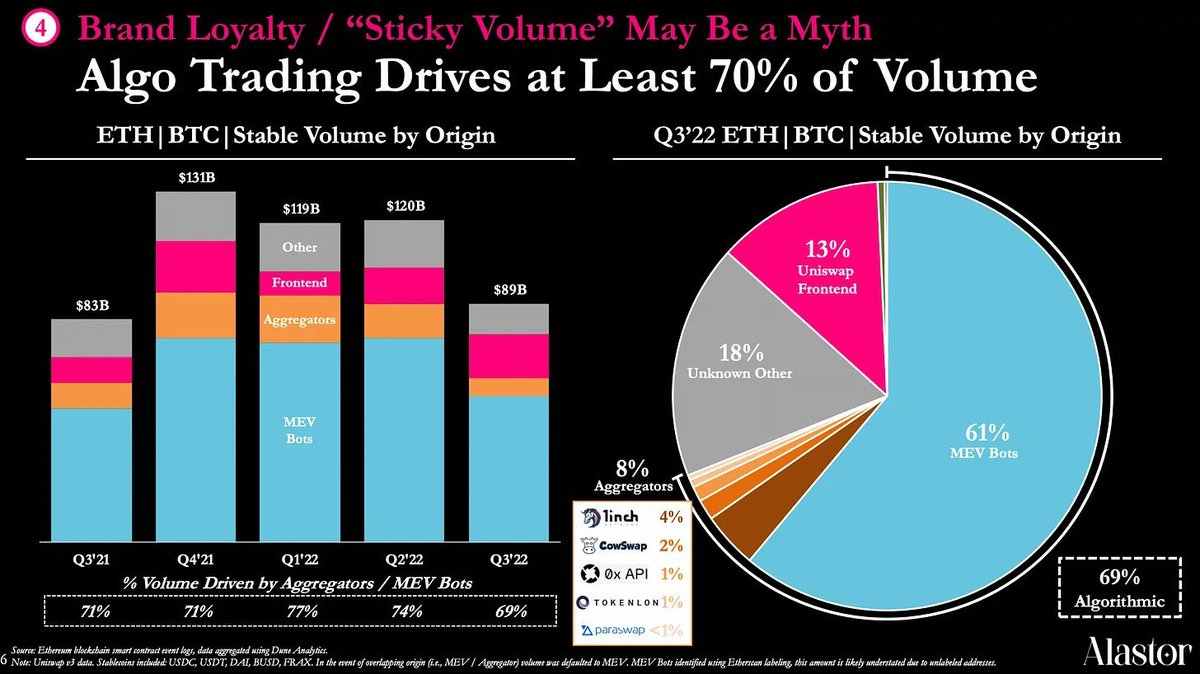

Although Uniswap’s frontend only accounts for 13% of total trading volume, if you exclude MEV arbitrage trades and only consider active trading behavior, its share is still quite high—much higher than aggregators. This is a huge advantage compared to other DEXs.

Many people trading meme coins also prefer to use Uniswap’s frontend directly, since the Gas Fee is cheaper compared to aggregators. Currently, bots have some share, but in terms of DAU, they only account for about 10% of Uniswap’s users.

This time, the fee only targets mainstream trading pairs, but there is uncertainty as to whether it will be extended to other pairs in the future. Users can no longer mindlessly use the Uniswap frontend, which will undoubtedly damage the user experience, reduce frontend usage, and push more people toward aggregators. This is not good for Uniswap’s competitiveness.

Some may argue that Metamask swap also takes a cut, but on one hand, Uniswap’s frontend is not comparable to Metamask, and on the other hand, there are fewer complete newbies using Uniswap, making it harder to collect this kind of “IQ tax.”

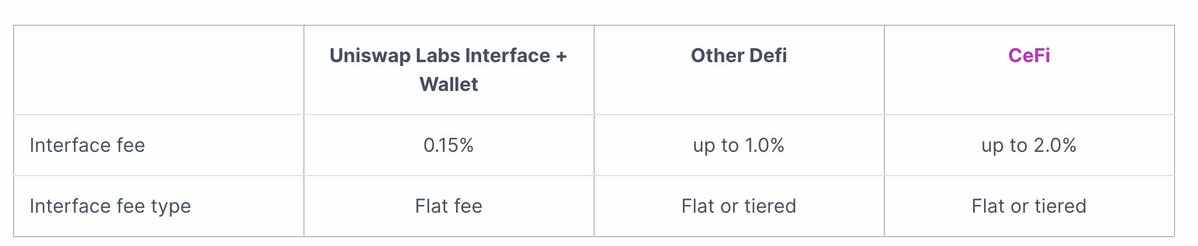

Looking at the fee structure, it is also very high. Uniswap itself made a clearly misleading comparison chart. In reality, the main spot trading channel, Binance, only charges 0.1%, and there are significant discounts for BNB holders and VIPs, not to mention that Uniswap’s LPs also charge fees (ranging from 0.05% to 1%).

Charging fees to Uniswap Labs instead of $UNI not only confirms that $UNI is indeed a "meaningless governance token," but also, given that the team has been offloading large amounts of $UNI and funding is not an issue, choosing to sacrifice growth for revenue at this point is truly a puzzling move.

In summary, this currently appears to be an unwise move. For regular users, the best thing to do is to use aggregators more and the Uniswap frontend less.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A $500 billion valuation giant is emerging

With a valuation comparable to OpenAI and surpassing SpaceX and ByteDance, Tether has attracted significant attention.

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

Why does bitcoin only rise when the U.S. government reopens?

The US government shutdown has entered its 36th day, leading to a decline in global financial markets. The shutdown has prevented funds from being released from the Treasury General Account (TGA), draining market liquidity and triggering a liquidity crisis. Interbank lending rates have soared, while default rates on commercial real estate and auto loans have risen, increasing systemic risk. The market is divided over future trends: pessimists believe the liquidity shock will persist, while optimists expect a liquidity release after the shutdown ends. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model is updated.

Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."