Trump's Crypto Pardon Sparks Firestorm as Khanna Pushes for Trading Ban

- Rep. Ro Khanna (D-Calif.) proposes banning Trump, family, and Congress from crypto trading to address alleged "unprecedented" corruption, citing World Liberty Financial ties. - Trump's controversial pardon of Binance founder CZ Zhao, a foreign national convicted of U.S. money laundering violations, sparks bipartisan criticism and legal scrutiny. - Binance's $740,000 lobbying efforts in Washington, including payments to Trump-linked operatives, raise questions about the pardon's motivations and regulatory

Representative Ro Khanna (D-Calif.) has delivered a sharp rebuke of President Donald Trump’s involvement with cryptocurrency, accusing his administration of engaging in “unprecedented” self-enrichment and promising to propose a resolution that would bar the president, his relatives, and members of Congress from trading cryptocurrencies or accepting foreign funds, as reported by

Khanna, who has long criticized Trump’s financial conduct, accused the president of leveraging his position for “excessive” personal gain, pointing to Zhao’s investment in the Trump-endorsed stablecoin

During a press briefing, Trump justified his decision to pardon Zhao, stating he was told Zhao’s actions “did not even constitute a crime” and that the previous administration had “targeted” him, according to Cointelegraph. The pardon has ignited a political uproar, with Democratic figures such as Senator Elizabeth Warren (D-Mass.) denouncing it as favoritism. Meanwhile, Binance’s lobbying activities in Washington—including $450,000 paid to individuals linked to Trump and $290,000 to former SEC candidate Teresa Goody Guillén—have raised suspicions about the reasons behind the pardon, as detailed in a

This controversy highlights deeper disputes within the cryptocurrency industry. While Trump’s executive order to position the U.S. as a “crypto capital” has been welcomed by industry leaders like CZ, who vowed to “generate significant wealth for the nation,” critics argue that the pardon sets a precedent for leniency toward regulatory offenders, Cointelegraph noted. Legal experts also point out that a presidential pardon does not erase Zhao’s conviction, leaving his criminal record and potential civil liabilities intact, according to a

Khanna’s proposed resolution reflects increasing demands for openness in cryptocurrency policy. Having previously supported Bitcoin as a strategic reserve, the congressman described the ban as essential to avoid conflicts of interest, Benzinga reported. His office also emphasized USD1’s involvement in a $2 billion transaction between Abu Dhabi’s MGX and Binance earlier this year, further complicating the Trump family’s claims of financial independence, according to Benzinga.

The White House has not issued a statement regarding the resolution, while Binance expressed gratitude to Trump for “his leadership” in promoting cryptocurrency adoption. As debate over crypto regulation grows more heated, Khanna’s proposal marks a possible shift in congressional oversight, with Democrats using the issue to spotlight what they call Trump’s “damaging” financial behavior, Benzinga reported.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MMT Token TGE and Its Impact on the Market: Evaluating the Trigger for Altcoin Price Fluctuations and Institutional Embrace

- MMT token's 2025 TGE sparked 1330% price surge post-Binance listing, driven by $82M oversubscribed sale and strategic exchange listings. - TVL exceeding $600M highlights DeFi innovations like YBTC.B pools and ve(3,3) tokenomics, aiming to balance liquidity with governance incentives. - Institutional adoption targets through MSafe wallets and Momentum X platform, though speculative trading risks overshadow long-term stability. - Phishing threats and name confusion with NYSE fund MMT raise volatility conce

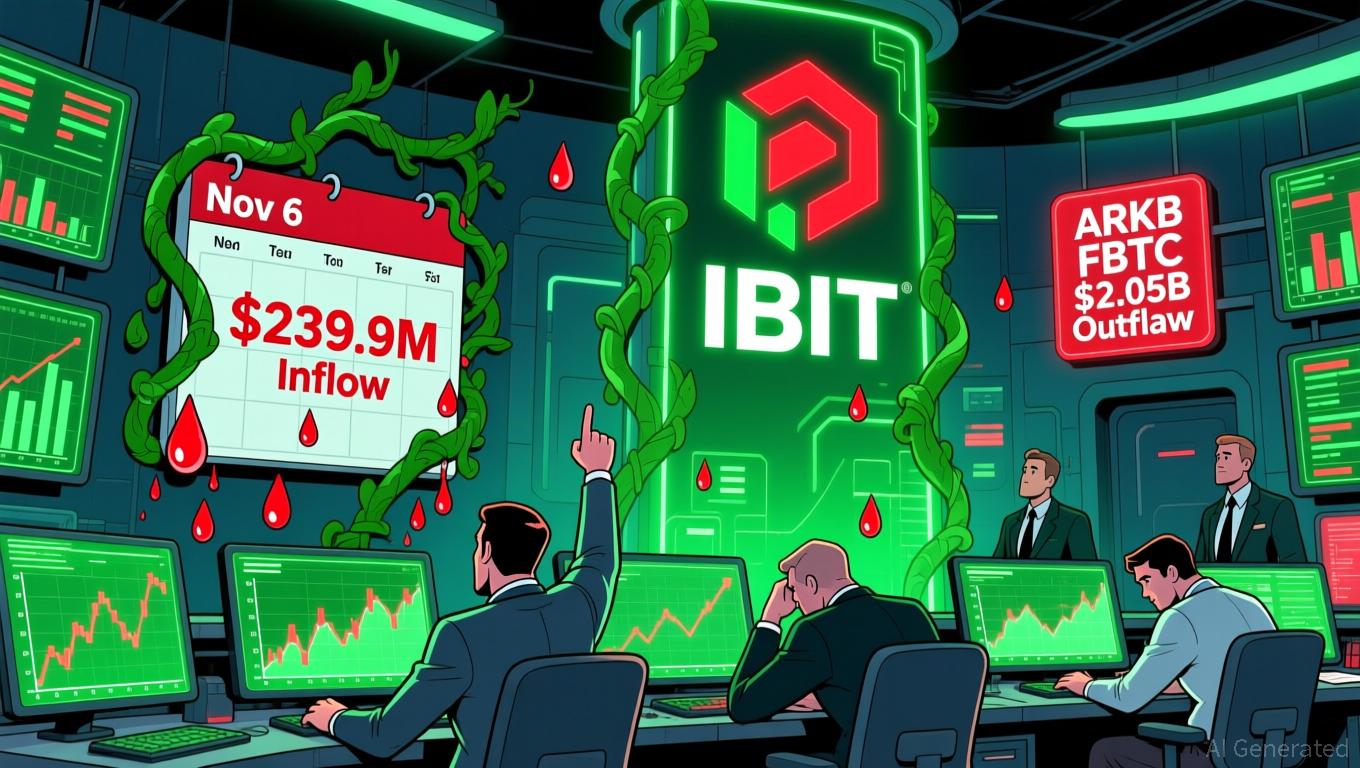

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod