Bitcoin ETFs $2 Billion Outflows Could Push BTC Into Capitulation

Bitcoin ETFs have seen massive $2 billion outflows, draining institutional confidence and pushing BTC closer to the $100,000 threshold — a level that could determine whether the market capitulates or rebounds.

Bitcoin’s price is struggling to hold above $100,000, marking one of its weakest phases in recent months. BTC exchange-traded funds (ETFs), once considered bullish catalysts, now appear to be amplifying market pressure.

The recent data show that ETF outflows are intensifying Bitcoin’s decline, shaking investor confidence, and presenting a potential bearish phase ahead.

Bitcoin May Struggle To Hold Investors’ Conviction

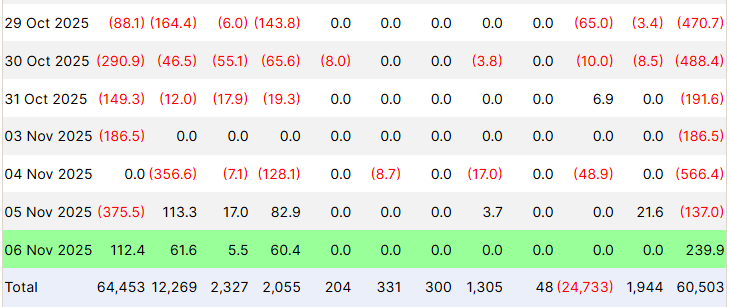

Spot Bitcoin ETFs have reported one of the steepest weekly outflows since their launch. Over the past seven days, approximately $2 billion worth of Bitcoin has exited these funds. This surge in withdrawals highlights how broader macroeconomic uncertainty is weighing on institutional sentiment, particularly amid weakening risk appetite and rising Treasury yields.

The continued outflows suggest that investors are opting to de-risk rather than accumulate exposure. If this pattern persists, the sell-side liquidity pressure could accelerate, reinforcing the downward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Spot Bitcoin ETFs Flows. Source:

Spot Bitcoin ETFs Flows. Source:

