DASH up 29.87% over the past week: Earnings Shortfall Sparks Intense Sell-Off Fueled by Reinvestment

- DoorDash Q3 2025 revenue exceeded forecasts at $3.45B, but GAAP EPS of $0.55 missed expectations, triggering a 17.2% stock drop. - Management announced 2026 heavy investments in AI, autonomous vehicles, and global expansion, shifting focus from margin growth to reinvestment. - Analysts revised EBITDA forecasts downward (Wells Fargo -19%), though DASH remains up 18% YTD with 31 analysts maintaining a "Buy" consensus. - Strategic shifts include GBP2.8B Deliveroo acquisition and unified tech stack developme

As of November 7, 2025,

DoorDash posted third-quarter 2025 revenue of $3.45 billion, surpassing market forecasts. However, its GAAP earnings per share came in at $0.55, missing the consensus estimate of $0.68, which led to a 17.2% decline in its share price. The earnings miss was compounded by a softer-than-anticipated adjusted EBITDA outlook of $760 million at the midpoint, well below Wall Street’s $822.4 million projection. Investors responded quickly, as management’s guidance emphasized reinvestment rather than immediate margin growth.

The sell-off intensified after management disclosed that 2026 would involve significant capital spending.

CEO Tony Xu presented a long-term vision focused on artificial intelligence, automation, and international growth. The company is working on a unified technology infrastructure to accelerate product rollouts globally, supporting initiatives like DoorDash Dot (its self-driving vehicle) and DashMart Fulfillment Services, which aims to help retailers offer delivery within the hour. The acquisition of Deliveroo, finalized on October 2, 2025, for GBP2.8 billion in equity, is a cornerstone of this global expansion strategy.

Following the earnings release, analysts revised their outlooks. Wells Fargo reduced its 2026 EBITDA estimate by 19% to $3.6 billion and cut its price target from $301 to $239. UBS and Stifel also lowered their targets, while BTIG kept a Buy rating with a $315 target. Despite the recent decline, the stock is still up 18% for the year and maintains a moderate Buy consensus from 31 analysts.

Backtest Hypothesis

To evaluate the stock’s behavior around major earnings announcements, a backtest could be designed using DASH as the main ticker. An earnings beat would be defined as any quarter where DoorDash’s reported EPS surpassed analyst expectations. Running a backtest from January 2022 to November 2025 would allow for analysis of the stock’s reaction to both positive and negative earnings surprises.

This backtest could also factor in unusual trading volumes and volatility trends to better understand how the market has historically responded to news. DoorDash’s latest results and guidance highlight how reinvestment cycles can strongly influence investor sentiment, often resulting in short-term price swings. A thorough backtest could help measure the risk and reward associated with these strategic changes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jack Dorsey Just Changed Everything! 4 Million Merchants Can Accept Bitcoin

Japan’s Mitsubishi UFJ Boosts MicroStrategy Stake to $29 Million

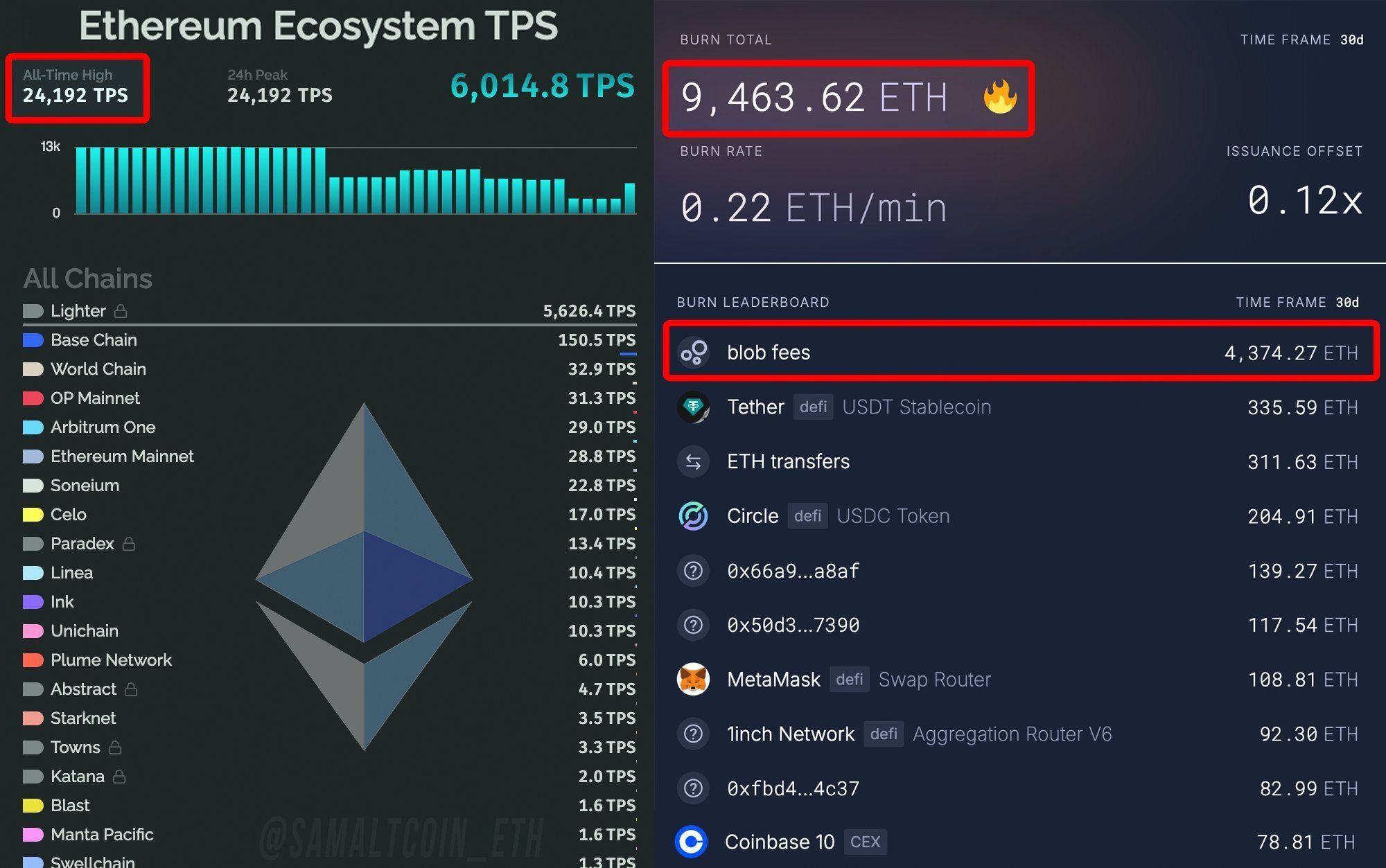

Ethereum Burns $32 Million in ETH as Network Hits Record 24,192 TPS