Altcoins Collapse: Less Than 5% Beat Bitcoin as BTC Dominance Hits 60%+

Bitcoin is reclaiming control of the crypto market as altcoins “bleed,” with dominance soaring above 60% for the first time in years. Analysts warn that 2025 may favor Bitcoin and high-quality sectors like DeFi and RWA, leaving speculative altcoins behind.

After more than two months of weakness, Bitcoin is reasserting its dominance. The Bitcoin Dominance Index surpasses the 60% mark, the highest level since mid-2021.

Meanwhile, most altcoins have plunged, with fewer than 5% of the top 55 tokens outperforming BTC. As institutional inflows continue to favor Bitcoin, a clear “risk-off” sentiment is spreading across the market, firmly placing crypto in a new “Bitcoin Season.”

Bitcoin Consolidates Power as Altcoins Lose Ground

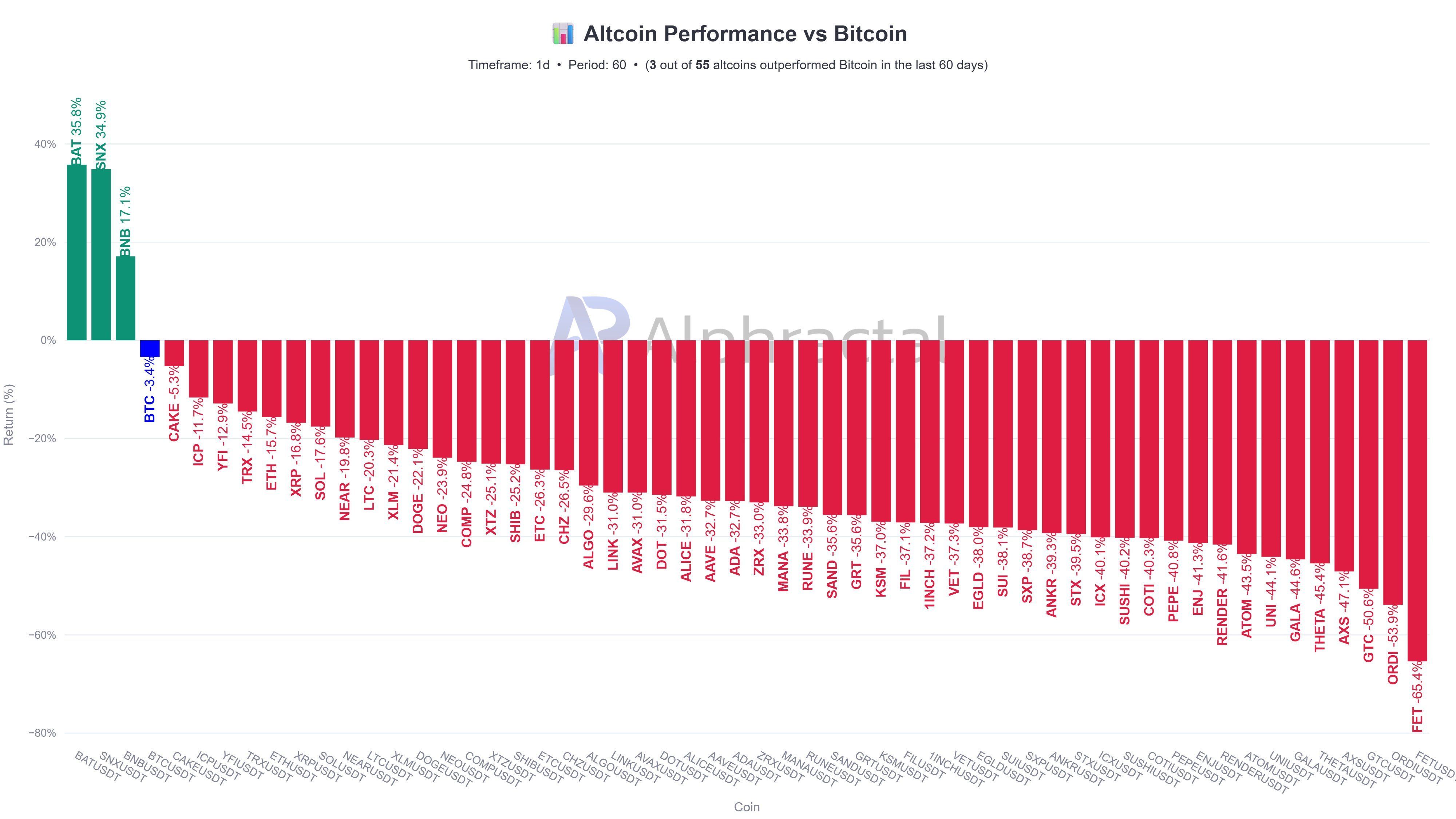

According to data from Alphractal, only 3 out of 55 major altcoins have outperformed Bitcoin (BTC) over the past 60 days, while the rest have lost between 20% and 80% of their value. The broader altcoin market remains deeply in the red, as reflected in the Altcoin Season Index, which currently hovers around 25-29, indicating that the market is in a Bitcoin Season.

