What upcoming events may impact XRP Price?

The XRP market is on edge as it drifts sideways near the $2.30 zone, caught between weak technical momentum and one of the most critical fundamental catalysts of the year — the Franklin Templeton spot XRP ETF decision on November 14. This event, alongside broader macro triggers like the December FOMC meeting, could decide whether XRP breaks free from its multi-month slump or extends its downtrend into winter.

XRP Price Prediction: What the Chart Shows Right Now

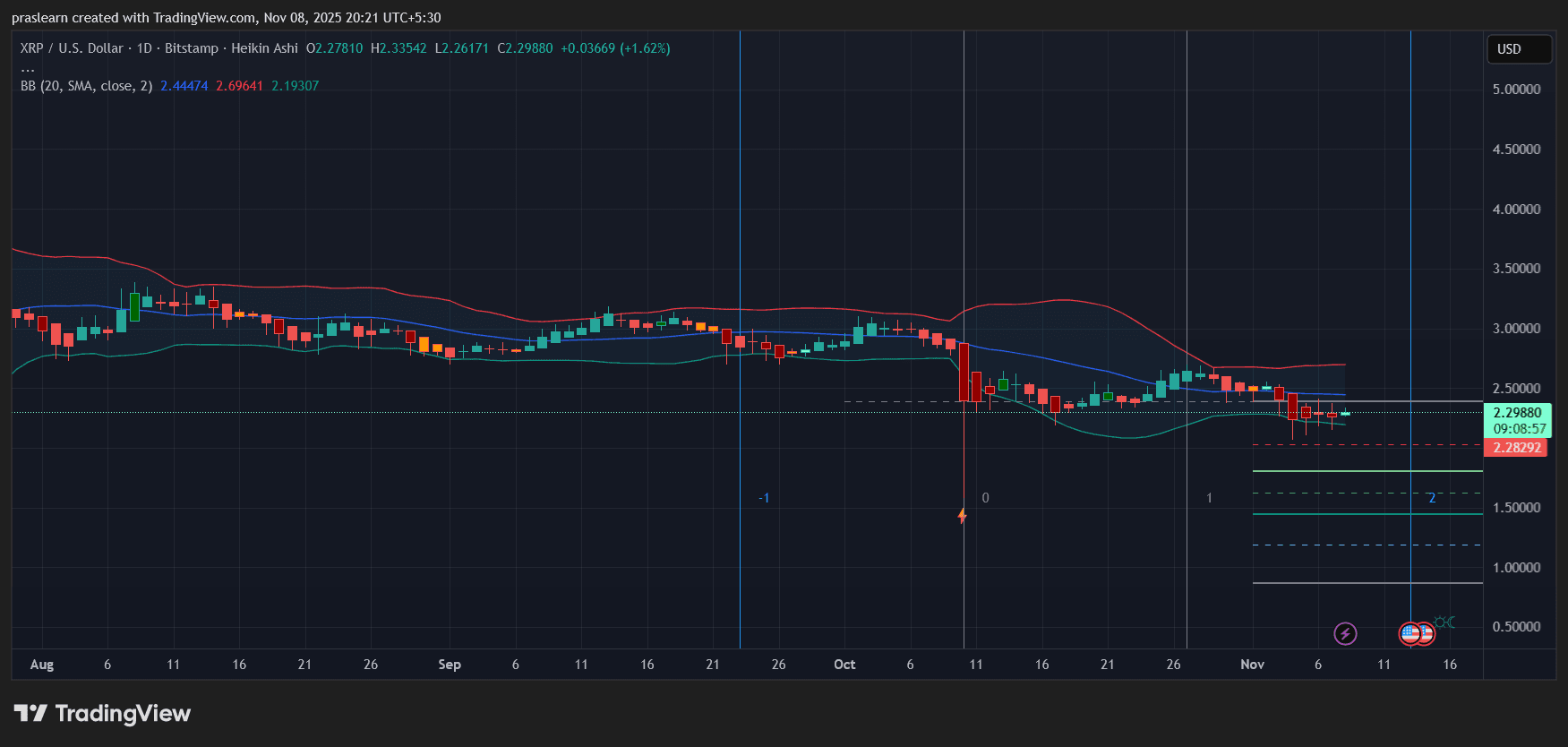

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

The daily chart reflects indecision. XRP trades around $2.29, just above the midline of the Bollinger Bands (20, 2), while the upper band sits near $2.70 and the lower band hovers around $2.19. The candles are compressed, showing reduced volatility and a clear squeeze — a classic setup that precedes a strong directional move.

