Silently claiming the top spot in the Solana DEX market share, how did HumidiFi achieve this?

You can think of it as the on-chain version of Citadel Securities, a fully blockchain-based and permissionless market maker solution.

Original Article Title: "Solana's 'Invisible Champion': Rising to First in Market Share Quietly, How Did Dark Pool HumidiFi Do It?"

Original Article Authors: TATO, azsui

Original Article Translation: Tim, PANews

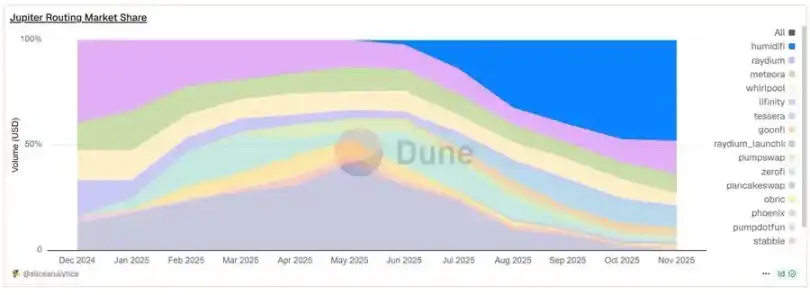

PANews Editor's Note: PANews Flash on November 3 — HumidiFi's 30-day trading volume surpassed Meteora and Raydium, leading the Solana DEX market. Most of the market is unfamiliar with HumidiFi, and the project's official Twitter account has only 12,000 followers. For this "invisible champion," PANews has organized and translated the relevant content of authors TATO and azsui, including an introduction to the HumidiFi project.

Body:

What Is Prop AMM? And What Is HumidiFi?

Traditional Automated Market Maker (AMM):

• Allows any user to provide liquidity→earn trading fees

• Uses a passive pricing mechanism (x*y=k constant product formula)

• Requires TVL to achieve deep liquidity

• Liquidity Providers (LPs) face impermanent loss risk

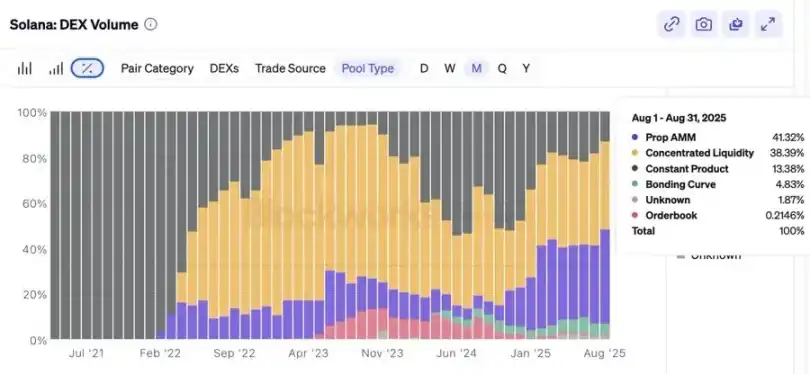

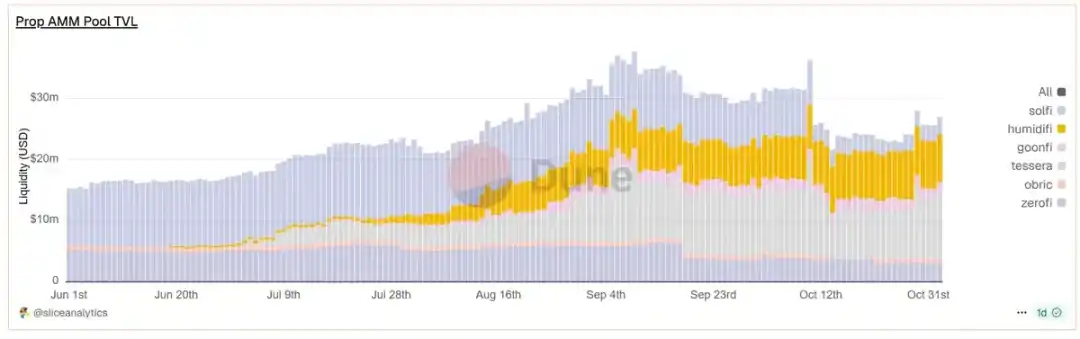

Professional Market Maker Automated Market Maker (Prop AMM):

• All liquidity provided by professional market makers

• Pricing strategy continuously updated and independent of user trading behavior

• Algorithm actively manages inventory like a centralized exchange market maker

• No public liquidity providers (LPs) = retail users do not bear impermanent loss

Core Features of HumidiFi:

• Rapid quote updates, performing multiple repricings per second

• Private order flow mechanism reduces volatility and front-running risk

• Achieves capital efficiency by precisely concentrating liquidity in the highest-demand areas

• Operates entirely on-chain with an algorithm

• Accessible only through the Jupiter route

This can be understood as the on-chain version of Citadel Securities, a fully blockchain-native and permissionless market maker solution.

