Ripple Price Analysis: XRP’s Path to $3 Still in Doubt Due to This Crucial Resistance

XRP has been trading with relatively low volatility in recent weeks, consolidating below key resistance levels as broader market momentum stalls. While the recent bounce from support suggests short-term buyers are still present, the price remains trapped in a range without clear bullish conviction.

Technical Analysis

By Shayan

The USDT Pair

On the USDT pair, XRP is hovering around $2.50, still below the confluence of the 100-day and 200-day moving averages. After the sharp liquidation wick into the demand zone, the asset bounced quickly but failed to break back above the key resistance near $2.60.

The RSI has also flattened out around 45, reflecting weak momentum and a lack of strong bullish drive. Unless the price reclaims the moving averages and breaks above the $2.60–$2.75 zone with volume, the path of least resistance remains sideways to slightly bearish. Regardless, a return to the support level around $2.20 would offer a better risk-reward for buyers.

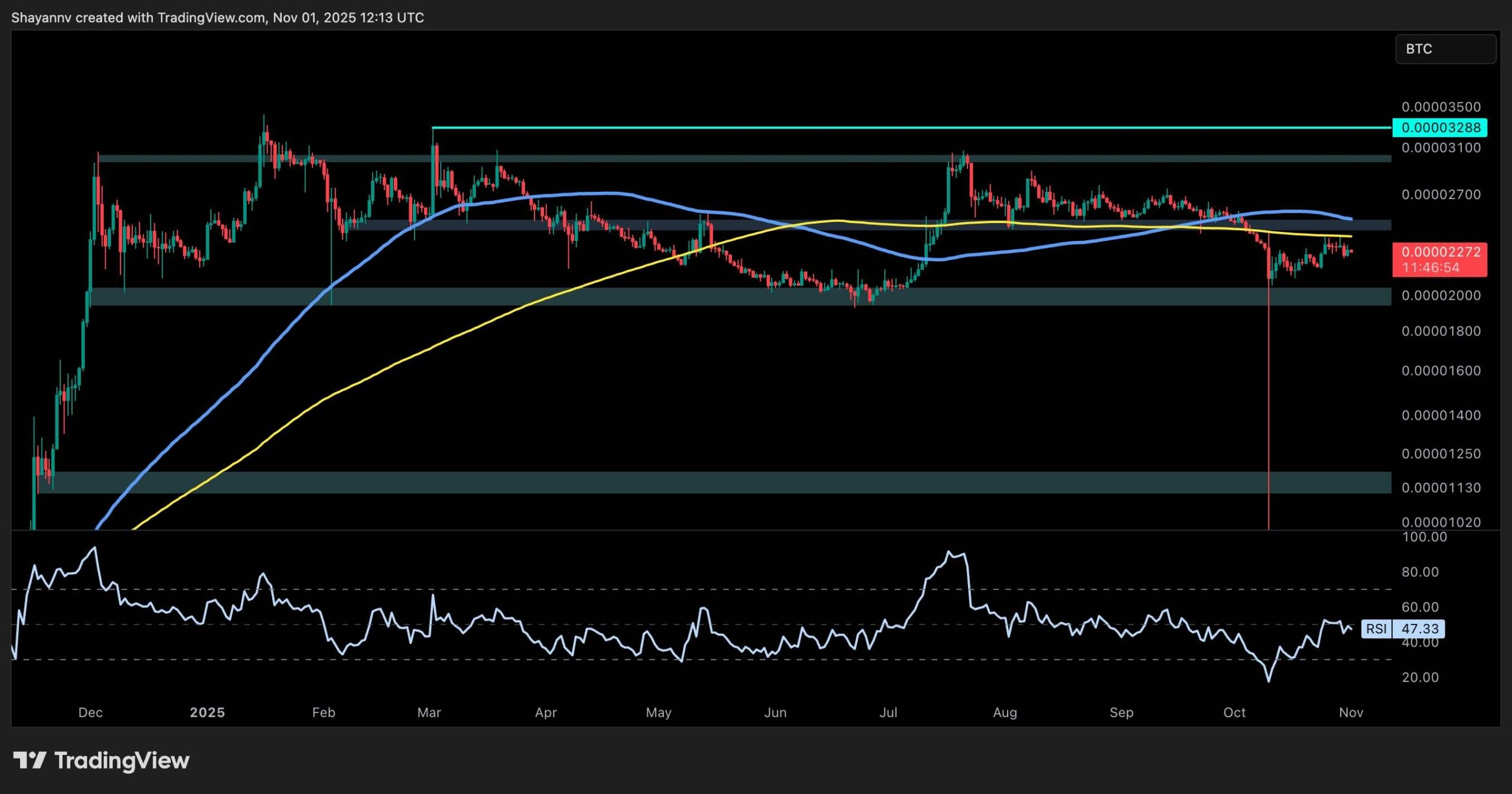

The BTC Pair

Looking at the XRPBTC chart, the price remains under pressure after multiple failed attempts to reclaim key resistance levels. It’s currently trading around 2,270 sats, stuck below the 100-day and 200-day moving averages. This entire structure has been a prolonged accumulation or distribution range, depending on how it resolves.

While the bounce off the 2,000 sat zone shows buyers are still defending key long-term support, there’s little follow-through to suggest strength. The RSI at 47 indicates a neutral momentum, but unless a clean break above 2,500 sats with high volume occurs, XRP continues to lag against Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As treasury companies start selling coins, has the DAT boom reached a turning point?

From getting rich by holding coins to selling coins to repair watches, the capital market is no longer unconditionally rewarding the narrative of simply holding tokens.

Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges