Towards a Dogecoin ETF as early as this month? Bitwise reignites speculation

Dogecoin, the quirkiest crypto on the market, could soon enter institutional portfolios. Bitwise has filed a new spot ETF application with the SEC, removing the last administrative barriers. The green light could come within twenty days… triggering a new rush towards Elon Musk’s favorite meme.

In brief

- Bitwise has filed a modified version of its Dogecoin ETF application with the SEC.

- Without objection from the SEC, the launch could happen within twenty days.

- Dogecoin jumped 13% in 24 hours after the announcement.

Bitwise goes on the offensive with its Dogecoin ETF

Bitwise, one of the largest crypto asset managers, has just withdrawn its delaying amendment with the SEC, making a quick listing of the Bitwise Dogecoin ETF possible.

If the federal agency raises no objection within twenty days, the fund will automatically become active, thus opening the door to the first Dogecoin ETF managed by a major institutional player.

This is not the first time American investors could get exposure to DOGE. In September, Rex Shares and Osprey Funds had already paved the way with the DOJE ETF , which recorded a trading volume of over $17 million at its launch.

But Bitwise’s entry changes the game: the manager, known for its rigor and educational approach to the crypto market, could make Dogecoin a mainstream investment product.

Financial advisor Ric Edelman believes that “Bitwise is acting rightly: investors should have access to a diversified range of digital assets.” According to him, altcoin ETFs will follow the trajectory of Bitcoin ETFs, now capitalized at over $150 billion.

An institutional turning point for DOGE

Created in 2013 as a simple parody of Bitcoin, Dogecoin has gradually established itself as one of the most striking symbols of Internet culture. What was just a joke among developers has become, over the years, a genuine popular icon of the crypto economy, supported by quirky humor, a loyal community, and an unexpected supporter: Elon Musk .

Today, Dogecoin is no longer a digital gadget. It ranks among the top ten largest cryptocurrencies worldwide, with a market capitalization of $25.4 billion.

Since the announcement of the Bitwise ETF filing, its price has jumped 13%, reaching $0.18, a level still far from its all-time high of $0.73 reached in 2021, but reflecting a return of speculative appetite for the market’s favorite “meme coin.”

This momentum fits within a larger context: the explosion of crypto ETFs. According to Bloomberg, over 90 approval requests have been filed with the SEC by asset managers from both traditional finance and the crypto ecosystem.

A craze fueled by the easing of admission criteria for funds backed by digital commodities, and by the colossal success of Bitcoin and Ethereum ETFs, today valued respectively at $150 billion and $20 billion assets under management.

In short, with the impending arrival of the Bitwise Dogecoin ETF, the boundary between serious finance and Internet culture blurs even further. This product could well turn the joke into an institutional asset… and remind us that in crypto, even memes can be worth billions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

