Top Trader Expands $360M Long as Profits Hit $16.9M

Quick Take Summary is AI generated, newsroom reviewed. A top trader with a 100% win rate expanded his $360M crypto leveraged long. His holdings include 1,683 BTC and 40,305 ETH, showing bullish conviction. Unrealized profit currently stands at $16.9 million and rising. The move reflects renewed market optimism and potential for near-term rallies.References 💰TRADER WITH 100% WIN RATE ADDS MORE LONGS! He's now playing a $360M leveraged LONG with 1,683 $BTC ($194M) at 13x and 40,305 $ETH ($168M) at 5x. His u

In a remarkable move that’s capturing attention across crypto markets, a trader with a 100% win rate has once again gone big. Known for his strategic entries and precise timing, this trading giant has now expanded his crypto leveraged long to a staggering $360 million.

With 1,683 BTC ($194 million) at 13x leverage and 40,305 ETH ($168 million) at 5x leverage, his positions reveal strong confidence in market upside. Despite volatile conditions, this trader’s steady hand continues to pay off as his unrealized profit climbs to $16.9 million.

💰TRADER WITH 100% WIN RATE ADDS MORE LONGS!

— Coin Bureau (@coinbureau) October 27, 2025

He's now playing a $360M leveraged LONG with 1,683 $BTC ($194M) at 13x and 40,305 $ETH ($168M) at 5x.

His unrealized profit is now at $16.9 MILLION. pic.twitter.com/GYuQ1Ageug

Confidence Returns to the Crypto Market

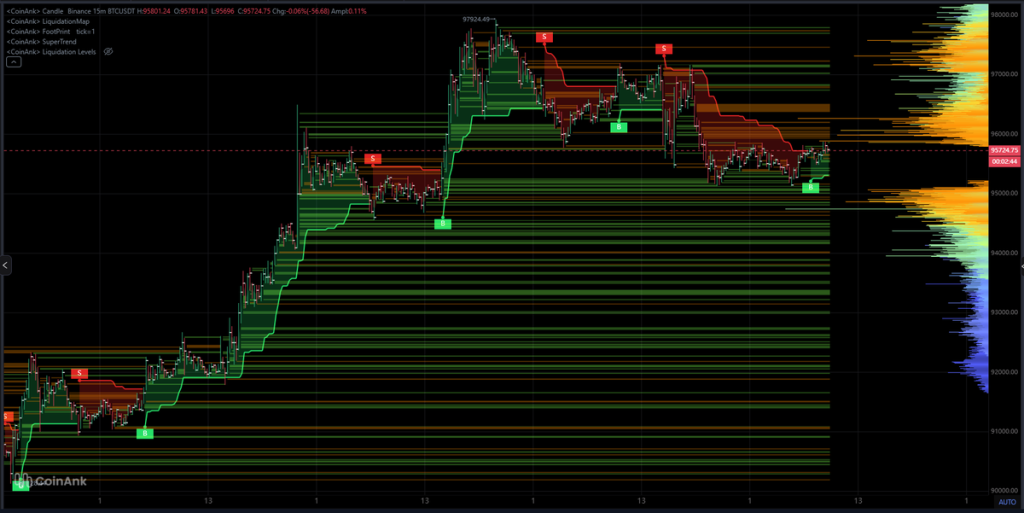

The expansion of such a massive crypto leveraged long highlights renewed confidence in market momentum. Bitcoin has shown strong support near $67,000, while Ethereum is holding above $2,900, both signaling potential for further recovery.

Traders with deep capital often make moves that reflect underlying sentiment. This one seems to indicate a bullish phase ahead. Retail investors and institutions alike are watching closely to see if this bold bet will set the tone for November’s trading trend.

The trader’s continued success is also shaping social media discussions, with many analysts speculating that he anticipates a breakout for both BTC and ETH in the coming weeks.

The Bullish Sentiment Behind His Moves

Market sentiment has started to shift after weeks of consolidation. The Bitcoin long positions built by this trader align with a broader bullish narrative, one fueled by institutional accumulation, stable ETF inflows, and improving liquidity conditions.

Likewise, his Ethereum long trades reflect confidence that the network upgrades coming soon for ETH. An increasing strength of DeFi activity, supporting optimism for longer-term growth in the Ethereum ecosystem. This will continue to attract developers and investors.

Taken as a whole, it can be argued that these conditions make up a compelling case for a further rally. Especially as momentum could accelerate as more traders follow a high-performing investor’s lead.

What This Means for Retail Traders

For everyday traders, this move is both inspiring and cautionary. It demonstrates how experience, capital, and timing can lead to massive rewards. But this also reminds us that crypto leveraged long trading is not for beginners.

Retail investors should concentrate on learning the market structure, using lower leverage, and taking a long position. Following professionals’ strategies blindly can be perilous without sufficient capital and experience

Nonetheless, the development is a sign that optimism is growing, and renewed confidence is appearing for the longer crypto bull cycle. Given that both Bitcoin and Ethereum remain in a solid support, you may see additional buyers follow suit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PI Price Analysis: PI Holds $0.20 Support After Triangle Breakdown—What’s Next?

Bitcoin Trend Cools After Spike to $98K: Key BTC Price Levels to Watch Over the Next 48 Hours

Ethereum Price Hits a Key Zone vs. Bitcoin—Is an Altcoin Rotation Finally Starting?