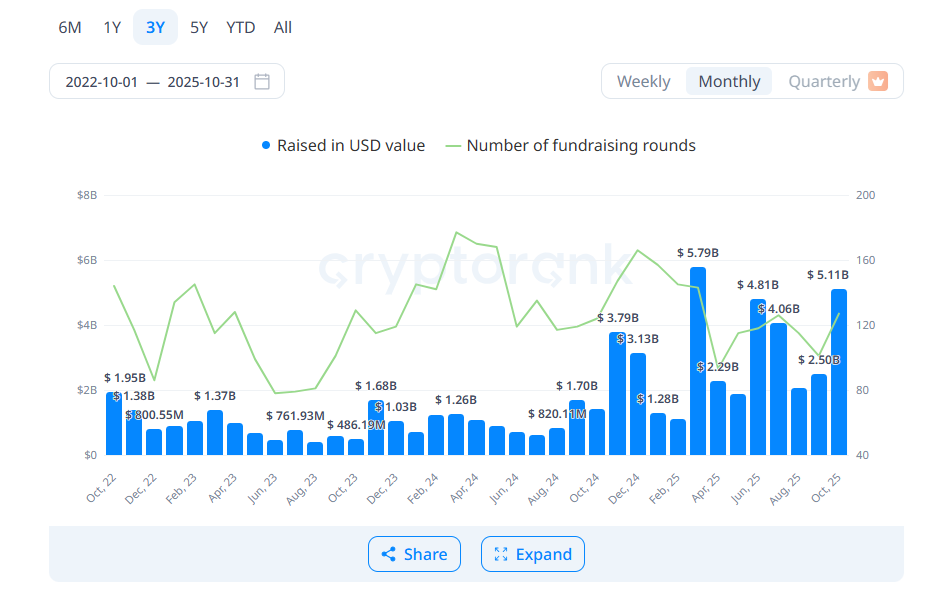

Crypto Venture Funding Rebounds: Surges to $5.11B in October

Crypto venture capital activity continued its steady recovery in October, closing the month with $5.11 billion in reported deals. Investor confidence strengthened after a slower summer, and funding levels nearly matched the March 2025 peak of $5.79 billion. Early data suggests that October’s final total could rise further once all undisclosed rounds are reported.

In brief

- October crypto VC deals hit $5.11B, the second-highest since 2022, signaling renewed investor confidence.

- The U.S. led with $2.26B in funding, while international projects added $1.63B in undisclosed deals.

- 127 rounds closed, led by Coinbase Ventures; Echo and Kalshi headline large late-stage raises.

- AI-linked crypto projects captured 32% of funding as NFT and gaming investments continued to fade.

US Leads Crypto VC Revival as October Funding Hits $5.11B

Venture activity gained momentum across late-stage projects, indicating that investors favored established ventures over early experimental platforms. The United States maintained its dominant position, securing $2.26 billion in deals.

Meanwhile, international projects with undisclosed deal details contributed another $1.63 billion. Overall, October ranked as the second-strongest month for crypto VC activity since 2022.

Over the past year, funding patterns have undergone notable shifts. Investors are focusing more on projects with proven business models and less on speculative tokens with limited liquidity. This change reflects lessons learned from the 2021–2022 cycle, during which many low-float assets struggled in secondary markets.

VC Market Recovers with 127 Deals and Late-Stage Focus

A total of 127 funding rounds closed in October, marking a return to typical investment activity levels. Coinbase Ventures once again led the space, participating in 10 rounds, followed by Yzi Labs with five deals.

Echo’s $375 million raise, led by Coinbase Ventures, was one of the month’s largest announcements. Founded by well-known crypto personality Jordan Fish (also known as Cobie), Echo attracted significant institutional attention. Prediction market platform Kalshi also raised $300 million, reinforcing the trend toward larger, late-stage investments.

Average deal sizes ranged between $3 million and $10 million, although major rounds such as Kalshi and Tempo helped lift overall totals. Larger fund allocations have become increasingly common as mature projects seek growth capital.

Investment activity was concentrated in several key sectors:

- AI-linked crypto projects accounted for 32% of all funding activity.

- Binance Alpha initiatives made up more than 15% of total deals.

- Real-world assets (RWA) and payment solutions remained steady investment targets.

- Developer tools continued attracting mid-sized rounds.

- NFT and gaming projects saw limited funding, reflecting a shift away from 2021’s dominant categories.

Coinbase Ventures also participated in several smaller rounds between $5 million and $20 million, expanding its footprint across early infrastructure and application layers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum Faces $2,800 Test—Will It Surge to $3,000 or Retreat to $2,300?

- Ethereum tests $2,800 resistance, key threshold for November, with potential to rebound toward $3,000 if breakout succeeds. - Recent $55.7M inflow into ETH ETFs, led by Fidelity’s FBETH, signals cautious institutional interest after nine-day outflow streak. - Technical indicators show improved momentum with RSI rebound and MACD stabilization, but $2,800 remains critical for further gains. - Derivatives data and Coinbase’s ETH-backed lending expansion hint at conditional recovery, though liquidation risks

Ethereum Updates: Centralized DNS Compromise Highlights DeFi Weaknesses as Aerodrome Suffers $1 Million Loss

- Aerodrome Finance suffered a DNS hijacking attack on Nov 22, 2025, redirecting users to phishing sites that siphoned over $1M in assets through deceptive transaction approvals. - Attackers exploited vulnerabilities in centralized domain registrar Box Domains, forcing users to approve unlimited access to NFTs and stablecoins via two-stage signature requests. - The protocol shut down compromised domains, urged ENS-based access, and revoked recent token approvals, marking its second major front-end breach i

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu

Bitcoin News Update: Navigating Crypto’s Balancing Act to Steer Clear of 2018’s Downturn as Global Economic Conditions Evolve

- Crypto markets avoid 2018-style collapse as macro-driven cycles and reduced speculation prolong volatility, per Lyn Alden. - Fed policy uncertainty and leveraged ETF launches highlight risks and innovations amid $2.2B crypto outflows and $914M liquidations. - MSTR's BTC gains and Gunden's $1.3B sell-off reflect divergent investor strategies, while Munari's Solana project targets long-term adoption. - Analysts split between 65-70% Bitcoin retracement forecasts and prolonged cycles driven by institutional