Altcoin performance vs Bitcoin. Source:

Alphractal

Altcoin performance vs Bitcoin. Source:

Alphractal

On the Bitcoin Dominance (BTC.D) chart, the index reached 60.74%, up from 59% at the end of September, marking the highest level over two years. This signals that capital rotates out of riskier assets and back into Bitcoin. Analysts, such as Benjamin, forecast that altcoins could drop another 30% against Bitcoin in the coming weeks if Bitcoin’s uptrend continues.

BTC.D chart. Source:

TradingView

BTC.D chart. Source:

TradingView

Selling pressure across the altcoin market has intensified after several analysts noted that the structure established following the October crash is now breaking down. If this selling momentum persists, altcoins could enter a deeper downside phase.

Still, some traders remain optimistic about the broader market structure over the next three to six months. Bitcoin continues to hold above its 50-week EMA, with liquidity rising and expectations growing for a potential Fed rate cut in December. According to one trader, altcoins will eventually follow as long as BTC maintains its trend.

“Ignore fear, follow structure,” the user emphasized.

At this stage, we may witness a familiar liquidity rotation, capital flowing out of altcoins to reinforce Bitcoin’s dominance. As long as BTC remains strong on the weekly timeframe and institutional capital continues to enter the market, altcoins are unlikely to break out independently. This environment favors a defensive strategy, prioritizing BTC and stablecoins over speculative assets.

Recovery Signs May Emerge, but Not for All

Despite the short-term bearish outlook for altcoin performance vs Bitcoin, several analysts highlight the possibility of a technical bounce soon. According to another X user, the “Others vs BTC” chart just closed its monthly candle with a long wick to the downside, a pattern that has historically preceded short-term rebounds as markets “fill gap” in subsequent sessions.

Others/BTC chart. Source:

Bitcoinsensus

Others/BTC chart. Source:

Bitcoinsensus

While Bitcoin holds the upper hand, any pause or pullback in BTC’s momentum could allow altcoins to stage a selective recovery. This would enable speculative capital to flow back into smaller-cap tokens.

In summary, while a short-term recovery is possible, only a few market segments are likely to benefit, particularly projects with strong fundamentals and tangible applications, such as RWA, DeFi, or AI-linked tokens. The market is becoming increasingly selective, leaving little room for narrative-driven altcoins with weak fundamentals. Therefore, late 2025 may not bring a broad-based “altseason,” but rather a selective mini-altseason defined by quality over hype.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Dawn: Solana's Fast Track to International Financial Markets

- Wormhole Labs launched Sunrise, a Solana platform for instant token listings via NTT framework, bypassing wrapped tokens. - MON became first token listed on Nov 23, enabling immediate trading on Jupiter and Orb DEXs with native liquidity. - Platform addresses Solana DeFi's fragmented liquidity by standardizing cross-chain entry for new assets from day one. - Sunrise aims to expand beyond crypto to tokenized commodities and real-world assets, competing with Ethereum's DeFi dominance.

Hyperliquid News Today: Crypto Faces Widespread Challenges as Short Sellers Profit and Long Positions Suffer Amid Market Volatility

- HYPE whale 0x082 faces $10M unrealized loss after 126% price drop, raising pre-announcement trading suspicions. - Abraxas Capital liquidates $620K in HYPE shorts while BitMine reports $3.7B ETH unrealized loss amid compressed crypto premiums. - Hyperliquid's 0x5D2F nets $51M BTC short profits as 53.2% of platform positions favor bearish bets. - Robinhood's $1.27B Q3 revenue surge contrasts with $1.5B insider share sales and tokenized stock expansion into Europe. - Market fragility persists with declining

ICP Jumps 30% in a Week: What’s Fueling the Buzz and What Could Happen Next?

- ICP token surged 30% in 7 days amid whale accumulation and rising network adoption metrics. - Daily active addresses rose 35% while DEX volumes hit $843.5M, signaling growing decentralized computing utility. - Futures open interest reached $188M as retail optimism clashes with technical concerns below EMA-9 at $5.40. - Key resistance at $6.47 could trigger further gains if ICP sustains above $5.40, but leveraged positions pose correction risks.

Grayscale & Franklin Templeton XRP ETFs Go Live: What’s Next for XRPs Price?