LSEG Wins GLEIF Global vLEI Hackathon for Advancing Digital Identity in Crypto

Quick Breakdown

- LSEG wins GLEIF’s vLEI Hackathon for digital asset infrastructure.

- vLEI tech enables compliance and audit-ready crypto transactions.

- Clearstream recognized for vLEI-based secure login innovation.

The Global Legal Entity Identifier Foundation (GLEIF) has named the London Stock Exchange Group (LSEG) as the winner of its Global vLEI Hackathon under the Digital Asset and Financial Infrastructure category. The competition spotlighted how verifiable digital identities can enhance transparency, compliance, and security across blockchain-based financial systems.

Congratulations to London Stock Exchange Group for winning the @GLEIF vLEI Hackathon at SmartCon, and to Clearstream for securing the runner-up spot.

Sponsored by Swift ( ) and Chainlink, the hackathon was held during SmartCon’s exclusive…

— Chainlink (@chainlink) November 4, 2025

Selected from over 110 global submissions, LSEG’s winning solution showcased how the Legal Entity Identifier (LEI) and verifiable LEI (vLEI) can be integrated into crypto and digital asset frameworks to enable automated compliance and real-time auditing. By embedding trust at the protocol level, the innovation supports a future where institutional blockchain transactions are verifiable and regulator-ready.

Embedding digital trust in blockchain systems

The vLEI system, a next-generation digital identity framework, provides verifiable proof of organizational identity and authority — a critical need as crypto markets mature under tighter oversight. LSEG’s implementation demonstrates how decentralized systems can interoperate with traditional financial infrastructure while maintaining auditability and compliance.

Clearstream, the hackathon’s runner-up, was recognized for developing a secure login model using vLEI on its ClearstreamXact platform, showing how regulated institutions can streamline user verification and reduce operational risk through cryptographic identity tools.

Driving regulated innovation in crypto finance

Hosted during Chainlink’s SmartCon in New York, the GLEIF Hackathon underscored the growing convergence of blockchain, regulatory technology, and digital identity. As institutions move toward tokenized securities and on-chain financial operations, vLEI-based identity standards are emerging as the backbone for trusted digital asset ecosystems.

The event reinforced GLEIF’s commitment to building a globally interoperable framework that supports the secure exchange of digital assets and institutional-grade blockchain finance.

Meanwhile, Deutsche Börse Market Data + Services has also announced a strategic partnership with Chainlink to deliver real-time multi-asset market data from Eurex, Xetra, and Tradegate directly on-chain — further reinforcing the shift toward verifiable, blockchain-based financial information. The initiative marks a breakthrough in bridging traditional finance and blockchain-based systems.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

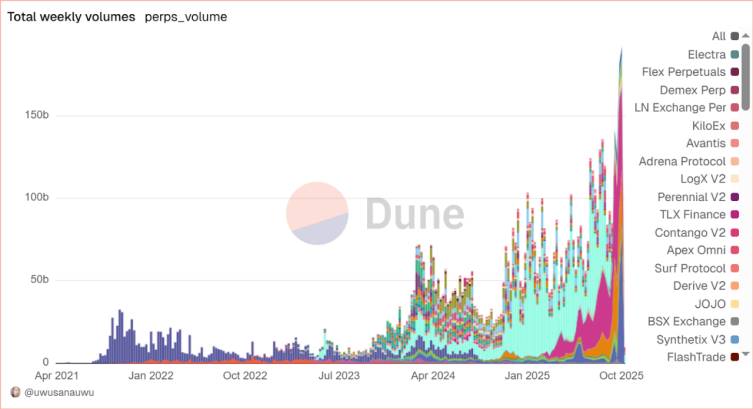

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.