Ray Dalio Voices Concern Over the Fed’s Policy Direction

The US Federal Reserve stimulates the economy even as markets soar and employment remains strong. For Ray Dalio, this unusual combination bodes ill. The legendary investor sees it as symptoms of the end of a major economic cycle, where excessive debt forces monetary authorities to play with fire.

In Brief

- Ray Dalio warns that the Fed is creating a bubble by loosening its monetary policy in an already strong economic context.

- This atypical situation recalls the terminal phases of a 75-year economic cycle, marked by massive debt.

- The combination of expansionary fiscal policy and monetary easing risks monetizing the US public debt.

- This inflationary dynamic could favor Bitcoin and gold as refuges against monetary depreciation.

Ray Dalio Warns About a Bubble Fueled by the Fed

Ray Dalio , an iconic figure in global finance, has just published a scathing analysis on the current choices of the Federal Reserve.

The founder of Bridgewater Associates points to a major anomaly: the Fed is lowering its rates while the US economy shows outstanding health.

Normally, the central bank intervenes only when activity slows down, unemployment rises, and markets collapse. This was the case during the Great Depression of the 1930s or the 2008 financial crisis.

Today, the situation is radically different. The United States is experiencing historically low unemployment, sustained economic growth, and record-high financial markets.

Yet, the Fed lowered its rates by 25 basis points in October and could do so again in December. This “dangerous” configuration , according to Dalio, characterizes economies in the terminal phase of a major economic cycle, burdened by excessive debt.

The former hedge fund manager does not mince words. He calls this combination of expansionary fiscal policy and monetary easing “more inflationary.”

The US government is already running massive deficits by issuing large amounts of short-term Treasury bills. By injecting additional liquidity, the Fed risks monetizing this debt rather than supporting the private sector. In other words, the money created is used to finance public spending without truly stimulating the productive economy.

This dynamic occurs in a tense political climate. Donald Trump has recently intensified his criticism of Jerome Powell , even publicly mentioning his replacement “very soon.” This political pressure on the Fed’s independence adds an additional layer of uncertainty.

Bitcoin and Gold, the Big Winners of Monetary Depreciation?

Faced with this troubling macroeconomic picture , certain assets stand out. Bitcoin and gold naturally assert themselves as preferred safe havens. The logic is relentless. The more the money supply increases and the more debt is monetized, the more fiat currency loses its value. Investors then turn to rare and unmanipulable assets.

The continued inflationary pressure and the depreciation of the dollar are powerful catalysts for Bitcoin . Unlike traditional currencies, the number of bitcoins is strictly limited to 21 million units.

This programmed scarcity makes it a bulwark against the monetary dilution orchestrated by central banks. Many analysts now view the flagship crypto queen as a hedge against major macroeconomic and geopolitical risks.

Yet, crypto markets remain cautious. During the October rate cut, prices did not jump as anticipated. Matt Mena, analyst at 21Shares, explains that this decision was “fully priced in” by investors. Traders had largely anticipated this announcement, neutralizing its potential positive impact.

Uncertainty hovers over the Fed’s next decision. According to Chicago Mercantile Exchange data, 69% of investors bet on another 25 basis point cut in December.

Jerome Powell cooled markets in October, reminding that a rate cut in December remains uncertain. In this unstable climate, Ray Dalio’s warnings make perfect sense. The Fed is stimulating an already strong economy, risking fueling a bubble and inflation. For investors, every decision could seal the end of a historic cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

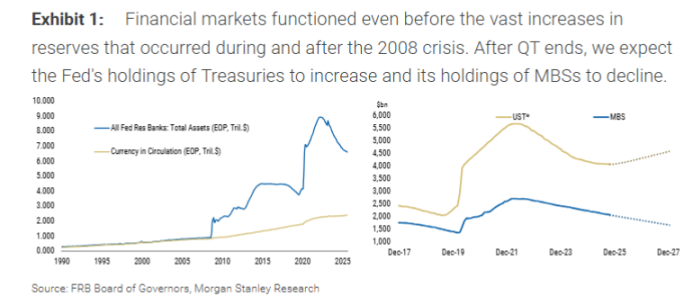

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.