Volume has thinned, suggesting traders are waiting for confirmation. The Heikin Ashi candles have transitioned from red to mild green in the past few sessions, hinting at early accumulation, though not yet enough to confirm a breakout. If XRP closes decisively above $2.45, the next resistance lies at $2.70, and a rally toward $3.00 becomes possible. On the downside, losing $2.18 could open a slide toward $1.85 and even $1.50 in a risk-off scenario.

How the Franklin Templeton ETF Decision Could Move XRP Price

This is the near-term catalyst everyone’s watching. If the SEC approves Franklin Templeton’s spot XRP ETF , it would mark the first institutional gateway into XRP exposure after years of regulatory uncertainty. Such approval would legitimize XRP’s post-lawsuit status and could invite new capital from both retail and institutional investors. Historically, ETF approvals have triggered short-term surges of 5–10% followed by sustained uptrends if inflows persist.

A rejection, however, could reinforce the narrative that the SEC remains cautious about XRP’s liquidity and market structure. That might cause a brief selloff toward $2.00 or below, especially if Bitcoin dominance rises at the same time. Expect heightened volatility from November 13–15 as traders price in the decision.

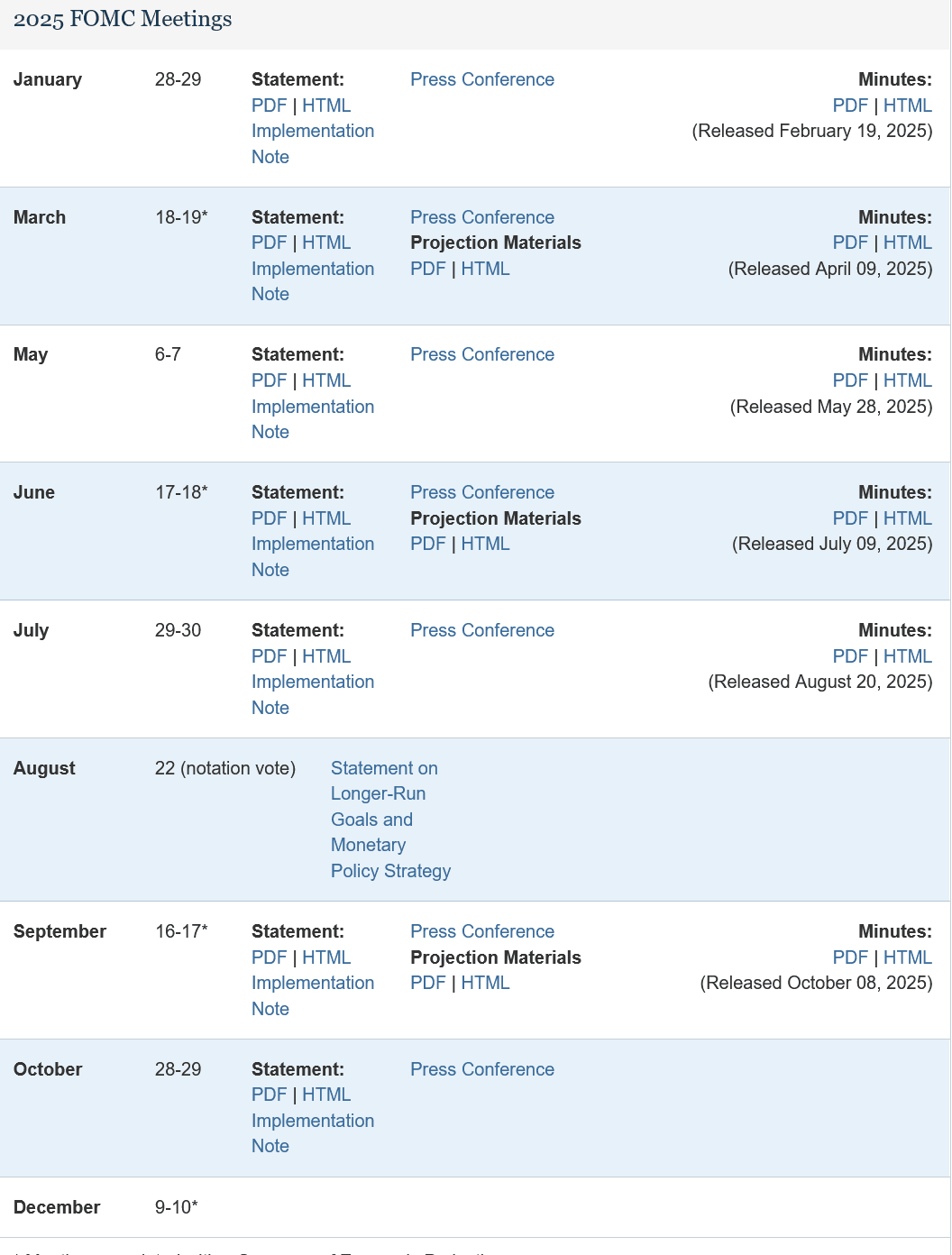

The December 10 FOMC Meeting: Macro Volatility Trigger

The next Federal Open Market Committee (FOMC) meeting is arguably the biggest macro event for all risk assets. If the Fed hints at a rate cut or even a dovish pause, liquidity will flow back into crypto, possibly overriding XRP’s weak technicals. A hawkish tone, on the other hand, could suppress speculative demand across all altcoins.

Crypto’s 0.75 correlation with Nasdaq remains a key metric. A post-FOMC tech rally would likely spill into Bitcoin and large-cap altcoins like XRP , creating short-term upside momentum. Traders should watch the CME FedWatch probabilities — any move above 70% for a 2026 rate cut expectation could turn XRP bullish again.

