Pi Coin Rally Heats Up as Every Group Buys In — But a Risk Lurks Below $0.29

The Pi Coin rally is heating up again, with every buyer group — from whales to retail — loading up. A breakout could be just 7% away, but a single bearish signal still shadows the move.

After months of drift, Pi Coin is finally showing life again. The Pi Coin price jumped nearly 32% this week, making it one of the token’s best performances in months. Traders are seeing this Pi Coin rally as the start of something bigger. Yet, some Pi chart metrics show that the rally might be fragile unless the price clears one key level.

The signs beneath the surface, though, hint at a deeper story of one where confidence may be quietly rebuilding, and the next breakout could decide PI’s direction for the next few weeks.

A Quiet Confidence Builds Around The Pi Coin Rally

Momentum behind Pi Coin isn’t just random speculation; it’s coming from all sides of the market.

The Smart Money Index (SMI), which tracks activity from historically profitable or institutional wallets, has climbed sharply since October 25. The index recently moved above its signal line for the first time in weeks, a sign that larger investors are returning after sitting out much of the recent downtrend.

Pi Coin Sees Smart Money Inflow:

TradingView

Pi Coin Sees Smart Money Inflow:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

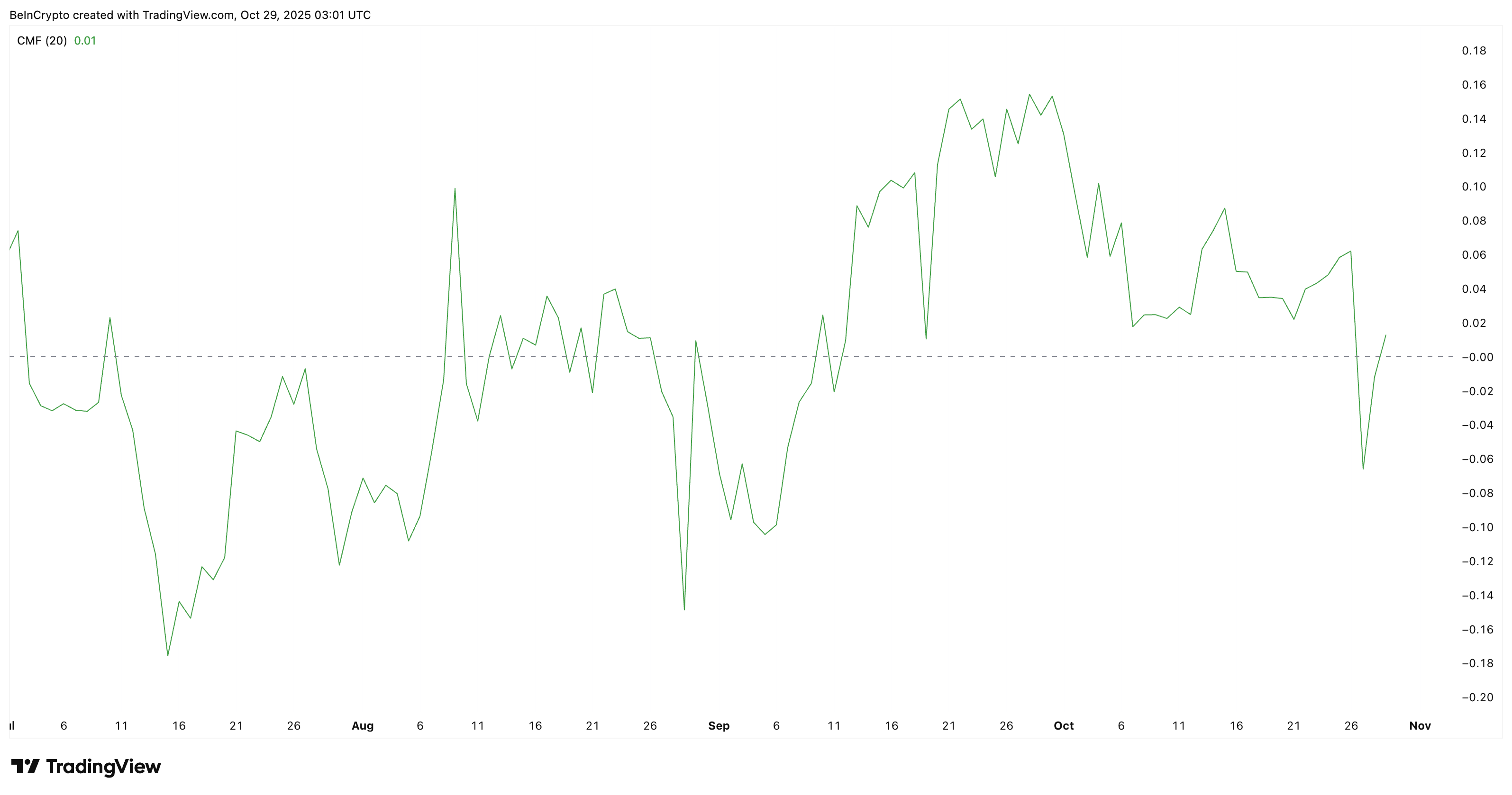

Whale movement is starting to mirror that optimism. The Chaikin Money Flow (CMF), which measures large money inflows, just flipped above zero for the first time since mid-September.

The last time this happened, Pi Coin saw a short burst of upside before cooling off. A positive CMF now suggests that whales are once again allocating capital into the token, not exiting.

Big Money Flows Into PI:

TradingView

Big Money Flows Into PI:

TradingView

Retail traders seem to be following their lead into this ongoing Pi Coin rally.

