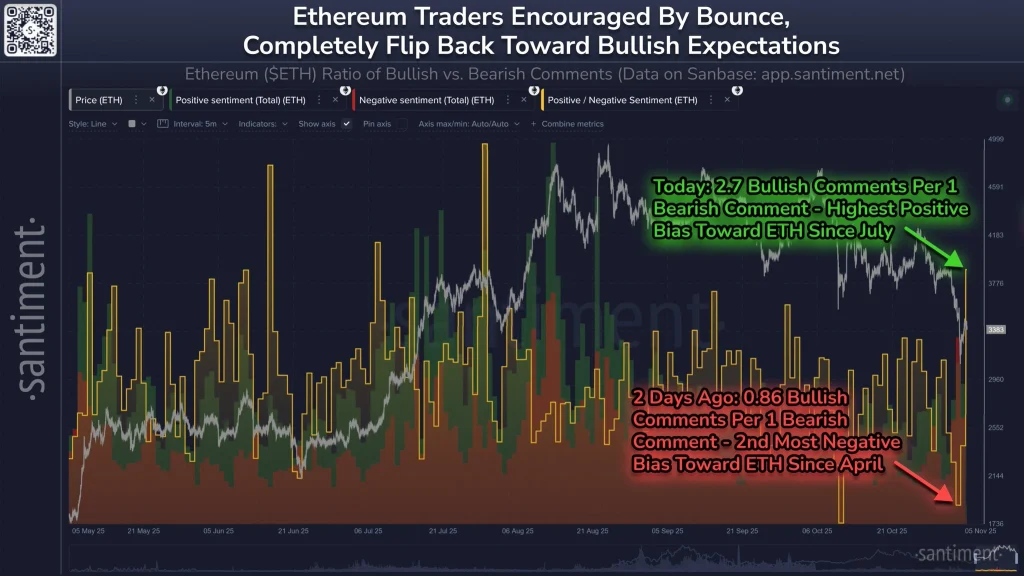

Ethereum (ETH) traders have quickly pivoted to extreme bullishness after the recent crypto market crash. According to market data analysis from Santiment, Ethereum traders have been expecting a strong rebound in the coming days following a series of deleveraging.

Source: Santiment

However, Santiment cautioned Ethereum traders for turning extremely bullish as history has proven that the market often moves in the opposite direction of the crowd’s expectations.

Ethereum traders have turned extremely bullish in the recent past following the notable deleveraging and renewed demand from whale investors. For instance, on-chain data analysis shows Tom Lee-led BitMine has been buying the recent market dip, whereby it withdrew ETH valued at about $70 million on Thursday.

The Ethereum traders have been expecting a bullish rebound as Wall Street gradually turns to altcoins. Ahead of the anticipated Fed’s Quantitative Easing (QE), institutional investors have been building on Ethereum via Digital Assets Treasuries (DATs), spot Exchange-Traded Funds (ETF), and tokenization of real-world assets (RWA).

From a technical analysis standpoint, ETH price has been retesting a crucial support level, which previously acted as a resistance level for long.

Source: X

With the ETH’s daily Relative Strength Index (RSI) hovering around oversold levels, a potential rebound towards a new all-time high is highly likely. However, if Ether price consistently dips below the support level above $3000, a full-blown bear market will be inevitable in the subsequent months.