Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

The month-long slide in crypto prices hasn’t just hit major assets like Bitcoin (BTC) and Ether (ETH) — it’s also dealing heavy losses to digital asset treasury companies that built their business models around accumulating crypto on their balance sheets.

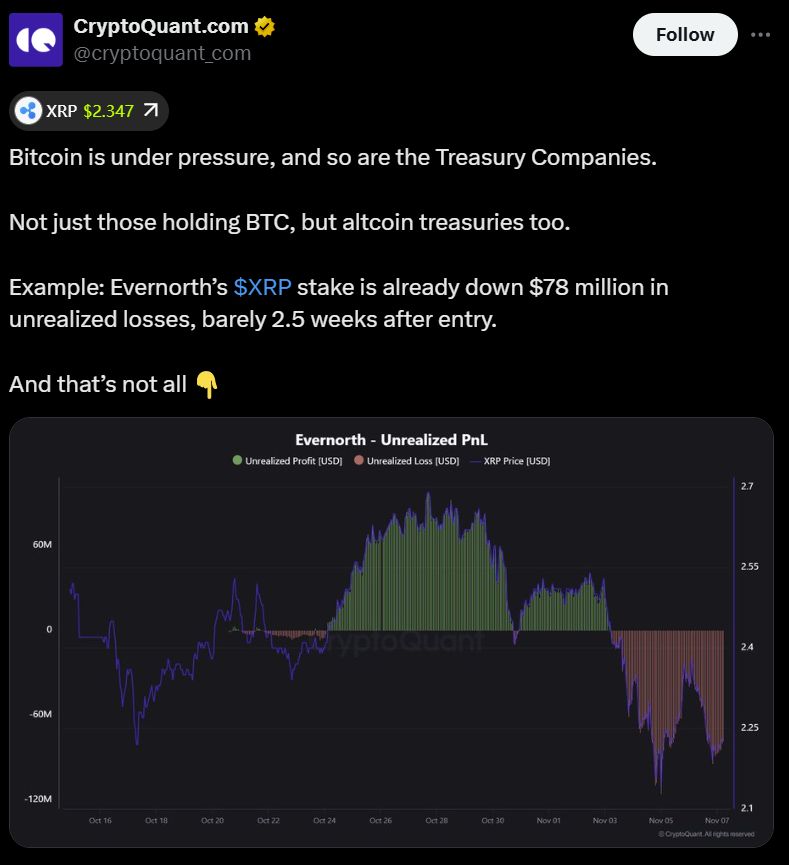

That’s one of the key takeaways from a recent social media analysis by onchain data company CryptoQuant, which cited XRP-focused treasury company Evernorth as a prime example of the risks in this sector.

Evernorth has reportedly seen unrealized losses of about $78 million on its XRP position, mere weeks after acquiring the asset.

The pullback has also battered shares of Strategy (MSTR), the original Bitcoin treasury play. The company’s stock has dropped by more than 26% over the past month, as Bitcoin’s price has slumped, according to Google Finance data. CryptoQuant noted a 53% drop in MSTR shares from their all-time high.

However, Strategy still holds a sizable unrealized gain on its Bitcoin reserves, with an average cost basis of roughly $74,000 per BTC, according to BitcoinTreasuries.NET.

Meanwhile, BitMine, the largest Ether-holding corporation, is now sitting on approximately $2.1 billion in unrealized losses tied to its Ether reserves, according to CryptoQuant.

BitMine currently holds nearly 3.4 million ETH, having acquired more than 565,000 over the past month, according to industry data.

Digital asset treasury companies: Echoes of the dot-com bubble

Digital asset treasury companies, or DATs, have come under mounting valuation pressure in recent months, with analysts cautioning that their market worth is increasingly tied to the performance of their underlying crypto holdings.

Some analysts, including those at venture capital firm Breed, argue that only the strongest players will endure, noting that Bitcoin-focused treasuries may be best positioned to avoid a potential “death spiral.” The risk, they say, stems from a collapse in the companies’ market net asset value (mNAV) — a metric comparing enterprise value to the market value of their cryptocurrency investments.

Others have compared the rise of digital asset treasury companies to the dot-com boom and bust of the early 2000s, a period driven by long-term visionaries and innovators, as well as opportunists chasing quick gains.

Ray Youssef, founder of peer-to-peer lending platform NoOnes, predicted that most digital asset treasuries will ultimately fade out or collapse as market realities set in.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Price Rally in November 2025: A Turning Point for Institutional Investors?

- Bitcoin's November 2025 surge to $145,000 sparks debate: institutional adoption or speculative frenzy masking structural fragility? - Macroeconomic stability and $72M+ infrastructure investments (e.g., Galaxy Digital in Canaan) signal maturing institutional strategies, contrasting ETF outflows and leveraged liquidations. - Regulatory clarity via U.S. spot Bitcoin ETFs (BlackRock, Fidelity) creates legitimacy but exposes crypto to traditional finance dynamics amid $1B+ ETF outflows. - Anchorage Digital's

DOGE Rises 8.52% Over the Past Week as Whales Sell and ETF Filings Progress

- DOGE surged 8.52% in 7 days amid whale outflows of 3B tokens over 30 days, signaling strategic capital reallocation. - Bitwise's ETF filing for DOGE awaits SEC review within 20 days, potentially catalyzing institutional adoption like 2024 BTC/ETH ETFs. - $0.20 resistance has historically failed to sustain breakouts, with 31 tests showing <52% success rate and -2% 30-day returns. - Traders advised to treat $0.20 as a supply zone, requiring volume spikes or regulatory catalysts for bullish positioning.

ZEC rises 5.96% amid large investor movements and portfolio adjustments

- ZEC surged 5.96% in 24 hours, hitting $631.83, with 44.09% weekly and 1031.31% annual gains. - Whale activity included a $1.25M profit from a 20,800 ZEC long position closed at $585, alongside a new $4.5M leveraged long at $593.17. - Strategic whale positioning and reduced leverage in other positions highlight growing institutional interest and speculative momentum in ZEC.

Algo +1.57% Propelled by Robust 7-Day Surge

- Algo (ALGO) rose 1.57% in 24 hours on Nov 9, 2025, with a 17.27% surge over seven days. - The 7-day rally signals short-term bullish momentum, though a 46.01% annual decline remains unresolved. - Technical indicators like RSI and MACD suggest continued upward trends, but analysts caution against long-term optimism. - Traders are advised to monitor volume and market conditions amid ALGO's distinct performance versus broader crypto trends.