Traditional Hedge Funds Deepen Crypto Exposure Despite Market Swings

Quick Breakdown

- 55% of traditional hedge funds now have crypto exposure, up from 47% last year.

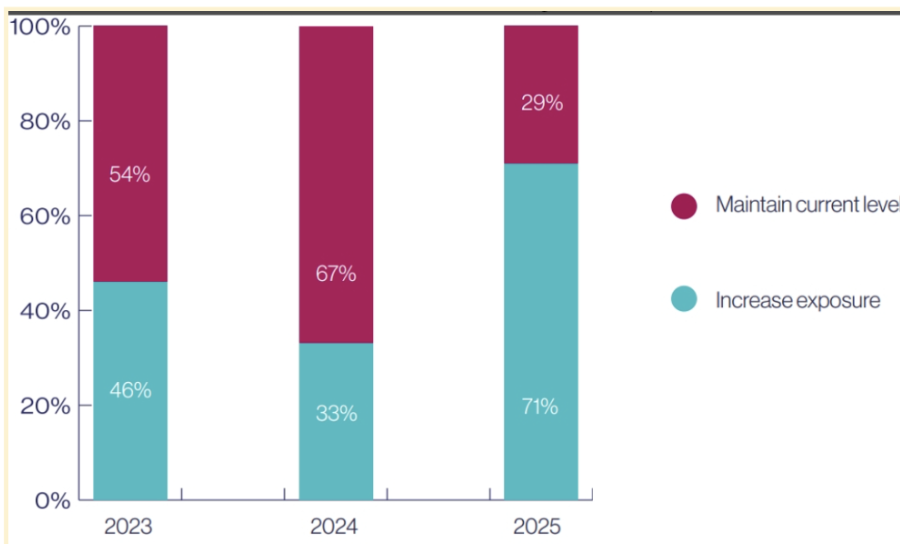

- Most funds maintain small allocations, though 71% plan to expand within the next year.

- Shifting U.S. crypto regulations are a major driver of renewed institutional participation.

More than half of traditional hedge funds are now invested in digital assets as institutional interest in crypto continues to gain ground, according to a new industry survey released on Thursday.

Source

:

AIMA

Source

:

AIMA

The report from the Alternative Investment Management Association (AIMA) shows that 55% of hedge funds currently hold some form of crypto exposure in 2025. This marks an increase from 47% in 2024, signaling a gradual shift in sentiment even amid recent price turbulence and regulatory scrutiny.

Growing exposure, but allocation still modest

The survey — which polled 122 hedge fund managers overseeing roughly $982 billion in assets — found that hedge funds dedicate an average of 7% of their portfolios to crypto-related assets. However, most still remain cautious, with the majority allocating less than 2%.

Importantly, 71% of the surveyed funds say they plan to increase their crypto exposure over the next 12 months, reflecting a view that the digital asset market is moving toward greater maturity.

Derivatives dominate entry strategy

Despite rising interest, 67% of hedge funds prefer gaining crypto exposure through derivatives, avoiding direct ownership of digital tokens.

The report cautions that the market’s recent flash crash highlighted structural weaknesses — particularly excessive leverage and the lack of high-grade institutional support for derivatives markets.

Regulatory shifts in the U.S. fuel optimism

Nearly 47% of respondents pointed to changing U.S. regulatory dynamics as a key factor behind renewed confidence in digital assets. This comes after policy developments under the Trump administration and ongoing bipartisan negotiations in the Senate on a comprehensive crypto market structure bill.

Lawmakers have been working to push forward crypto-focused regulation before political activity tied to upcoming elections begins to slow legislative momentum. Meanwhile, the GENIUS Act, which proposes a national framework for stablecoin-based payments, recently entered its second public comment phase — a sign it may be inching closer to implementation.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE -3.37% 7-Day Surge Despite Year-Long Downtrend as Market Integrates

- Aave's AAVE token fell 0.89% in 24 hours to $207.68 despite a 3.37% 7-day rally amid strategic integrations. - Aave Horizon's partnership with VanEck's VBILL tokenized Treasury fund enables institutional-grade collateral via Chainlink and Securitize infrastructure. - The integration creates arbitrage opportunities with 4.84%+ potential returns through VBILL collateralized RLUSD borrowing strategies. - Backtests show Aave outperformed BTC by +14.54% over 30 days post-announcement, with 67% positive excess

Kyo Achieves $1 Billion Valuation: Wagering on Cross-Chain DeFi Integration During Industry Upheaval

- Kyo Finance secures $5M Series A at $1B valuation, aiming to unify blockchain liquidity via cross-chain interoperability. - DeFi faces innovation vs. security tensions as projects like Mutuum advance infrastructure while crises like Stream Finance's $93M loss expose systemic risks. - Industry responds with risk mitigation tools (e.g., RedStone ratings) and modular infrastructure reforms to address contagion risks from interconnected lending markets. - Kyo's valuation reflects institutional confidence in

Bitcoin News Today: Trump Media Utilizes $1.3 Billion in Bitcoin as Collateral, Driving Further Growth in Cryptocurrency

- Trump Media holds $1.3B in Bitcoin as strategic reserve, using it for collateral and liquidity amid Q3 2025’s $54.8M net loss. - Loss driven by legal costs, non-cash adjustments, and crypto investments, but $10.1M operating cash flow highlights financial resilience. - Partnership with Crypto.com deepens crypto integration, including CRO treasury firm and Truth Predict prediction markets. - Plans to expand Truth Social with AI features and America-First ETFs aim to leverage crypto growth despite regulator

Pi’s 100 Million Downloads Inspire Hope Despite Doubts from Developers

- Pi Network surpasses 100M app downloads, outpacing Coinbase/OKX, with 60M active miners and 25M KYC-verified users. - PI coin stabilized above $0.21 despite 5.49% drop, showing reduced exchange selling pressure and community-driven price resilience. - Sale of flagship dApp WorkforcePool raises sustainability concerns as developers criticize slow decentralization and limited support. - Platform expands into AI/robotics via OpenMind partnership, aiming to solidify crypto ecosystem position with 8M mainnet