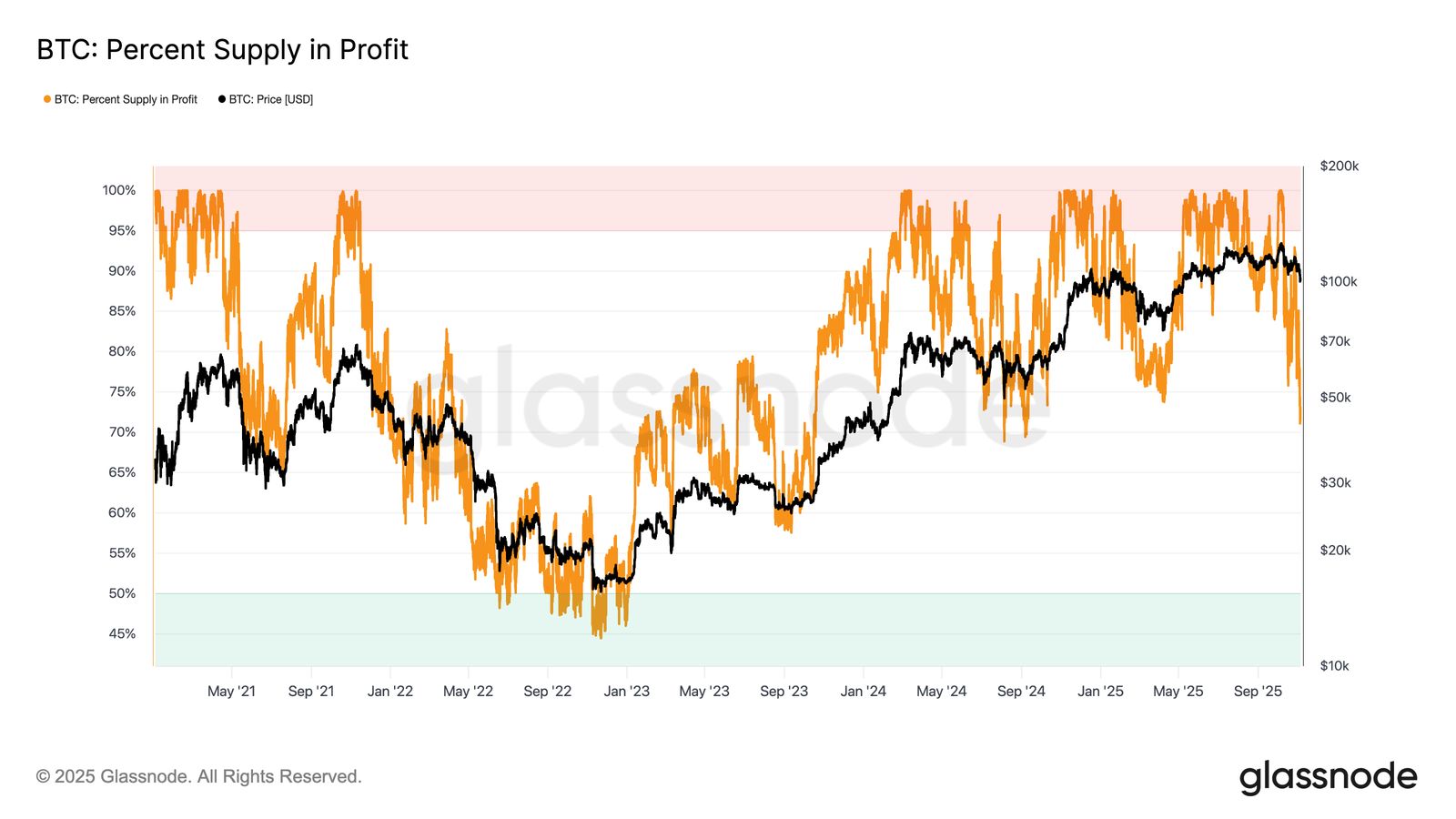

On-chain metrics reveal that Bitcoin’s supply in profit has slipped to around 71% at the $100,000 level. This positions the market near the lower end of the 70%–90% equilibrium range typically seen during mid-cycle slowdowns. At this stage, markets often consolidate before a recovery, but the risk of further decline remains high if new demand fails to emerge.

If a larger portion of the supply moves into loss, the probability of capitulation increases. This could transform the current correction into a deeper bearish phase similar to previous market cycles. For a sustainable rebound, Bitcoin must attract renewed inflows and maintain healthy exchange balance levels in the coming weeks.

Bitcoin Supply In Profit. Source:

Bitcoin Supply In Profit. Source:

BTC Price Is Fighting A Crash

At the time of writing, Bitcoin trades at $101,274, hovering just above the $100,000 psychological support. A breach below this level could trigger panic among retail traders.

If ETF outflows and bearish sentiment persist, Bitcoin could fall below $100,000 and test the $98,000 support. This decline could extend further, sending the crypto king towards $95,000 or lower.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

However, should low prices attract fresh capital inflows, BTC may rebound toward $105,000 and aim for $110,000. Reclaiming this resistance would signal renewed market strength and invalidate the prevailing bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Trump's Pause on China Tariffs Triggers Worker Protests Over Future of U.S. Shipyards

- Trump administration suspends China tariffs on shipbuilding imports, drawing labor union criticism over domestic industry risks and worker refunds. - 175 H-1B visa abuse investigations reveal $15M+ potential refunds, as unions warn of wage suppression and corporate favoritism in trade policies. - Square enables Bitcoin payments for 4M U.S. merchants, advancing crypto adoption while Trump dismisses inflation concerns and vows meatpacking crackdowns.

Bipartisan Legislation Assigns Crypto Regulation to CFTC to Clarify Oversight Uncertainty

- U.S. lawmakers propose shifting crypto regulation from SEC to CFTC via a bipartisan bill, reclassifying most digital assets as commodities. - The draft aims to resolve regulatory ambiguity stifling innovation, building on stalled House CLARITY Act efforts during the 38-day government shutdown. - Market optimism surged as shutdown relief pushed Bitcoin above $105k, with ETF outflows persisting amid anticipation of clearer CFTC-led oversight. - Critics warn of CFTC resource constraints, while proponents hi

Solana News Update: DevvStream Invests in SOL Despite $11.8M Deficit, Shows Strong Confidence in Sustainable Blockchain Prospects

- DevvStream Corp. (DEVS) disclosed holding 12,185 SOL and 22.229 BTC, staking SOL for 6.29% annualized yield amid a $11.8M fiscal 2025 loss. - The company launched a digital asset treasury via BitGo/FRNT Financial, securing $10M liquidity from a $300M convertible note facility. - Plans include a 2026 tokenization platform for carbon credits and Solana staking, aligning with its de-SPAC/Nasdaq listing strategy. - Despite crypto market outflows, DevvStream's staked SOL attracted inflows, contrasting broader