A whale's trading record: from a profit of 25 million to a loss of 30 million

Author: Sanqing, Foresight News

Original Title: The Myth of 100% Win Rate Ends: How a Whale Emptied Himself

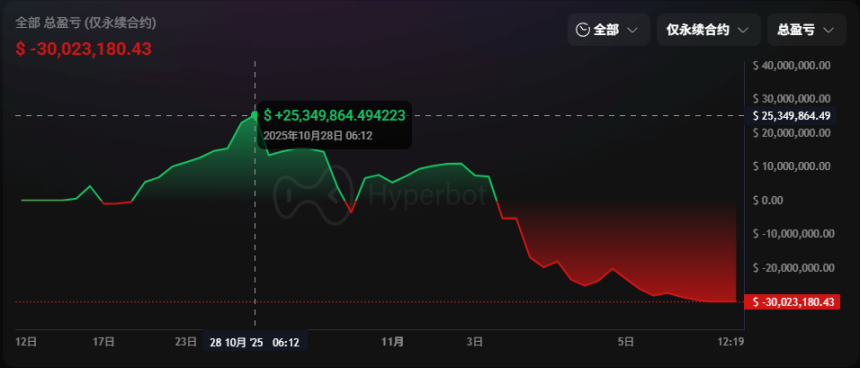

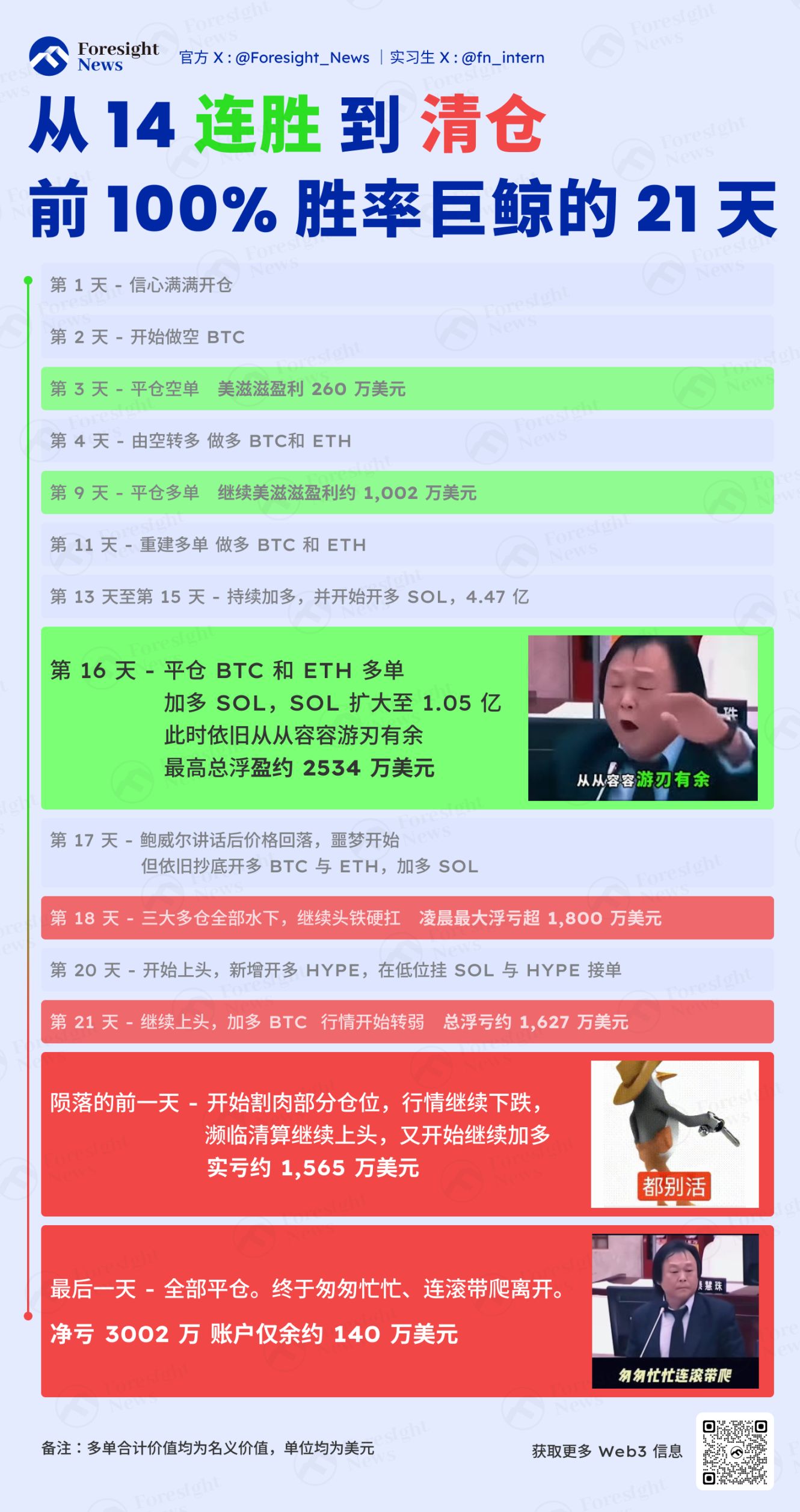

On November 5, an anonymous whale who had achieved a 100% win rate with fourteen consecutive wins on Hyperliquid was forced to liquidate, with his account dropping from a peak profit of over $25.34 million to a net loss of $30.02 million, leaving only about $1.4 million in margin. This 21-day trading cycle began on October 14 with a precise short followed by a long, reaching the peak of the profit curve on October 28. In just one week after that, due to concentrated leverage, a market pullback, and a chain reaction of adding to losing positions, all his profits and principal evaporated this morning.

