Solana News Update: Sonami Addresses Solana's Scalability Issues for Live dApps

- Sonami ($SNMI) raises $2M in presale for Solana Layer 2 solution to reduce network congestion and improve transaction efficiency for real-time dApps. - 40% of 82.999B tokens allocated to development/exchange listings, with post-presale utility including Layer 2 bridging and exchange listings at $0.0019 price. - Solana ecosystem expands with Solmate's UAE validator (0% commission) and Alchemy's 20x faster infrastructure upgrades, addressing scalability as ETF inflows hit $294M. - Blazpay's AI-driven presa

Sonami ($SNMI) has revealed notable advancements in its efforts and the introduction of its

The token is presently priced at $0.0019, reflecting robust investor enthusiasm, and the project's roadmap highlights a commitment to openness and community-led expansion, per LiveBitcoinNews.

Sonami’s Layer 2 initiative is in step with broader advancements across the Solana network. Solmate Infrastructure (SLMT) has recently introduced the UAE’s inaugural bare-metal Solana validator, operating at zero commission and intended to boost validator capacity and transaction throughput, according to a

Interest from institutional investors in Solana has also climbed, with ETFs such as Bitwise’s BSOL and Grayscale’s GSOL drawing over $294 million in combined inflows since their debut on October 28, according to Yahoo Finance. Retail participation is also rebounding, shown by a 2.73% increase in SOL futures open interest to $7.64 billion and a positive shift in the OI-weighted funding rate, as reported by

Web3 infrastructure provider Alchemy has further strengthened Solana’s appeal to institutions by revamping its Solana stack. This redesign, created in partnership with ecosystem collaborators, delivers archive calls that are 20 times faster and achieves 99.95% uptime, addressing scalability constraints as ETF interest rises, according to CryptoNews. This upgrade is essential for supporting high-frequency transactions across wallets, exchanges, and dApps.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Short-Term Holders Increase Holdings While Long-Term Holders Realize Gains—$100K Becomes Key Level

- Bitcoin fell below $100,000 as Coinbase premium hit a seven-month low, reflecting weak U.S. demand and ETF outflows. - On-chain data shows short-term holders (STHs) accumulating Bitcoin while long-term holders (LTHs) moved 363,000 BTC to STHs, signaling mixed market dynamics. - Analysts highlight a "mid-bull phase" with STHs absorbing selling pressure, and a $113,000 support level critical for potential rallies to $160,000–$200,000 by late 2025. - The Fear and Greed Index entered "Extreme Fear," and exch

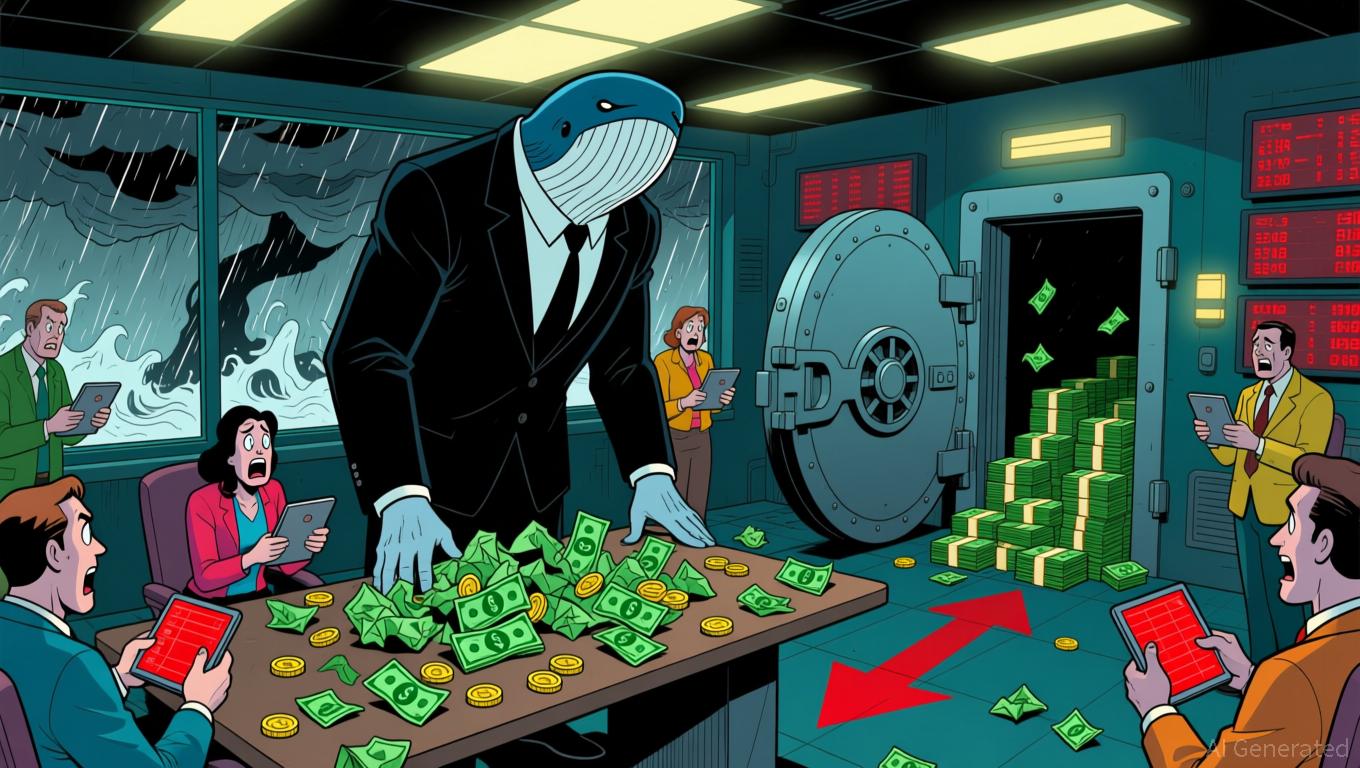

Bitcoin Update: Large Holders Depart and Economic Instability Push Bitcoin Under $100K

- Bitcoin fell below $100,000 as OG whales BitcoinOG and Owen Gunden moved $1.8B BTC to exchanges, signaling bearish bets. - $260M in long positions liquidated amid SOPR spikes, while Trump's crypto policies and China's $20.7B BTC holdings added macro risks. - Bit Digital staked 86% of ETH holdings for 2.93% yield, while Coinbase's negative premium highlighted waning U.S. buyer demand. - Analysts warn consolidation phases often follow whale profit-taking, with geopolitical tensions and derivatives volatili

Aster DEX's Latest Protocol Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX upgraded its protocol on Nov 5, 2025, enabling ASTER token holders to use their assets as 80% margin collateral for leveraged trading and receive 5% fee discounts. - Binance's CZ triggered a 30% ASTER price surge and $2B trading volume spike via a $2M token purchase three days prior, highlighting market speculation and utility convergence. - The platform introduced a "Trade & Earn" model allowing yield-generating assets like asBNB and USDF to be used as trading margin, enhancing capital efficie

XRP Update: Digitap's Practical Applications Put XRP's Delayed Ambitions to the Test

- Digitap ($TAP) raised $1.4M in November 2025, outpacing rivals like Bitcoin Hyper and Pepenode with an 80% early investor discount. - The project combines crypto and fiat banking via a live app, Visa cards, and deflationary tokenomics, positioning it as XRP's real-world competitor. - $TAP's fixed 2B token supply and transaction-burning model create scarcity, with analysts projecting 50x-70x price growth by late 2026. - Digitap's 124% APR staking rewards and privacy-focused features like offshore-shielded