XRP Flirts With a Death Cross: How Holders Could Save the Rally

XRP faces a technical crossroads as a looming Death Cross threatens short-term losses, but growing investor maturity could reignite a surprise rally reminiscent of July 2025’s breakout.

XRP’s price recovery has shown signs of weakness in recent days as the altcoin struggles to build sustained momentum. The looming possibility of a Death Cross—a historically bearish technical pattern—has further weighed on market sentiment.

However, maturing investor behavior may offer hope, potentially setting the stage for XRP to repeat its July 2025 rally.

XRP Holders Could Rescue

The exponential moving averages (EMAs) for XRP are edging dangerously close to forming a Death Cross. This occurs when the 200-day EMA moves above the 50-day EMA, signaling growing bearish momentum in the market. Traders often interpret this as a sign of potential long-term weakness, prompting caution across the community.

Interestingly, the last time XRP’s EMAs neared a Death Cross was in July 2025, just before the token surged by 53%. The current structure bears resemblance to that earlier pattern, suggesting a similar outcome remains possible if market confidence returns soon.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP EMAs. Source:

XRP EMAs. Source:

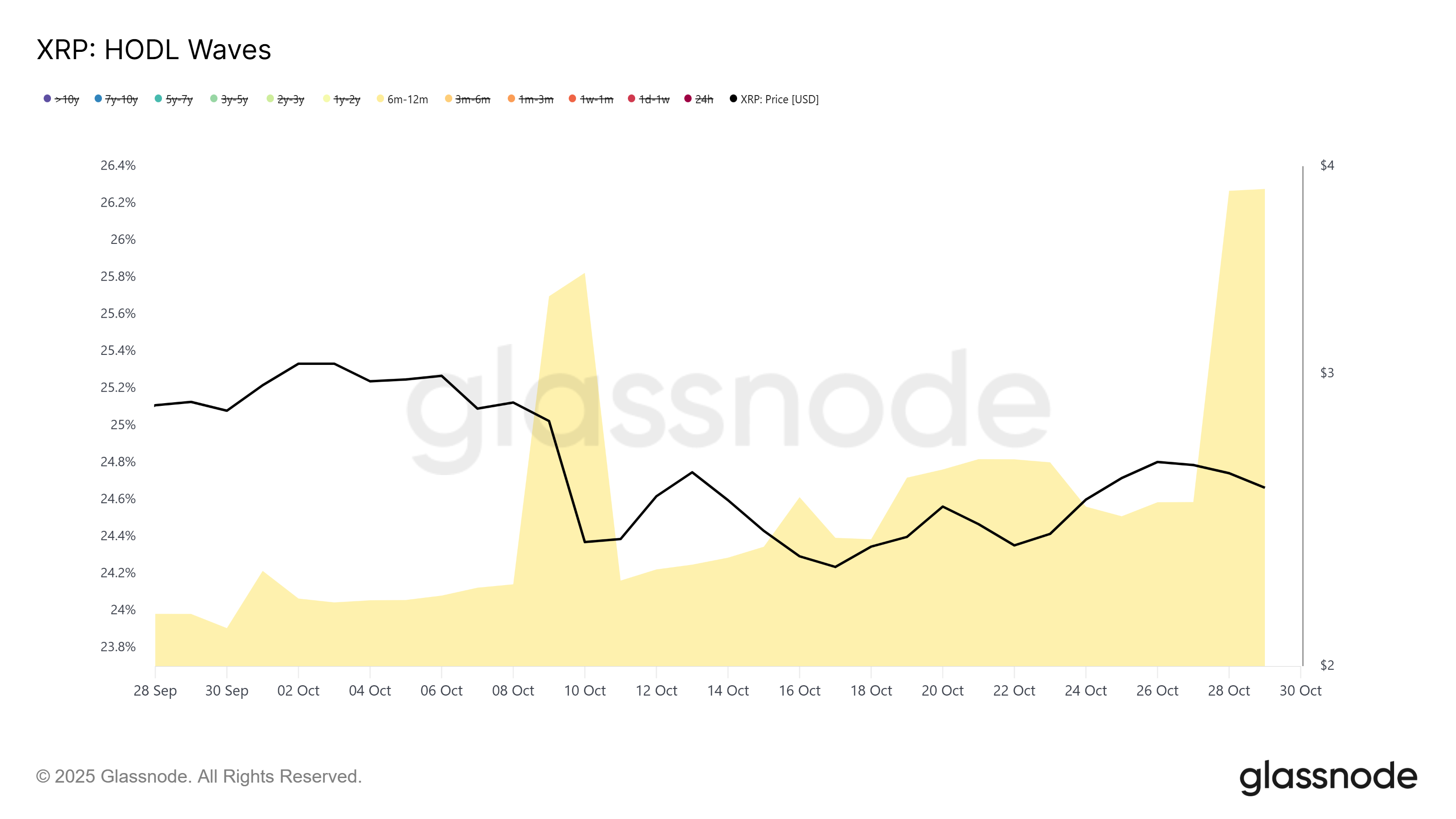

XRP’s on-chain data adds an intriguing dimension to this narrative. The HODL Waves chart shows a notable increase in mid-term holders, particularly those holding for 6 to 12 months. This cohort’s dominance has grown from 24.5% to 26.2% in just two days, signaling that short-term traders are transitioning into longer-term investors.

