Bitcoin Updates: Crypto Tensions Escalate as Trump Moves to Surpass China in Bitcoin Strategy

- Trump administration unveils Bitcoin strategy to counter China and secure dollar dominance via Strategic Bitcoin Reserve and corporate adoption. - Strategy (formerly MicroStrategy) acquires 397 BTC, boosting holdings to $69.1B, surpassing most sovereign reserves through equity offerings. - Executive order halts crypto enforcement, creates seized-asset reserve while GENIUS Act rejects CBDC to prioritize private-sector innovation. - U.S. corporate Bitcoin holdings exceed $110B, but challenges include regul

The Trump administration has launched a comprehensive initiative to establish the United States as the dominant global

Strategy, recognized as the leading corporate purchaser of Bitcoin, revealed on November 3 that it had bought an additional 397

The company has financed these purchases through a series of at-the-market stock offerings, securing $69.5 million just last week. These funds were allocated directly to Bitcoin acquisitions, highlighting CEO Michael Saylor’s ongoing belief that Bitcoin is the “digital gold” of this century, as noted in

During remarks at the American Business Forum in Miami, Donald Trump described Bitcoin as a key pillar of America’s economic and security agenda. “America must lead in crypto, not China,” he asserted, pledging to end what he called the Biden administration’s “war on cryptocurrency.” Trump signed an executive order suspending federal crackdowns on crypto businesses and introduced the Strategic Bitcoin Reserve, which will consist of confiscated digital assets, as outlined in

The administration also enacted the

This U.S. approach comes as China continues to broaden its reach in the crypto industry, despite domestic prohibitions on trading and mining. While the Chinese government has prioritized its official digital yuan (e-CNY), it’s estimated that Chinese citizens collectively own 194,000 BTC—worth $20.7 billion—according to a

At the same time, the U.S. has become the world’s largest Bitcoin holder, with institutional investment accelerating across industries. Publicly listed firms now possess over $110 billion in Bitcoin, with Strategy’s holdings making up almost 3% of the total supply, as reported by a

Following the administration’s announcements, Bitcoin’s price has seen volatility, dropping below $109,000 soon after Strategy’s latest buy before settling near $111,000, as covered by Bitcoin Magazine. While corporate purchases have historically triggered price rallies, experts now emphasize that broader institutional participation and macroeconomic trends are increasingly shaping the market.

Senator Cynthia Lummis, a prominent supporter of cryptocurrency, has put forward a controversial proposal to liquidate Federal Reserve gold reserves in order to acquire 1 million bitcoins—a move she argues would eliminate the national debt and secure a strategic asset for the future, according to a

As the U.S. accelerates its efforts to lead in the crypto sector, obstacles persist. The ongoing government shutdown has stalled crucial regulatory measures, and America’s reliance on China for mining equipment and rare earth elements complicates the transition—issues also raised in the moomoo post. Nevertheless, with the Trump administration intensifying its focus on Bitcoin and corporations continuing to expand their reserves, the digital asset’s place in the global financial system appears increasingly secure.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×

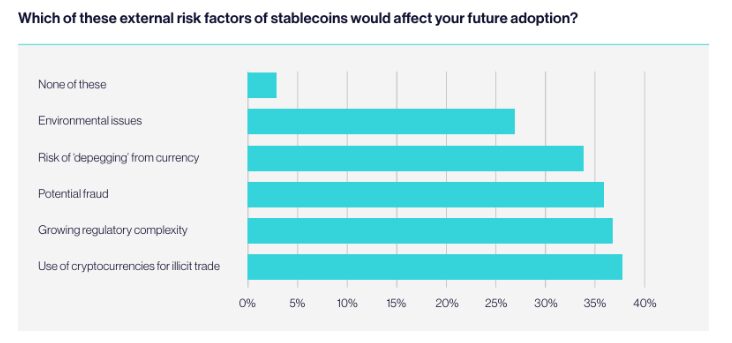

European Tech Startups Eye Stablecoins, But Risks Stall Adoption

Stellar News Today: Turbo Energy's tokenization opens up clean energy investment to everyone

- Turbo Energy partners with Taurus and Stellar to tokenize hybrid renewable energy projects, targeting the $74.43B EaaS market. - The pilot uses blockchain to fractionalize solar storage PPA debt, leveraging Stellar's low-cost infrastructure for transparent green finance. - Tokenization aims to democratize clean energy investment, with Turbo's CEO highlighting scalability and security in AI-optimized storage solutions. - The initiative aligns with sustainable development goals, driving a 12.5% premarket s

Cardano News Update: MoonBull's AI Wager—Will It Surpass Cardano and Ethereum by 2025?

- MoonBull's $590,000 presale gains traction as a 2025 crypto contender, leveraging AI features and community governance. - Cardano partners with Wirex to launch ADA-branded crypto payment cards, aiming to bridge blockchain and traditional finance. - NFT and memecoin markets show 12-11% weekly gains, while Ethereum and TRON compete with MoonBull for 2025 growth narrative. - Regulatory risks and macroeconomic pressures persist, challenging projects like JFrog and Bumble amid crypto market volatility.