XRP ETF Hits $100,000,000 Milestone in Assets Under Management in Just Five Weeks

The REX-Osprey XRP ETF (XRPR) has surged past $100 million in assets under management in just over a month.

This fund is the first in the US to provide spot exposure to XRP, launching five weeks ago.

XRPR was built under a ’40 Act structure, holding at least 80% in actual XRP, plus US Treasuries, cash equivalents and limited derivatives for tax compliance.

Trading on major platforms, it debuted at $25.82 and now hovers near $20.65, up 3.82% recently, largely tracking the native asset’s own price movements.

The rise in AUM comes amid SEC delays on six other XRP ETF applications due to government shutdowns, with XRPR filling the gap ahead of potential approvals.

Meanwhile, CME Group’s futures-based XRP products have witnessed $26.9 billion in volume since launching five months ago, which is the equivalent of about 9 billion XRP.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana price forecast: SOL eyes $170 after sweeping the August 4 low

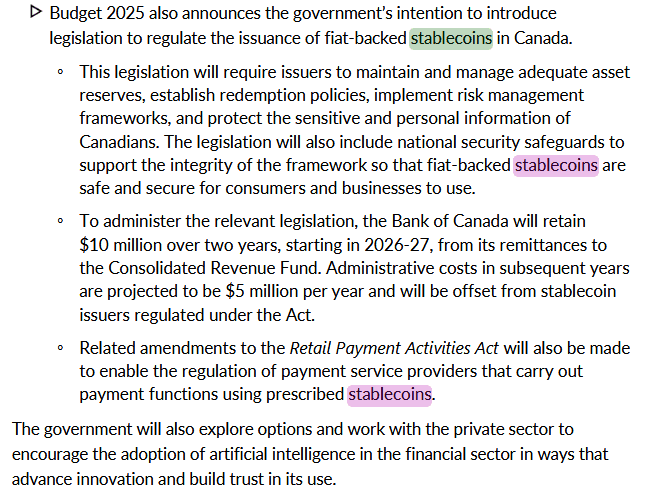

Canada Takes a Major Step Toward Regulating Stablecoins

Epic Games CEO hails Google’s antitrust agreement as a victory for Android’s ‘future as an open platform’