Silent for two years, the "Big Short" finally speaks! Subtle warning: Is there a deadly bubble hidden in the current market?

Source: Wallstreetcn

Original Title: "The Big Short" Burry Issues Cryptic Warning: Sometimes We See a Bubble, and the Only Winning Move Is Not to Play

After two years of silence, Michael Burry, the real-life inspiration for the movie "The Big Short," spoke out again on Friday, warning of the risk that a market bubble could burst.

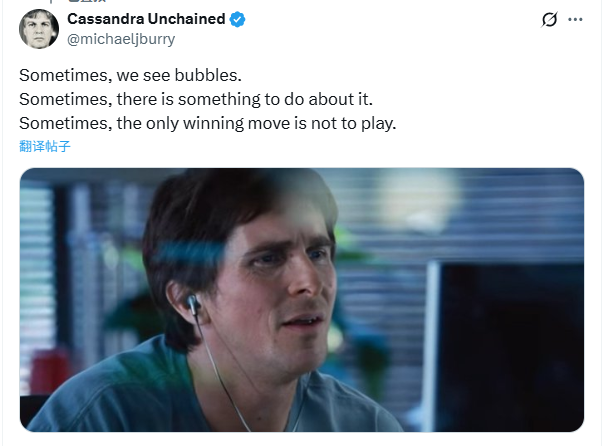

Burry shared a still from "The Big Short" on social media platform X, showing actor Christian Bale, who plays him in the film, staring at a computer screen in shock. He captioned the post: "Sometimes we can see a bubble. Sometimes we can do something about it. Sometimes the only way to win is not to play."

It is reported that Burry's quote is from the 1983 film "WarGames." In the movie, an artificial intelligence (AI) system simulates thousands of US-Soviet nuclear wars, only to find that all scenarios end in "mutual destruction." The system ultimately concludes: "A strange game. The only winning move is not to play."

Clearly, Burry's post implies that he believes the current market is filled with unsustainable speculative behavior and that the bubble will eventually burst. He himself has chosen not to participate in the AI frenzy, neither betting on it nor shorting it, which he sees as "the only way to win."

Although Burry did not specify exactly what the bubble is, many believe he is referring to the current AI boom. Amid the AI wave, the market value of major tech stocks like Nvidia has soared. Since the beginning of 2023, Nvidia's stock price has skyrocketed by more than 1200%, and this week its market value surpassed $5 trillion for the first time, driving the S&P 500 and Nasdaq indexes to new highs.

Burry updated his profile name to "Unbound Cassandra," referencing the cursed priestess from Greek mythology who could foresee the future but was never believed. His bio now reads: "Someone ready to share what he knows."

Similar to his return to social media in November 2021, Burry once again changed his homepage banner to Jan Brueghel the Younger's famous painting "A Satire of Tulip Mania," alluding to the first recorded asset bubble in human history. Notably, three months later, the Nasdaq peaked and then entered a bear market.

Burry is best known for successfully predicting the US subprime mortgage crisis, a feat that brought him fame after being featured in the book "The Big Short." He later took early positions in GameStop and shorted Tesla, Cathie Wood's flagship ARK fund, Apple, and chip stocks including Nvidia.

As early as the summer of 2021, Burry issued a warning that the market was in "the greatest speculative bubble of all time in all things," cautioning that meme stock and cryptocurrency buyers would face a "mother of all crashes."

This series of bearish predictions drew ridicule from Musk at the time, who called Burry "a broken clock" that always sends out the wrong signals.

At the beginning of 2023, Burry posted just one word on social media X: "Sell," sparking heated discussion in the market. However, not long after, he admitted he had misjudged the situation. Such an admission of error is extremely rare on Wall Street; analysts almost never do this, typically just issuing new forecasts after some time has passed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.

Key Market Intelligence for November 6: How Much Did You Miss?

1. On-chain funds: $61.9M flowed into Hyperliquid today; $54.4M flowed out of Arbitrum. 2. Largest price changes: $SAPIEN, $MMT. 3. Top news: ZEC surpassed $500, marking a 575% increase since Naval’s call.