BlackRock Just Gave the XRP Community What It’s Been Waiting For

At Ripple’s Swell 2025 event, BlackRock’s Maxwell Stein said Ripple’s blockchain could move trillions in institutional capital, marking a turning point for XRP advocates. His remarks signaled growing TradFi confidence in tokenized finance, though legal experts urged caution over whether this reflected BlackRock’s official stance.

Ripple’s Swell 2025 conference in New York may have delivered one of the most defining moments in the digital asset industry’s relationship with Wall Street. The XRP community, in particular, got its long-awaited validation.

During a keynote session, Maxwell Stein of BlackRock’s digital assets team told the audience that “the market is ready for large-scale blockchain adoption” and that infrastructure from Ripple could soon move trillions of dollars on-chain.

BlackRock Validates Ripple at Swell 2025 — XRP Community Cheers

Stein praised early industry builders like Ripple for proving blockchain’s real-world utility, not just as a speculative concept but as a functioning layer of financial infrastructure.

“They’ve already tokenized fixed income, bonds, stablecoins… that’s where it started. But this is the rails for trillions in capital flows,” said Stein.

A BlackRock executive publicly crediting Ripple for helping prove blockchain’s real-world functionality marked a milestone in the narrative XRP holders have championed for years.

For a community that has long argued Ripple’s technology will underpin institutional liquidity, the comment landed like a thunderclap.

For the longest time, the XRP community has clung to the belief that Ripple’s technology will serve as the bridge between traditional finance and the decentralized economy.

Upon Stein’s statement, the XRP supporters across social networks saw the remark as long-awaited validation from the world’s largest asset manager.

🚨BREAKING: BlackRock Exec at Ripple Swell: “The Market Is Ready — Trillions Are Coming On-Chain” 💥This might’ve been the most electric moment of Ripple Swell 2025.Maxwell Stein, a representative from BlackRock, took the stage and straight-up said what everyone’s been…

“We’ve seen what early adopters of crypto have done — they’ve shown us what’s possible. And now, the market is ready for broader adoption,” he added.

His statement highlighted a shift in tone from TradFi, that blockchain is no longer an experiment. Rather, it is an emerging standard.

Legal Caution and Institutional Clarity Temper the Hype

However, the excitement that followed was tempered by legal caution. Australian lawyer and renowned XRP advocate Bill Morgan was among the first to raise questions about Stein’s remarks. He wondered whether they reflected an official BlackRock position or were simply Stein’s personal opinion.

“Very interesting, but… was he speaking in a personal capacity or for BlackRock?” Morgan posted on social media.

The question resonated deeply because of what’s at stake. If Stein’s statement signals BlackRock’s strategic confidence in tokenized finance, it could mark one of the clearest indications yet that institutional adoption is imminent.

If personal, it remains a powerful, but unofficial endorsement of Ripple and blockchain’s direction by extension.

In the same event, Nasdaq President and CEO Adena Friedman said the digital asset market is clearly maturing. However, she also acknowledged that regulatory clarity is essential for full-scale institutional participation.

“To get them really engaged in the market, there has to be regulatory clarity,” she emphasized, noting that banks are already experimenting with tokenized bonds and stablecoin frameworks.

Together, the remarks from Stein and Friedman painted a picture of convergence, where TradFi, blockchain, and regulation are aligning.

Ripple’s Swell 2025 conference, once an industry event primarily for crypto insiders, became a stage where some of the most influential voices in global finance signaled readiness for integration.

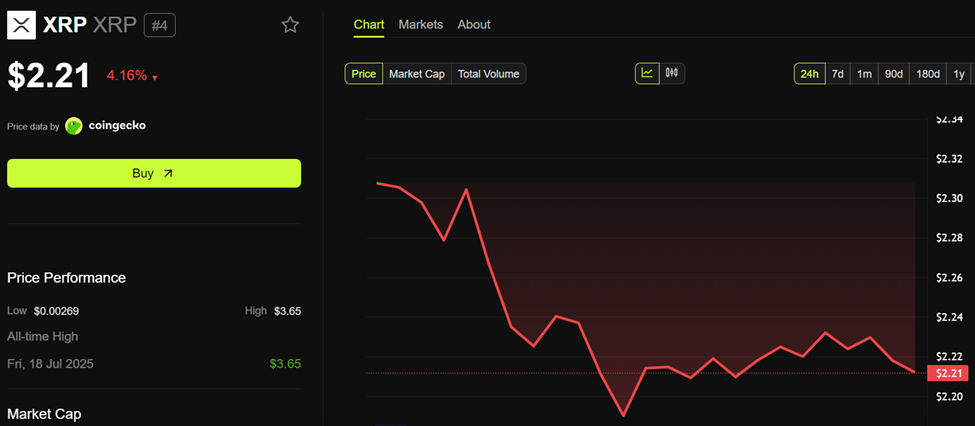

Despite these developments, along with the network’s growing institutional deals and exploding XRP adoption, the Ripple price remains lull.

Ripple (XRP) Price Performance. Source:

Ripple (XRP) Price Performance. Source:

In the last 24 hours, the XRP price has been down by over 4%. It was trading for $2.21 as of this writing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Is Zero Knowledge Proof? Here’s How Its Compute and Storage Beat Simple Staking Models!

Bitcoin bots compete for funds in compromised wallet linked to block reward identifier

Iran’s Crypto Market Hits $8B, Now 2% of GDP