Digital Euro: The ECB's Promise for a Stronger European Economy

The digital euro, an ambitious project of the European Central Bank (ECB), promises to transform payments in Europe. Led by Christine Lagarde, it generates as much enthusiasm as mistrust. Between financial innovation and concerns for individual freedoms, this project fits into a context where crypto redefines the rules of money. What will its real impact be on the economy and European citizens?

In brief

- Christine Lagarde presents the digital euro as a symbol of unity and trust, meant to strengthen Europe’s financial sovereignty.

- Voices denounce a risk of surveillance and centralization of the digital euro, preferring bitcoin as an alternative.

- The EU blocks the Russian stablecoin A7A5, fueling debates over a possible strategy to impose its CBDC against the rise of independent cryptos.

Christine Lagarde and the promise of an inclusive and secure digital euro

Christine Lagarde presents the digital euro as:

- A symbol of unity and trust ;

- A major advancement for Europe;

- A tool designed to strengthen financial sovereignty and facilitate daily transactions.

According to her, this digital currency will enable instant, free, and accessible payments to all, even without an internet connection. All this while guaranteeing confidentiality comparable to current systems.

The project, budgeted at 1.3 billion euros, aims for a gradual launch by 2027. Lagarde emphasizes its complementary nature to cash. Indeed, it offers a public alternative to private solutions such as bank cards or electronic wallets. For the ECB, the goal is to meet the needs of an increasingly digitalized economy while preserving the stability of the European financial system.

Criticism of the digital euro: between surveillance and centralization

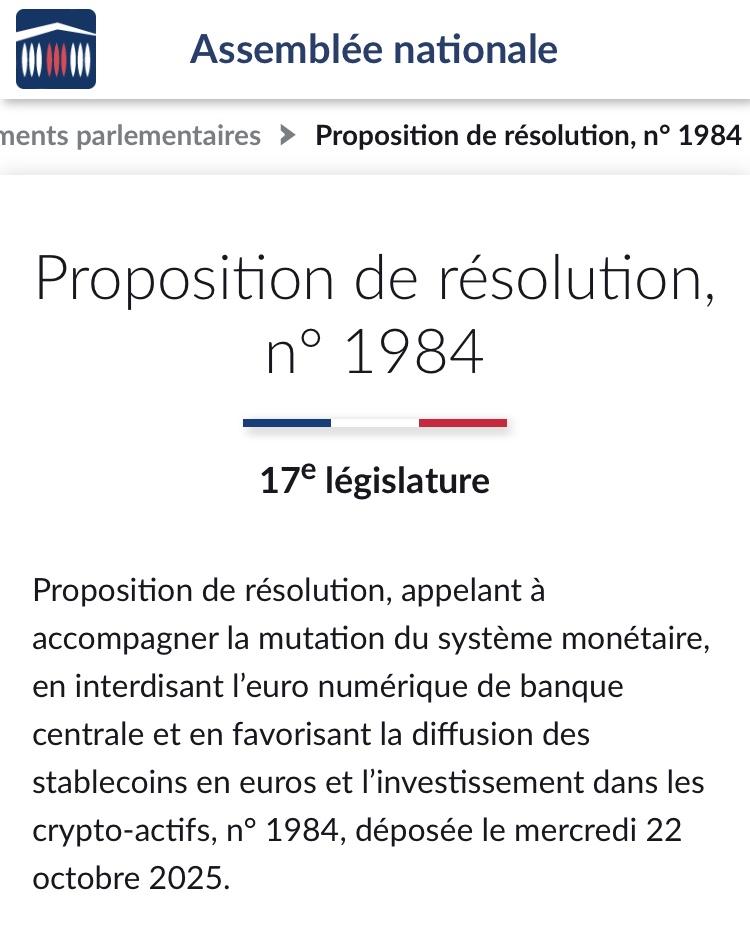

The digital euro is not unanimous, especially in the crypto ecosystem. Critics point to risks of increased surveillance and state control over financial transactions. For them, a digital currency issued by a central bank opposes the decentralization principles that underpin the spirit of cryptocurrencies. In France, political voices rise to denounce this project. Éric Ciotti even proposed a law aiming to ban the digital euro, advocating instead for adopting bitcoin as an alternative currency.

In France, Éric Ciotti proposes a law aiming to ban the digital euro.

In France, Éric Ciotti proposes a law aiming to ban the digital euro.

In Germany, parties such as the AfD call to recognize bitcoin as a national priority , arguing that the digital euro could lead to an overly intrusive financial system. These criticisms reflect growing mistrust towards central institutions and their ability to guarantee privacy.

The EU blocks the Russian stablecoin A7A5: a strategy to impose its CBDC?

At the end of October 2025, the European Union banned the Russian stablecoin A7A5 , accused of circumventing sanctions and financing the war in Ukraine. This stablecoin, backed by the ruble, allowed Russia to maintain financial exchanges despite embargoes. By banning it, the EU displays its intention to control monetary flows on its territory and limit the influence of foreign digital currencies.

This decision raises questions: is the EU looking to eliminate competition to facilitate the adoption of its own CBDC? In this context, bitcoin emerges as a neutral and censorship-resistant solution. While states develop their sovereign digital currencies, BTC remains the only fully decentralized asset, favored by those who reject a financial system controlled by central banks. A symbolic but also practical resistance in a landscape where crypto redraws the frontiers of finance.

The digital euro crystallizes hopes for a modern financial Europe according to Christine Lagarde, but also fears of an overly controlled system. Between innovation and preservation of freedoms, the debate remains intense. As states and central banks move their pieces, crypto, and particularly bitcoin , continues to represent a decentralized alternative. Will the balance between regulation and financial freedom be possible?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A $500 billion valuation giant is emerging

With a valuation comparable to OpenAI and surpassing SpaceX and ByteDance, Tether has attracted significant attention.

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

Why does bitcoin only rise when the U.S. government reopens?

The US government shutdown has entered its 36th day, leading to a decline in global financial markets. The shutdown has prevented funds from being released from the Treasury General Account (TGA), draining market liquidity and triggering a liquidity crisis. Interbank lending rates have soared, while default rates on commercial real estate and auto loans have risen, increasing systemic risk. The market is divided over future trends: pessimists believe the liquidity shock will persist, while optimists expect a liquidity release after the shutdown ends. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model is updated.

Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."