Bitcoin Updates Today: Wall Street Endorses Bitcoin’s Entry into the Mainstream as JPMorgan Allows Crypto as Collateral

- Bitcoin nears $111,700 as ETF inflows surge $4.21B in October, driven by BlackRock and Fidelity funds. - JPMorgan's crypto collateral approval validates institutional adoption, boosting market confidence ahead of 2025. - Technical analysis shows bullish consolidation above $108,000, with $113,500 as key breakout threshold. - Exchange outflows and ETF dominance (6.78% market cap) signal reduced liquidity, amplifying price volatility risks. - U.S.-China trade easing and Fed rate cuts position Bitcoin as in

Bitcoin Trades Near $111,000 as ETF Investments and Institutional Interest Drive Optimism

On October 25, 2025, Bitcoin (BTC-USD) hovered close to $111,700, bouncing back from a key support at $108,000 and stabilizing as institutional buying intensified. In October alone, net inflows into Bitcoin ETFs exceeded $4.21 billion, largely fueled by BlackRock’s iShares

This upward movement comes after a turbulent correction in late October, when Bitcoin dropped to $103,587 amid concerns over a U.S. government shutdown and global political unrest. Confidence has since been restored by recent news, including JPMorgan Chase’s decision to accept Bitcoin and

Technical analysis indicates that Bitcoin is currently consolidating within a bullish pattern. The price remains above its 200-day EMA but is still under the 50-day EMA, creating a narrow trading range between $108,000 and $113,500. If Bitcoin closes above $113,500, it could break out toward $116,200–$119,000, while a fall below $108,000 may lead to a retest of $104,000. According to Polymarket, there is a 52% chance that Bitcoin will finish between $110,000 and $112,000 on October 26, showing cautious optimism among traders.

Institutional interest is further evidenced by withdrawals from exchanges. Data from Coinglass reveals $12 million in net outflows from centralized exchanges in early November, suggesting a shift toward holding assets in custody rather than on trading platforms. This pattern is consistent with previous cycles where a decrease in exchange supply has preceded price stabilization. Meanwhile, ETF inflows have outpaced those of Ethereum by three times, with Bitcoin ETFs seeing $3.34 billion in weekly trading volume compared to Ethereum’s $1.41 billion, based on

Market confidence has also improved as U.S.-China trade tensions ease. The White House announced a meeting between Trump and Xi on October 30, raising hopes for reduced tariffs and trade disputes. Following the news, Bitcoin climbed 1.6% to $111,390, recovering from earlier declines linked to tariff concerns, according to

Experts point to ETF-driven liquidity as a major factor. BlackRock’s

Ethereum, on the other hand, is facing challenges as ETF outflows persist. In October, Ethereum ETFs saw $243.9 million in net redemptions, with BlackRock’s ETHA ETF leading the withdrawals. This trend reflects a broader shift from yield-focused assets to Bitcoin’s “store-of-value” appeal, especially as central banks worldwide hint at interest rate cuts.

Looking forward, Bitcoin’s direction will depend on institutional activity and broader economic conditions. With the Federal Reserve expected to lower rates in late October and early December, Bitcoin’s attractiveness as a non-yielding asset may increase as the U.S. dollar weakens. A breakout above $115,000 could open the door to $125,000–$130,000, while a sustained move below $108,000 would put long-term support near $100,000 to the test.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Elections 2025: Democrats’ Big Wins Challenge Trump’s Pro-Crypto Agenda

India to Launch ARC Token Stablecoin Backed by Government Securities

Solana price forecast: SOL eyes $170 after sweeping the August 4 low

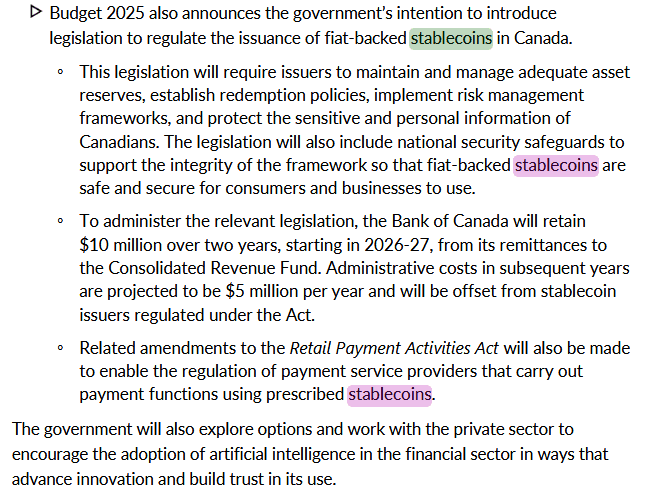

Canada Takes a Major Step Toward Regulating Stablecoins