LA Man Orchestrates $36,900,000 Money Laundering Scheme Centered on Global Investment Conspiracy: Report

A Los Angeles County man is heading to federal prison for helping launder over $36.9 million tied to a sprawling international digital asset investment scam run from Cambodia.

Jose Somaribba played a central role in a scheme that tricked victims around the world into wiring funds to U.S.-based accounts under false pretenses of legitimate cryptocurrency and investment opportunities, reports MyNewsLA.

The money was then funneled through a network of shell companies and bank accounts controlled by co-conspirators before being transferred overseas to Cambodia and other countries, where scam operators managed so-called “investment centers.”

The Department of Justice says the Los Angeles resident was among five men who have now pleaded guilty to their roles in the global digital asset investment conspiracy.

The investigation revealed that the group collectively laundered more than $36.9 million in proceeds derived from victims of the fraud.

Authorities say the scams often followed a pattern resembling “pig butchering” schemes, in which victims were lured through online messaging platforms and dating apps, convinced to invest in fake crypto platforms, and then gradually drained of their savings.

The Justice Department says that the sentencing underscores the reach of U.S. law enforcement in targeting the financial networks that enable large-scale digital fraud, even when the operations are based abroad.

“Money launderers are the lifeblood of these criminal networks. Those who move and conceal illicit proceeds for scammers abroad will be held accountable, no matter where the fraud originates.”

The case is part of a broader federal crackdown on transnational crypto and investment fraud schemes, many of which have been traced to organized criminal operations in Southeast Asia.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Billionaire CEO Michael Novogratz Makes Statement on Cryptocurrency Market Bill

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

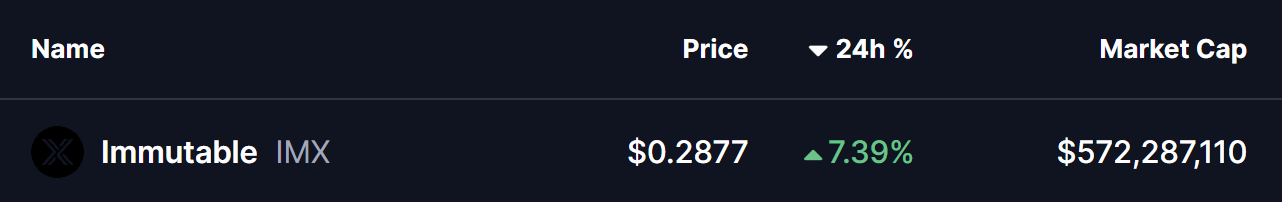

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!