Key Market Insights for October 29th, how much did you miss?

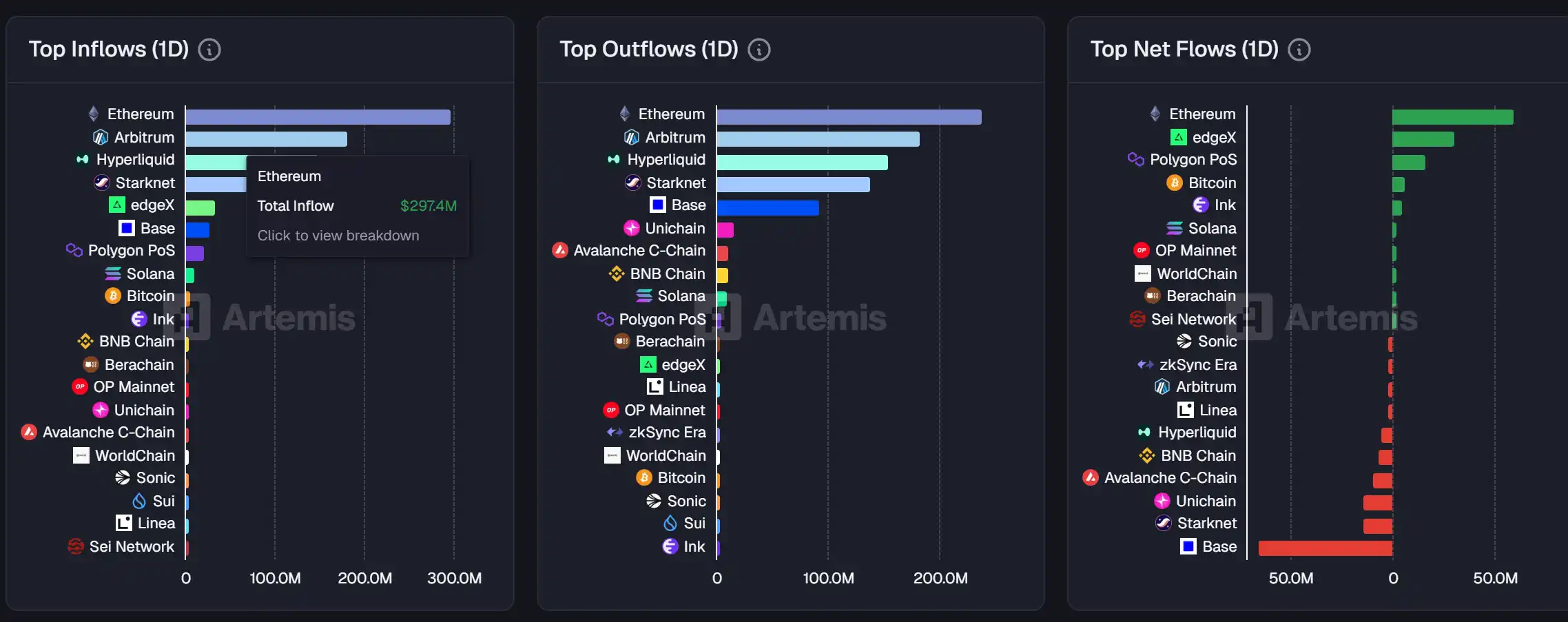

1. On-chain Fund Flow: $59.2M inflow to Ethereum today; $65.1M outflow from Base 2. Largest Price Swings: $FACY, $VULT 3. Top News: Zhihu x Ludong jointly hosted a roundtable on "Stablecoin Transparency" today, with a total view count of 25 million

Top News

1. Zhihu x Eudemonia Co-hosted Roundtable on "Penetrating Stablecoins" is now online today, with a total views of 25 million

2. MegaETH's public sale has raised over $700 million, with an oversubscription of 14.2 times

3. A total of $376 million has been liquidated across the network in the past 12 hours, with long positions being the main liquidations

4. FLM surged over 30% briefly and then retraced, with a market cap currently at $11 million

5. Users with at least 240 points in Binance Alpha can claim 2,688 BOS airdropped tokens

Featured Articles

1. "Chillhouse Leading Alone: The Past and Present of "Web3 Fun People""

The long-lost Solana meme hasn't been as lively for a long time, and it's happening in a way we can hardly imagine—a Solana meme coin "abstraction" involving Jesse Pollak, Base Protocol's lead, well-known crypto KOL Cobie, Solana's founder Toly, and pump.fun's founder alon. Especially with the addition of the Base camp, there is a sense of "breaking the taboo barrier." In the current environment where each chain is enthusiastically competing with each other, it is beyond players' expectations.

2. "The Best Market Performance in the Last Two Months of the Year? Is it Time to Surge or Retreat?"

As October draws to a close, the cryptocurrency market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the cryptocurrency market, especially after experiencing the 10/11 crash. The impact of this major drop is gradually fading, and market sentiment seems not to have further deteriorated but instead gained new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: positive net inflow data, approval of a batch of altcoin ETFs, and increasing rate cut expectations.

On-chain Data

Chain data for the week of October 28th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Rising Number of XRP Wallets Sparks Optimism for Crypto Summer as Institutions Increase Investments

- XRP sees 21,595 new wallets in 48 hours, Santiment's largest surge in eight months, as price rebounds from $2.2 support. - Technical indicators show bullish RSI divergence and potential reversal patterns, with $2.6 resistance as key hurdle. - Ripple's $500M institutional investment and Mastercard-led RLUSD integration boost XRP's institutional adoption and regulatory clarity. - Ethereum's ecosystem expansion and potential XRP ETF listings amplify crypto summer optimism amid Fed's QE expectations.

Zinc's Decline: An Early Warning Sign for the Crypto Industry

- Digital asset treasuries face sharp sell-offs as investor confidence wanes, with the S&P GSCI Zinc Index dropping 1.56% on Nov 5, 2025. - The zinc index's volatility mirrors crypto market declines, signaling a shift to safer assets amid regulatory uncertainty and macroeconomic pressures. - SEC actions against crypto platforms have intensified market jitters, with analysts warning of cascading liquidations if declines persist. - Zinc's performance now serves as a key barometer for digital asset risk, refl

Dogecoin News Today: Dogecoin's Unstable Buzz Fades as ETFs Turn Attention to Alternative Coins

- Dogecoin (DOGE) hovers near $0.15704, with analysts warning a breakdown could trigger sharp declines amid waning retail and institutional interest. - On-chain data and derivatives metrics signal deteriorating sentiment, as Bitcoin/Ethereum ETF outflows shift capital toward altcoins like Solana . - Weak large-holder support and declining community-driven hype expose DOGE to volatility, with prices at risk of falling below $0.15 without fundamental catalysts.

Chainlink and SBI Join Forces to Integrate Blockchains and Boost Institutional Adoption of Tokenized Assets

- Chainlink partners with SBI Digital Markets to build cross-chain digital asset solutions using CCIP technology. - Collaboration aims to accelerate institutional adoption of tokenized assets via secure multi-chain operations and existing pilots with UBS . - CCIP addresses blockchain interoperability challenges, positioning SBI Group as a key player in Japan's regulated digital asset market. - Recent partnerships with Ondo Finance highlight growing demand for cross-chain infrastructure in tokenized real-wo