This shift reflects a strengthening conviction in XRP’s future performance. Such behavior often supports price stability by reducing selling pressure and enabling more sustainable growth. If this trend continues, it could counteract the bearish implications of the nearing Death Cross and potentially fuel another upside move similar to the one witnessed last year.

XRP HODL Waves. Source:

XRP HODL Waves. Source:

XRP Price Has Two Paths

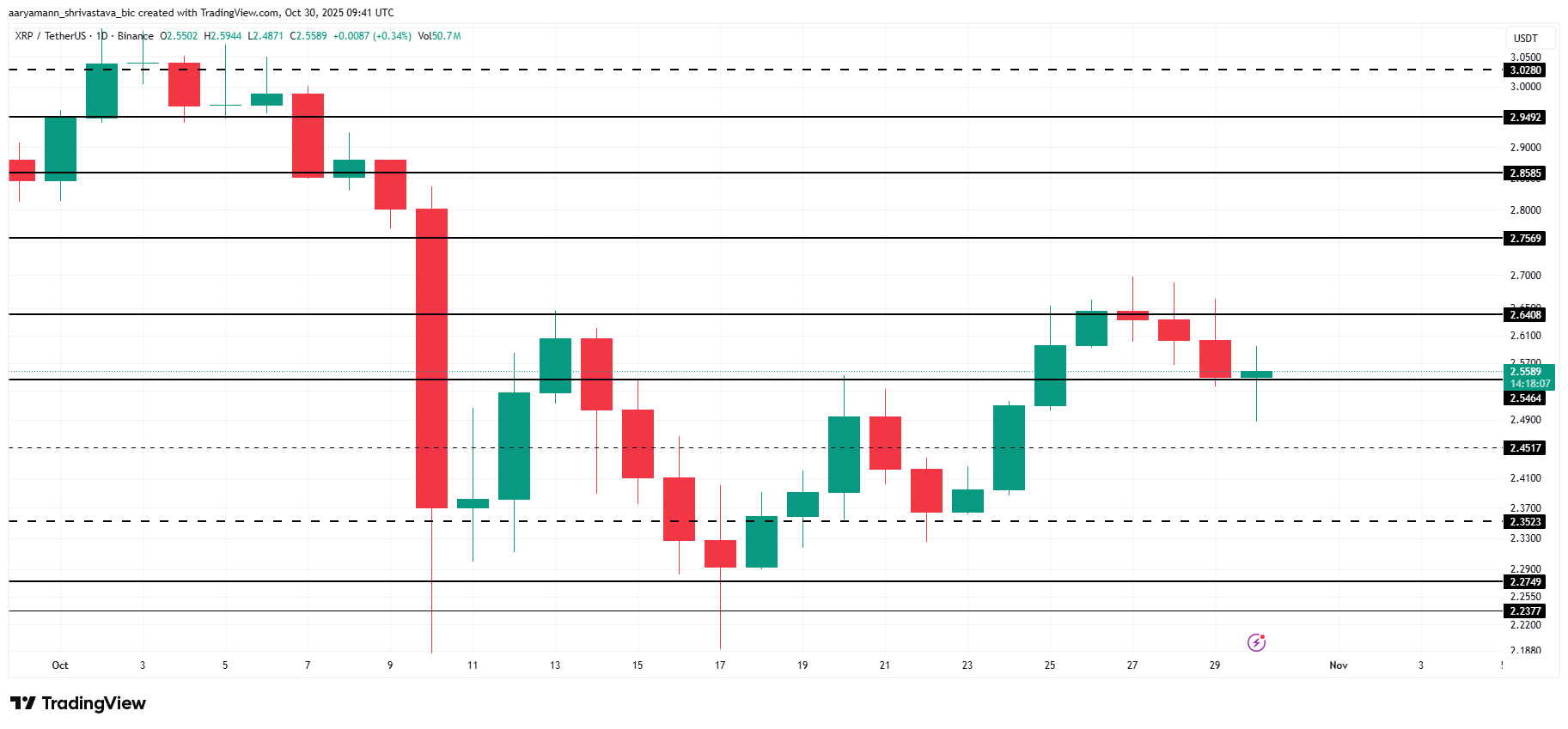

At the time of writing, XRP trades at $2.55, holding slightly above the crucial $2.54 support level. The altcoin needs renewed bullish activity to break through resistance at $2.64, which would confirm upward momentum.

If the Death Cross materializes, XRP could face a short-term correction, possibly dropping toward $2.35 or lower. Such a decline might trigger short-lived selling as traders react to the technical setup.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

Conversely, if investor maturity continues to grow, XRP could replicate its July 2025 breakout. A successful push above $2.64 could propel the token toward $2.75 and potentially $2.85. This would invalidate the bearish outlook and reignite bullish sentiment

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Duan Yongping gives a rare public interview more than 20 years after retirement: Buying stocks is buying companies, but less than 1% of people truly understand this statement.

Buying stocks is essentially buying into a company; the key lies in understanding its corporate culture and business model. Avoiding mistakes is more important than simply making the right decisions.

[English Long Tweet] When Payments Become Machine Language: The Economic and Technical Logic Behind x402x

Can the Fusaka upgrade open a new chapter for Ethereum scaling?