Ripple’s $1.25B Deal Brings XRP Trading to Big Investors

Ripple just made a major play in the U.S. crypto market. The company has rolled out a new digital asset spot prime brokerage, offering over-the-counter (OTC) trading for XRP, its stablecoin RLUSD, and a range of other digital assets. The launch follows Ripple’s $1.25 billion acquisition of Hidden Road, a move that merges traditional financial infrastructure with Ripple’s blockchain expertise. The goal is clear — bring institutional-grade trading, clearing, and liquidity under one powerful platform called Ripple Prime.

Ripple Expands Into U.S. Prime Brokerage

Ripple has officially launched a digital asset spot prime brokerage in the United States, marking a major leap beyond payments and into institutional trading. The platform, called Ripple Prime, offers over-the-counter (OTC) spot trading for top cryptocurrencies, including XRP , Ripple’s native token, and RLUSD , its new stablecoin.

This move strengthens Ripple’s position in the institutional finance space, letting clients trade, clear, and finance assets under a single umbrella. It’s not just another crypto service — it’s Ripple’s answer to bridging traditional finance and blockchain liquidity.

The Hidden Road Deal: A $1.25 Billion Catalyst

The launch follows Ripple’s $1.25 billion acquisition of Hidden Road , a multi-asset prime broker specializing in global markets. The acquisition brought with it critical licenses, regulatory frameworks, and advanced infrastructure — all now merged into Ripple’s ecosystem.

By combining Hidden Road’s technology with Ripple’s blockchain-based systems, the company can now offer a unified execution and clearing platform across digital assets, foreign exchange, derivatives, and even fixed income markets. It’s the kind of vertical integration that institutional investors love because it simplifies compliance and execution.

What Ripple Prime Offers Institutions

Ripple Prime’s new U.S. platform supports cross-margining, letting institutional clients use crypto and traditional assets side by side. A firm holding XRP or RLUSD can offset exposure with CME futures or other derivatives in one place.

Michael Higgins, Ripple Prime’s International CEO, said the new OTC spot capabilities complement the firm’s existing suite of OTC and cleared derivative services — effectively giving traders a one-stop shop for digital and traditional assets.

A Year of Aggressive Expansion

2025 has been a record-setting year for Ripple’s acquisitions. After Hidden Road, Ripple acquired GTreasury in a $1 billion deal to modernize corporate treasury management with blockchain. CEO Brad Garlinghouse called it a “watershed moment” for enterprise liquidity.

Ripple also led a $1 billion raise to bolster its XRP reserves, reinforcing on-chain liquidity for payment corridors. The company is clearly building an ecosystem designed to make institutional adoption of crypto infrastructure not just possible, but easy.

Politics, Regulation, and Strategy

Garlinghouse has been vocal about the improving U.S. regulatory climate under the Trump administration. With a stablecoin bill already passed and a market structure bill in progress, Ripple seems ready to seize the moment.

The company has also been politically active — joining Coinbase and other major firms as donors to the administration’s White House ballroom fund, a signal that Ripple wants a front-row seat in shaping crypto regulation.

What This Means for the Market

Ripple isn’t just expanding; it’s positioning itself as the institutional bridge between crypto and Wall Street. By integrating Hidden Road’s brokerage framework and GTreasury’s enterprise tools, Ripple is quietly building the infrastructure for large-scale adoption — the kind that banks, funds, and corporates will rely on.

The launch of Ripple Prime’s spot brokerage could mark a turning point where XRP evolves from a payments token into a core institutional asset.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

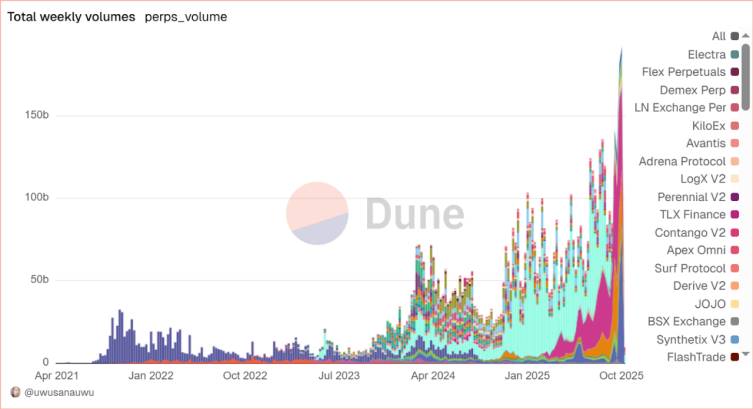

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.