HumidiFi Achievements

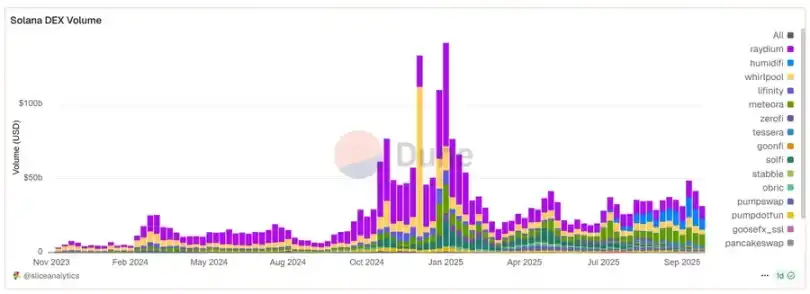

Trading Volume Leadership

• Achieved approximately $1 trillion in total trading volume within 5 months

• Accounted for 35% of the total DEX trading volume on the Solana blockchain

• Daily trading volume consistently ranged from $10 billion to $190 billion

• Last month's trading volume reached $340 billion (surpassing the total of Raydium and Meteora)

Execution Quality

• Narrower spread for SOL/USDC compared to Binance

• More competitive quotes → lower slippage, close to minimal price impact

• 99.7% fill rate (almost zero trade failures)

Capital Efficiency Marvel

• Processed $8.19 billion in daily trading volume with only $5.3 million TVL

• Achieved 154x capital efficiency (compared to around 1x for traditional AMMs)

• Oracle updates require only 143 computation units (approximately 1000x lighter than regular swaps)

The result? Users get better prices, without even needing to know that HumidiFi is behind the operation.

Why Choose HumidiFi?

Technological Superiority

• Ultra-lightweight oracle updates require only 143 computation units

• Sub-Millisecond Price Refresh (Competitors take 15-30 seconds)

• Tight liquidity around oracle-based price aggregation = Ultimate capital efficiency

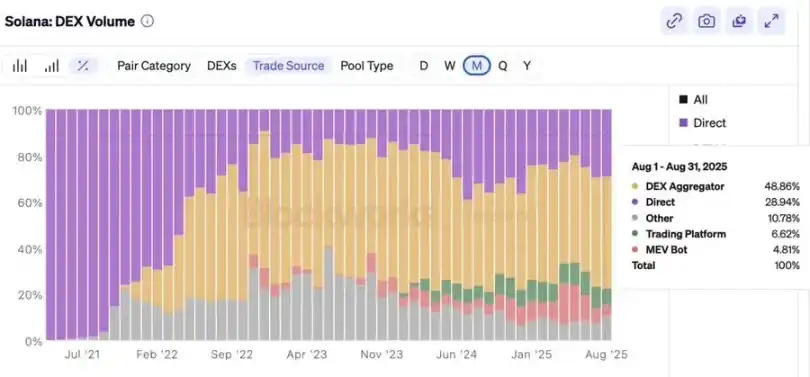

Jupiter Ecosystem Integration Advantage

• Jupiter processes 80%+ of Solana's swap volume

• HumidiFi captures 54.6% of Jupiter's professional market maker route

• Better prices → More routing options → Higher trading volume → Price edge amplification (Flywheel Effect)

Stealth Advantage

• No front-end interface

• Private order flow reduces MEV attack risk

• Anonymous operation = Reduced regulatory target risk

First-Mover Scale Effect

While competitors aim for millions, HumidiFi achieves a billion-asset breakthrough directly. In the DeFi market, liquidity attracts liquidity, and they have seized the initiative.

The Future is Here: HumidiFi Will Lead Solana DeFi Development

In short, it always gives you the best quote. For users, this is our core need.

Conclusion

HumidiFi is a professional AMM protocol, accounting for over 50% of total DEX trading volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×

European Tech Startups Eye Stablecoins, But Risks Stall Adoption

Stellar News Today: Turbo Energy's tokenization opens up clean energy investment to everyone

- Turbo Energy partners with Taurus and Stellar to tokenize hybrid renewable energy projects, targeting the $74.43B EaaS market. - The pilot uses blockchain to fractionalize solar storage PPA debt, leveraging Stellar's low-cost infrastructure for transparent green finance. - Tokenization aims to democratize clean energy investment, with Turbo's CEO highlighting scalability and security in AI-optimized storage solutions. - The initiative aligns with sustainable development goals, driving a 12.5% premarket s

Cardano News Update: MoonBull's AI Wager—Will It Surpass Cardano and Ethereum by 2025?

- MoonBull's $590,000 presale gains traction as a 2025 crypto contender, leveraging AI features and community governance. - Cardano partners with Wirex to launch ADA-branded crypto payment cards, aiming to bridge blockchain and traditional finance. - NFT and memecoin markets show 12-11% weekly gains, while Ethereum and TRON compete with MoonBull for 2025 growth narrative. - Regulatory risks and macroeconomic pressures persist, challenging projects like JFrog and Bumble amid crypto market volatility.