BitMine Acquires 77,055 ETH for $319 Million

- BitMine purchases 77,055 ETH worth $319 million.

- Firm becomes largest Ethereum holder globally.

- Market reacts with a brief Ethereum price increase.

BitMine Immersion, now the largest corporate holder of Ethereum, announced their acquisition of 77,055 ETH worth approximately $319 million via Twitter on October 27, 2025.

This substantial purchase positions BitMine as a significant Ethereum holder and may impact market liquidity and asset valuation, as shown by Ethereum’s recent 3.1% price increase.

BitMine made headlines with its purchase of 77,055 ETH valued at $319 million. This acquisition elevates BitMine as the largest corporate holder of Ethereum, with a treasury of more than 3.3 million ETH. BitMine Immersion Announces $14.2B in Crypto and Cash Holdings

In this high-profile move, BitMine’s Chair, Tom Lee, expressed confidence in Ethereum’s potential. The purchase, confirmed via BitMine’s official Twitter account on October 27, highlights the firm’s aggressive investment strategy.

The immediate market response saw Ethereum prices rebound by 3.1%. This reaction underlines institutional confidence in Ethereum as an asset, catalyzed by BitMine’s substantial acquisition.

Strategic backing from recognized investors like Ark Invest and DCG signifies trust in BitMine’s portfolio management. However, current data does not specify whether the ETH purchase will affect immediate staking or DEFI efforts. BitMine’s official Twitter handle (@BitMNR) stated, “Since October 20, the firm acquired 77,055 ETH worth approximately $319 million. BitMine’s total reserves in cryptocurrency and cash have reached $14.2 billion.”

Community reactions remain largely positive, with expectations of improved liquidity attributed to such institutional moves. The Ethereum community closely watches similar acquisitions for potential impacts on liquidity and staking activities.

Historically, large acquisitions have spurred regulatory discussions, especially if they hint at market concentration. BitMine’s purchase might lead to scrutiny, focusing on potential impacts on cryptocurrency market dynamics.

“While the fundamentals of Ethereum and crypto are ‘uncorrelated’ to equities, Fundstrat work has shown that in the past 15 years, Ethereum and crypto perform better when equities rise, meaning crypto is correlated to ‘risk-on’ assets via the associated leverage channel.” – Tom Lee, Managing Partner at Fundstrat, Chairman of BitMine.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

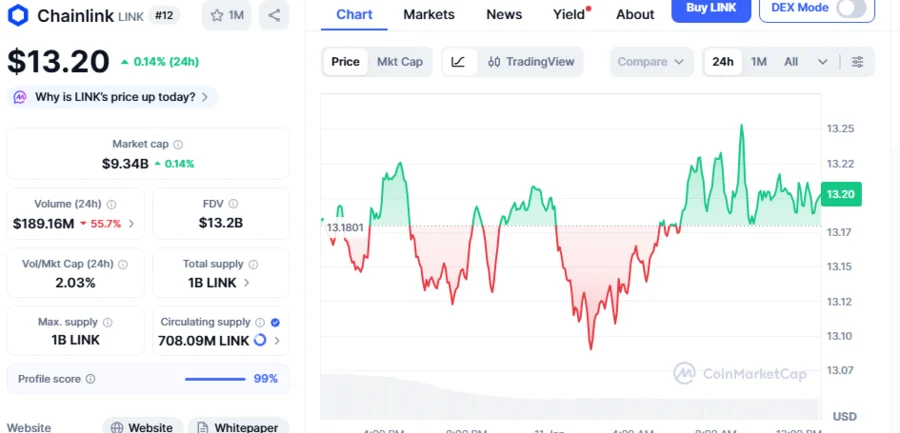

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026