Image source: Hyperbot

From Accumulation to Peak

On October 14, 2025, the anonymous whale with the address 0xc2a30212a8ddac9e123944d6e29faddce994e5f2 began his fourteen consecutive profitable trades on Hyperliquid.

He bought 5,255 ETH, sold all the next day for 22 million USDC, and used about 5x leverage to short BTC. Just one night later, at 8 a.m. on October 16, he closed the position, earning $2.6 million. This was his first consecutive win and the cleanest trade of the entire cycle.

In the following week, he switched directions precisely amid volatility. On the morning of October 17, he turned long, added to his position twice, and expanded his position to $222 million. Before the market dropped early on October 22, he closed about $300 million in long positions in advance, making a profit of $6.04 million. This move, described in tweets as "the guy reacts fast," established his myth of a 100% win rate.

From October 24 to 28 was his highlight period. He continuously added to BTC and ETH in batches, kept leverage below 8x, and expanded his position from $274 million to $447 million. On Hyperbot's P&L curve, this was the only complete upward green line—at 6:12 a.m. on October 28, his account had an unrealized profit of $25.349 million.

This was the last one-sided rise in his P&L curve. In the following week, the rhythm began to subtly shift.

From Taking Profit to Obsession

On October 29, the whale chose to close profitable positions first, while holding onto the losing ones. At 4 a.m., as the market dropped, he closed $268 million in BTC long positions, earning only $1.4 million, and in the afternoon closed $163 million in ETH longs, earning $1.63 million, leaving only the trapped SOL position.

Two days later, he increased his SOL position to a total of $105 million, with an average cost of $198.3. In the early morning of October 30, a speech by Federal Reserve Chairman Powell triggered a brief market drop, and he chose to bottom-fish BTC and ETH while also increasing his SOL position. That night, all three major positions were underwater, with an unrealized loss of $9.73 million.

At 4 a.m. on October 31, losses peaked at over $18 million, but as the market rebounded, the unrealized loss narrowed, and the whale tried to hold on until breakeven. By 8 a.m. on November 3, the unrealized loss had shrunk to $1.98 million, just one step away from breaking even, but he did not reduce his positions. Just three hours later, the market turned down again, and all four of the whale's long positions from his fourteen consecutive wins were back in the red.

He was just one step away from getting out unscathed, but in waiting and hesitation, he handed control back to the market.

From Stop Loss to Self-Destruction

In the early morning of November 4, his perfect win streak officially ended. He cut his losses and closed $258 million in BTC, ETH, and SOL long positions, realizing a loss of $15.65 million. This figure was almost equal to the $15.83 million profit he had made in the previous 20 days and fourteen consecutive wins. At this point, he still held $148 million in ETH, SOL, and HYPE long positions, with an unrealized loss of $18.86 million, and only 8% margin left before liquidation.

The market continued to fall that day. The whale was only 4% away from the liquidation price. His account balance had dropped $40.4 million from its peak, returning to square one with interest. As the liquidation price rapidly approached, any rational trader would have stopped, but he instead added 2,196 ETH and 78,724 SOL at $3,497 for ETH and $159 for SOL. The liquidation line was pushed even higher, with ETH's liquidation price at $3,348 and SOL's at $151.6. ETH was only $130 away from liquidation, and SOL only $8 away.

On November 5, it was all over. Around 5 a.m., he was forced to close all positions, leaving only $1.4 million in margin, almost equivalent to a full liquidation. Thus, this 21-day trading journey ended in complete wipeout. The $15.83 million profit from fourteen consecutive wins and $28.76 million in principal, totaling $44.67 million, was wiped out in a single loss.

Between Leverage and Human Nature

In Hyperliquid's trading records, almost every legend ends in a similar way: James Wynn once held a $1.2 billion BTC long with 20x leverage, peaking at $87 million in profit, but ultimately losing $21.77 million; qwatio used $3 million in principal to roll positions infinitely, once earning $26 million, but ended up at zero; veteran trader AguilaTrades turned $300,000 into a peak profit of $41.7 million, but ultimately lost $37.6 million. And this anonymous whale, famous for his "fourteen consecutive wins," turned $44.67 million to nothing in just one night.

Winning streaks can rely on skill and luck, but survival always depends on restraint. When everyone is obsessed with the upward curve, the ending is often already written beneath the leverage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges

XRP ETF: Nate Geraci predicts a launch within two weeks

Sequans Sells 970 Bitcoins, Unsettling the Markets

Crypto: Kaiko ranks XRP above Solana and Dogecoin in 2025