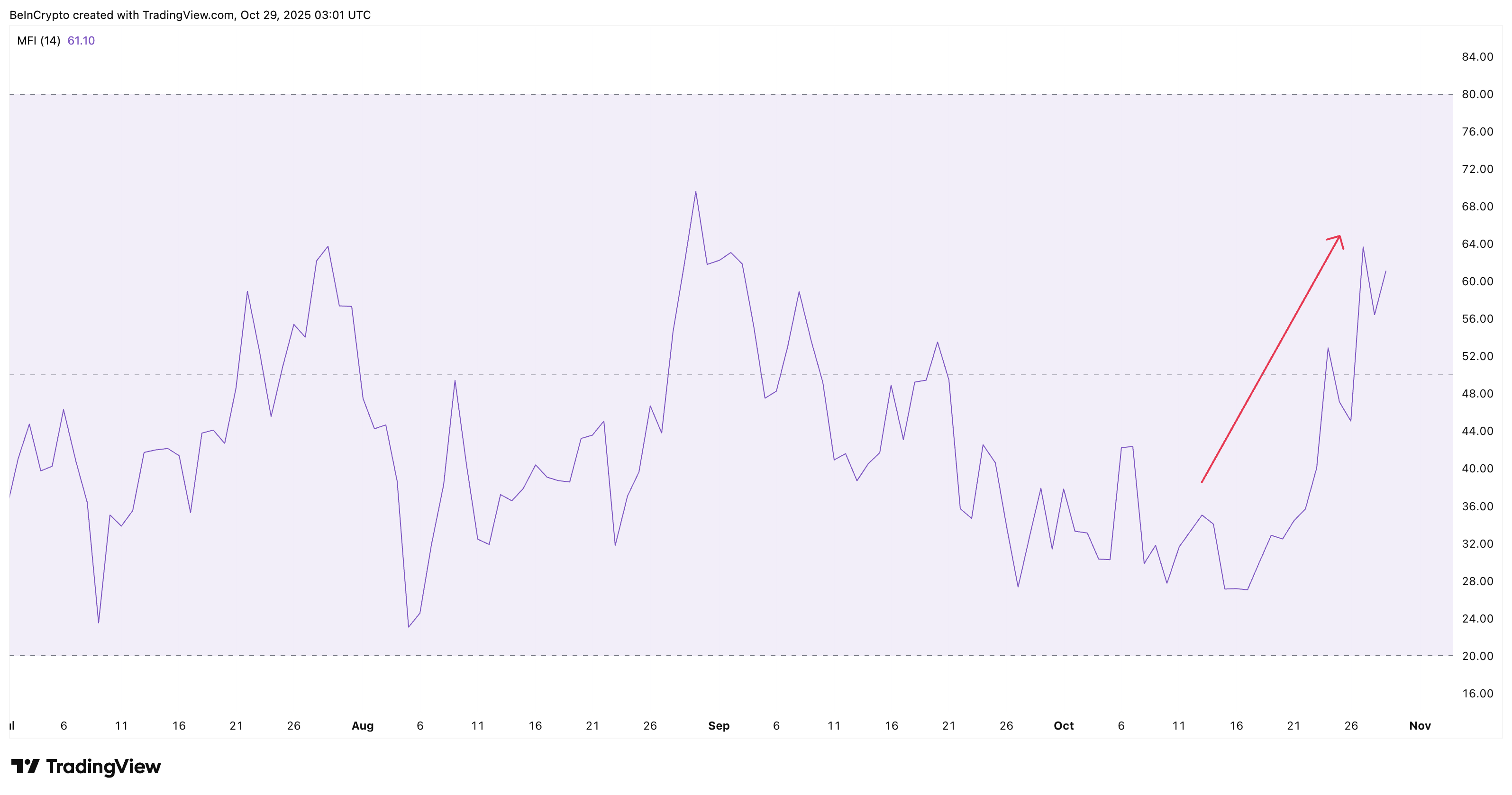

The Money Flow Index (MFI), which combines both price and trading volume to gauge buying pressure, has made higher highs since October 12, showing consistent accumulation. When all three signals — smart money, whales, and retail — line up like this, it often hints at a coordinated phase of quiet confidence before a strong price move.

Retail Seems Bullish on Pi Coin Rally:

TradingView

Retail Seems Bullish on Pi Coin Rally:

TradingView

That confidence, though, will soon face its biggest test.

Falling Wedge Faces a Defining Moment

On the daily chart, Pi Coin price remains inside a falling wedge, a pattern that often signals an eventual bullish reversal. The price briefly tested the wedge’s upper boundary at $0.29 on October 27, only to be rejected by sellers. But buyers have since regained footing, keeping the Pi Coin rally structure alive.

If Pi Coin breaks and closes above $0.29, it would confirm a breakout and open the door toward $0.32, followed by $0.37. The first immediate barrier to an extended PI rally, however, is $0.28 — a level identified in earlier forecasts as the first meaningful resistance.

A strong move past this zone could shift sentiment decisively in favor of bulls.

However, risk still lingers. Between August 9 and October 29, Pi’s price made lower highs while the Relative Strength Index (RSI), a momentum tool that measures buying versus selling strength, made higher highs. This mismatch is called a hidden bearish divergence, and it usually means the existing downtrend may still have strength left.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Pi Coin is still down 36.8% over the past three months, keeping the broader trend bearish for now. If price falls below $0.20, it would invalidate the bullish setup entirely, potentially dragging it toward $0.18 or $0.15.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A $500 billion valuation giant is emerging

With a valuation comparable to OpenAI and surpassing SpaceX and ByteDance, Tether has attracted significant attention.

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

Why does bitcoin only rise when the U.S. government reopens?

The US government shutdown has entered its 36th day, leading to a decline in global financial markets. The shutdown has prevented funds from being released from the Treasury General Account (TGA), draining market liquidity and triggering a liquidity crisis. Interbank lending rates have soared, while default rates on commercial real estate and auto loans have risen, increasing systemic risk. The market is divided over future trends: pessimists believe the liquidity shock will persist, while optimists expect a liquidity release after the shutdown ends. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model is updated.

Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."