Bitcoin’s Cycle Peak Model and Ripple Effect on XRP Price

Bitcoin’s potential cycle peak around December 22 could mark either the blow-off top or a consolidation phase before another wave higher. If BTC tests $120K–$130K at that time and fails, altcoins might bleed temporarily. Conversely, if institutional inflows push $BTC beyond $130K, XRP could ride the momentum wave, retesting the $3.50 zone by year-end.

Long-Term Perspective: Quantum Computing and Security Fears

While the quantum computing threat projected for 2028 doesn’t directly affect current prices, it shapes long-term investor psychology. Projects like XRP, which rely on ECDSA signatures, may face scrutiny over quantum resistance in coming years. Any proactive move by Ripple Labs to integrate quantum-safe cryptography could serve as a strong narrative catalyst later.

Final XRP Price Prediction

The next 30 days are critical for $XRP . The Bollinger Band squeeze shows pressure building, while upcoming macro and regulatory events could act as release triggers. If the Franklin Templeton ETF gets approved and the FOMC meeting turns dovish, XRP could retest $2.70–$3.00 swiftly. Rejections or hawkish signals, however, might push it down toward $1.85.

- Short-term range: $2.18 – $2.70

Bullish breakout target: $3.00 – $3.50

Bearish scenario: $1.85 – $1.50

In short, November to mid-December could define XRP’s trajectory for the next year — whether it reclaims its former bullish momentum or remains an underperformer depends entirely on how these catalysts unfold.

📈 Want to Trade XRP?

Start now on Bitget: Sign Up Here

Check Live XRP Chart: XRP/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Holds $2.26 Support as 12-Month Accumulation Structure Stays Intact

XRP Targets $1.90–$2 Zone as Key Technical Magnet Reappears

TRUMP Price Strengthens Following Wedge Breakout, Eyes Resistance at $7.93

Zcash Surges to $520.50, Sustaining Momentum Above $471 Support Toward $545 Resistance