Zcash tops $10B market cap, surpassing Hyperliquid to reclaim top-20 spot amid continued surge

Quick Take Zcash has surpassed Hyperliquid, catapulting back into the top 20 cryptocurrencies as its continued surge sees it eclipse a $10 billion market cap. Arthur Hayes said ZEC has now become the second-largest liquid asset in Maelstrom’s portfolio behind BTC, gaining around 750% since October.

Privacy-focused cryptocurrency Zcash re-entered the top 20 cryptocurrencies on Friday with a market cap of $10.9 billion, flipping cycle-darling Hyperliquid's $10.8 billion.

Despite the broader crypto slump, Zcash has defied the market, jumping more than 25% in the past 24 hours and extending a rally that’s lifted ZEC roughly 750% since the start of October, according to The Block’s prices page .

Zcash was changing hands for around $75 on Oct. 1, having traded in a range between $20 and $80 for much of the past three years. Following a resurgence in interest, ZEC reclaimed the $200 level for the first time since 2022 by Oct. 10 — shrugging off the largest liquidation event in crypto history — and going on to reach more than $680 on Friday at the time of writing.

That marks the highest price point for Zcash since early 2018, though it remains far below a CoinGecko -listed all-time high of more than $3,000 from October 2016 — a period when circulating supply was very limited and early trading distorted prices.

ZEC/USD price chart. Image: The Block/TradingView .

In contrast, most cryptocurrencies have struggled. Bitcoin is down about 18% since Oct. 10, ether has fallen 26% , and the GMCI 30 — an index tracking the top 30 digital assets — has slumped 25%, with smaller tokens generally faring even worse.

'Encrypted Bitcoin'

Supporters pointed to a mix of narratives behind the upswing, from renewed debates over financial surveillance in Europe to fresh attention on Zcash's mobile wallet integrations, and rising volumes across the sector as catalysts.

Zcash is a privacy-optional blockchain that allows users to transfer their tokens to a privacy pool, effectively "shielding" their transaction history. Shielded supply refers to the ZEC tokens stored in private addresses that utilize zero-knowledge proofs (zk-SNARKs). This allows transaction validation without revealing the sender, receiver, or amount.

The significant rise in shielded supply of late suggests growing trust in Zcash's features and improved infrastructure support, driven by renewed attention to privacy-focused cryptocurrencies and vocal community advocacy, The Block's research analysts Brandon Kae and Ivan Wu wrote last week.

Further, the sustained increase in shielded supply is a meaningful indicator of actual usage, as holders must opt in to shield tokens rather than passively holding them in self-custody or exchange wallets, they said.

Meanwhile, Nansen Senior Research Analyst Jake Kennis said Zcash's eight-year high is being fueled by several key drivers.

"Privacy is increasingly viewed as a necessity rather than a feature, renewing ideological demand for private, self-sovereign transactions," Kennis told The Block on Friday. "On the technical front, Zcash's zero-knowledge architecture, the Zashi wallet enabling shielded transfers, and Solana integration all improve usability and accessibility. Its Bitcoin-like tokenomics, a fixed 21M supply, Proof-of-Work consensus, and upcoming halving that will reduce new issuance combined with zk-SNARK-enabled privacy, position it as an 'encrypted Bitcoin.'"

In terms of market activity, both spot and futures taker volume is curving up, CryptoQuant analyst Maartunn told The Block. "It shows that investors and traders are both buying aggressively into the privacy coin hype," he said.

Zcash spot taker CVD. Image: CryptoQuant.

However, there is "speculation beyond the technology at this point," Nansen's Kennis warned, having increased by over 1,486% in just the last 3 months. "The funding rate is extremely negative, and there have been many liquidations for those short recently," he said.

ZEC now second-largest liquid holding behind BTC for Arthur Hayes' family office Maelstrom

The positive price action for Zcash has brought in renewed attention from high-profile figures like former BitMEX CEO Arthur Hayes, Kennis noted, "attracting fresh capital flows after years of underperformance."

Hayes, now co-founder and CIO of family office Maelstrom, said Friday that due to its rapid ascent in price, ZEC is now the second-largest liquid holding in Maelstrom's portfolio behind BTC — prompting concerns from some about top signals amid the ongoing hype.

Earlier in the day, Hayes had suggested Zcash's shielded transactions would power the next wave of "true DEXs" — arguing ZEC could soon hit a price target of $1,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

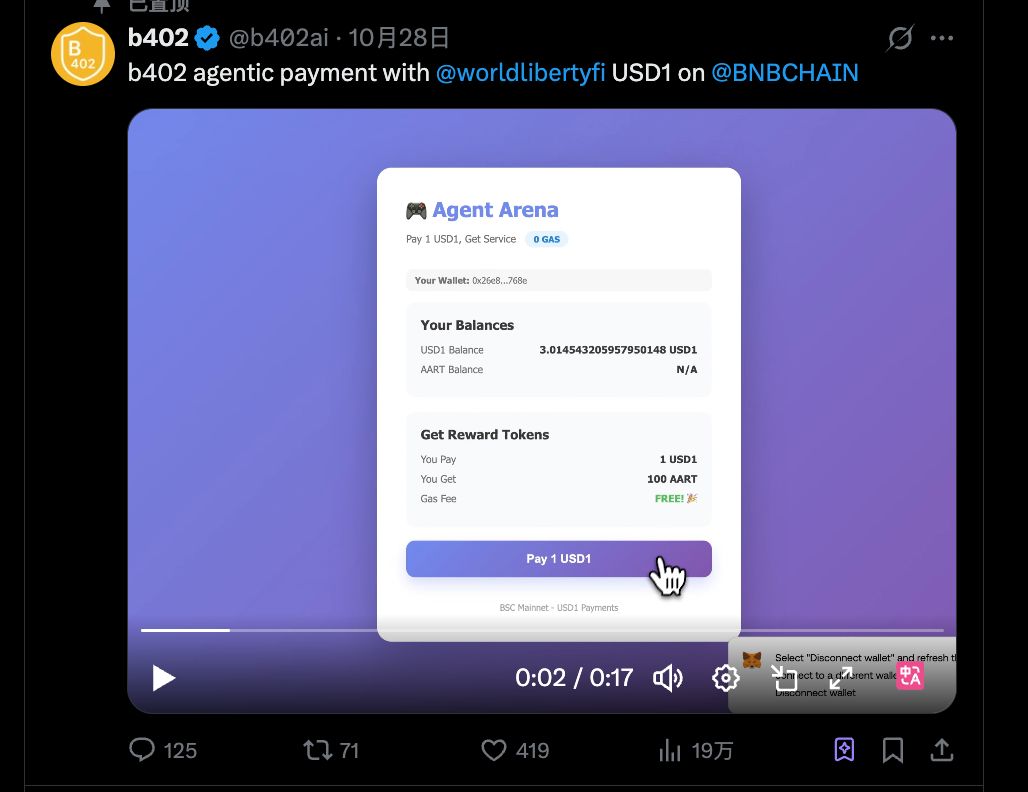

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?