Key Market Information Discrepancy on November 7th - A Must-Read! | Alpha Morning Report

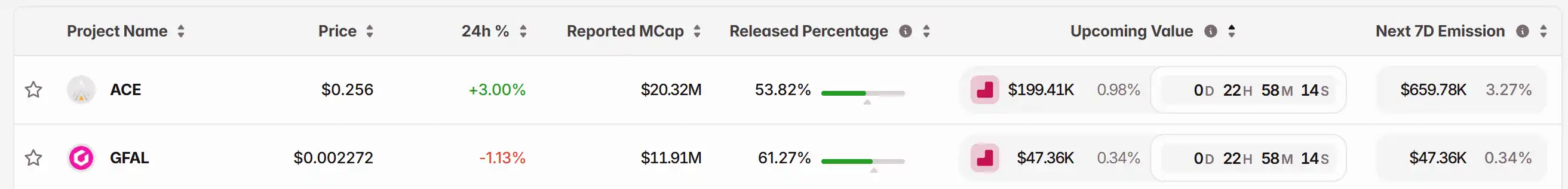

1. Top News: Stablecoin USDe Market Cap Drops Below $9 Billion, Decreasing by Around 45% in the Past Month 2. Token Unlocking: $ACE, $GFAL

Featured News

1. Stablecoin USDe Market Cap Falls Below $9 Billion, Down About 45% in a Month

2. Storage Sector Tokens Soar, FIL Surges Over 51.34%

3. Cryptocurrency Market Sees General Decline, Bitcoin Falls Below $101,000, US Stock Crypto-Related Stocks Significantly Affected

4. Nasdaq Extends Losses to 2%, NVIDIA Falls 3.43%

5. "Binance Life" Sees Large Buy-Ins Yesterday, Average Entry Price Around $0.17

Articles & Threads

1. "DeFi’s Potential $80 Billion Minefield, Only $1 Billion Exploded So Far"

The fund manager, a figure once trusted and later demystified in the stock market and enshrined with countless retail investors' wealth dreams. At first, everyone was chasing after fund managers who graduated from prestigious schools and had impressive resumes, believing that funds were a lower-risk, more professional alternative to direct stock trading. However, when the market plummeted, investors realized that the so-called "professionalism" couldn’t withstand systemic risks. Even worse, holding management fees and performance incentives, gains were seen as personal skills while losses translated to investors' money. Now, when the role of "fund manager" arrives on-chain with a new moniker "Curator" (an external curator), the situation becomes even more perilous.

2. "Intensifying Market Volatility, Why Bitcoin Still Aims to Reach $200,000 in Q4?"

This article was first published on October 27, 2025. On November 6, Tiger Research published again, stating that amidst increased market volatility, they are maintaining their $200,000 price target. This article elaborates on the specific reasons.

Market Data

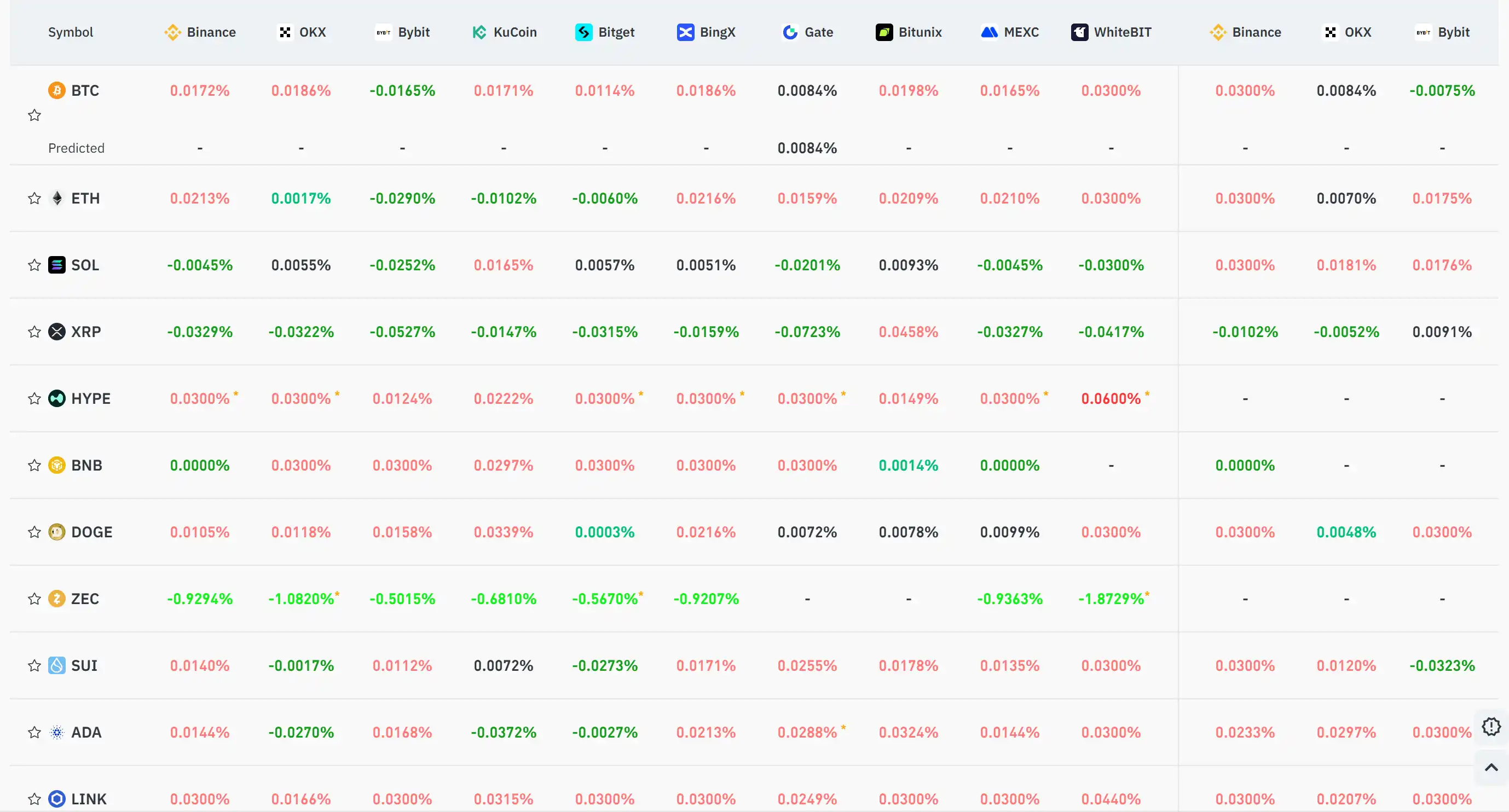

Daily Market Overall Funding Heatmap (as reflected by the Funding Rate) and Token Unlocks

Data Sources: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Rises 10.0% in a Day Despite Market Fluctuations

- LUNA surged 10.0% in 24 hours on Nov 7, 2025, but remains down 78.51% year-to-date amid broader crypto market declines. - Analysts attribute the short-term rebound to buying activity, yet highlight persistent bearish trends and macroeconomic uncertainties. - Technical indicators show LUNA trading below 50-day and 200-day moving averages, reinforcing the continuation of a long-term downtrend. - Backtesting suggests sharp price surges like LUNA's 5%+ daily gains historically lack sustained momentum without

European Central Bank to launch digital euro pilot phase starting in 2027

DeFi protocol Balancer suffers 128 million USD hack

Bitcoin miner Marathon Digital reports record results