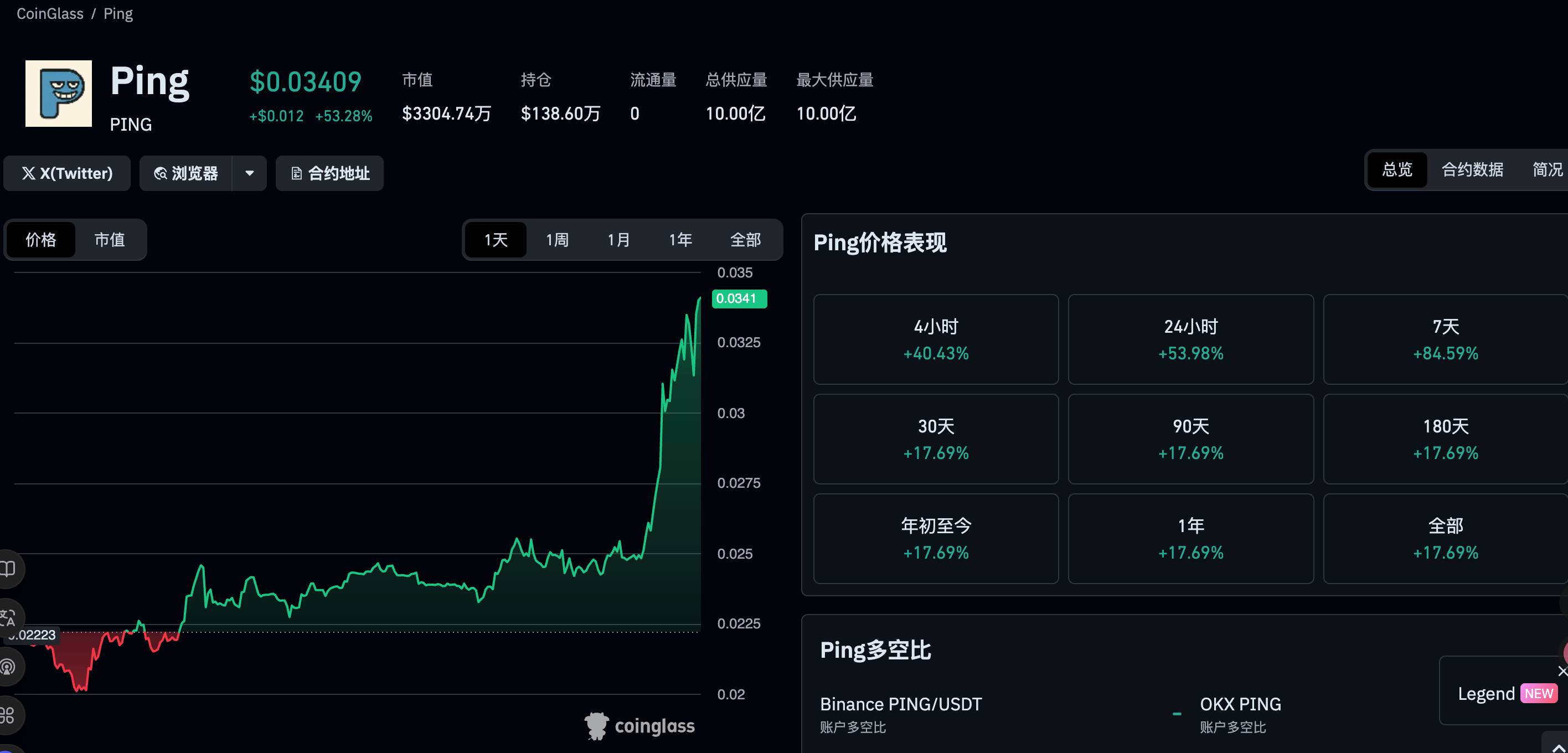

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

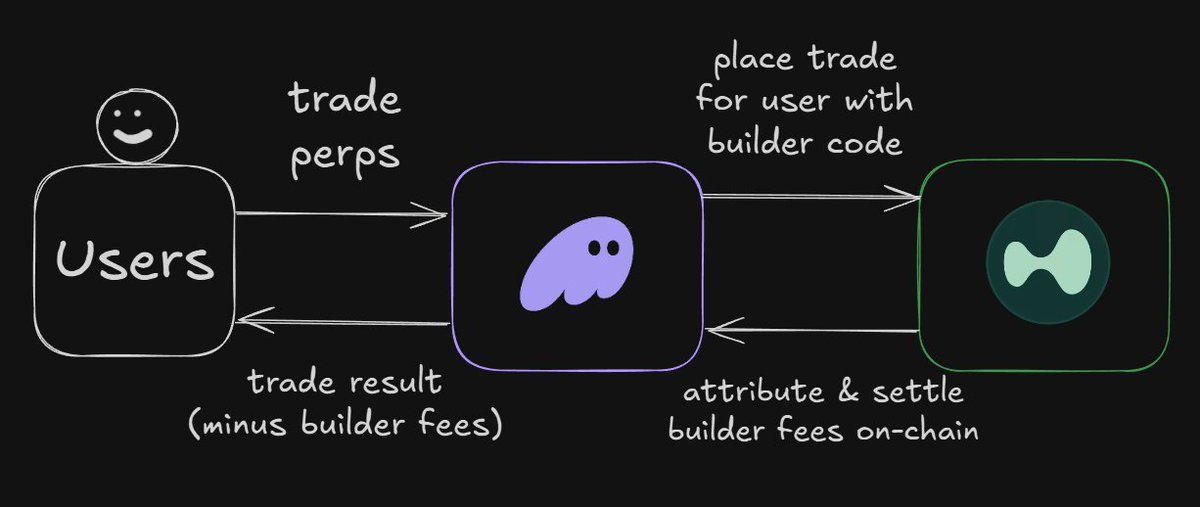

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

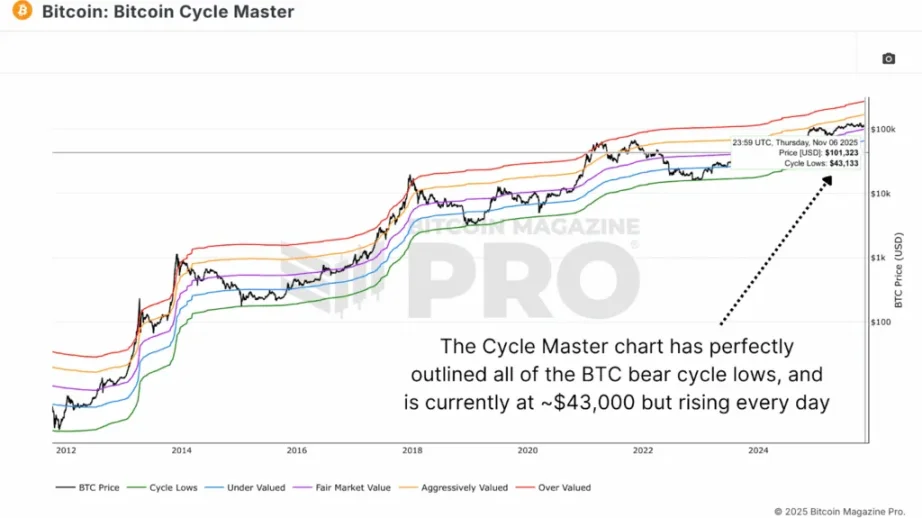

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.