UBS successfully executes its first instant tokenized fund transaction using Chainlink DTA technical standard

PANews, November 4th – According to official news from Chainlink, UBS announced today that it has successfully completed the world's first end-to-end tokenized fund workflow in a production environment using the Chainlink DTA technical standard.

The UBS USD Money Market Investment Fund Token ("uMINT") is a money market investment fund based on Ethereum distributed ledger technology. This time, uMINT completed subscription and redemption requests on-chain for the first time, demonstrating the ability to achieve seamless and automated fund operations on-chain, thereby improving efficiency and utility gains. In this instant transaction, DigiFT, acting as the on-chain fund distributor, successfully requested and processed the settlement of uMINT shares using the Chainlink DTA standard.

This brand-new end-to-end tokenized fund workflow covers every stage of the fund lifecycle, including order receipt, execution, settlement, and data synchronization between all on-chain and off-chain systems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

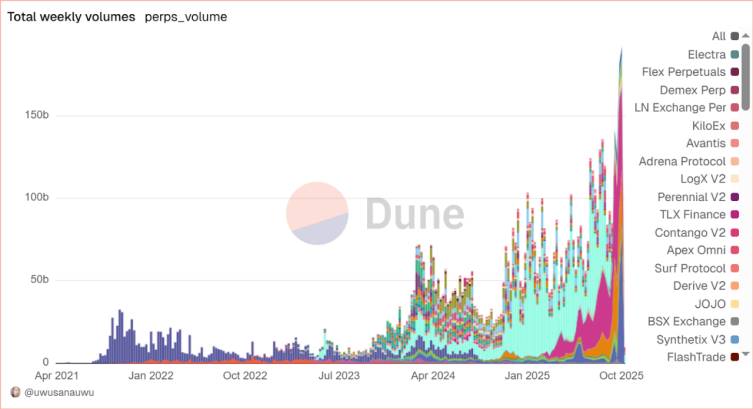

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.