All 12 Bitcoin ETFs see outflows totaling $558M, Solana extends inflow streak to day nine

All 12 U.S. Bitcoin spot ETFs recorded outflows totaling $558.44 million on November 7. This was one of the largest single-day withdrawals since the funds launched.

- Bitcoin spot ETFs saw $558M in outflows, led by Fidelity’s FBTC and BlackRock’s IBIT.

- It was the second-largest single-day withdrawal since U.S. Bitcoin ETFs launched.

- Solana ETFs extended their inflow streak to nine days with $12.7M added on Nov 7.

Fidelity’s FBTC led the outflow with $256.66 million in outflows, followed by ARKB at $144.24 million and BlackRock’s IBIT at $131.43 million.

The outflow comes after Bitcoin ( BTC ) spot ETFs saw a $240.03 million inflow on November 6. Cumulative total net inflow across all Bitcoin ETFs stands at $59.97 billion. Total net assets under management reached $138.08 billion as of November 7.

Fidelity and BlackRock lead Bitcoin ETF withdrawals

Grayscale’s GBTC recorded $15.44 million in outflows, while Bitwise’s BITB saw $10.68 million leave the fund.

Eight Bitcoin ETFs, including Grayscale’s BTC, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI, recorded zero flow activity.

The November 7 outflow is the second-largest single-day withdrawal in recent trading sessions. On November 4, Bitcoin ETFs recorded $577.74 million in outflows. The funds have posted mixed results over the past week, alternating between inflows and outflows.

Total value traded across all Bitcoin ETFs reached $5.04 billion on November 7. BlackRock’s IBIT maintained the highest cumulative net inflow at $64.32 billion, followed by Fidelity’s FBTC at $12.00 billion.

Solana ETFs extend inflow streak to nine days

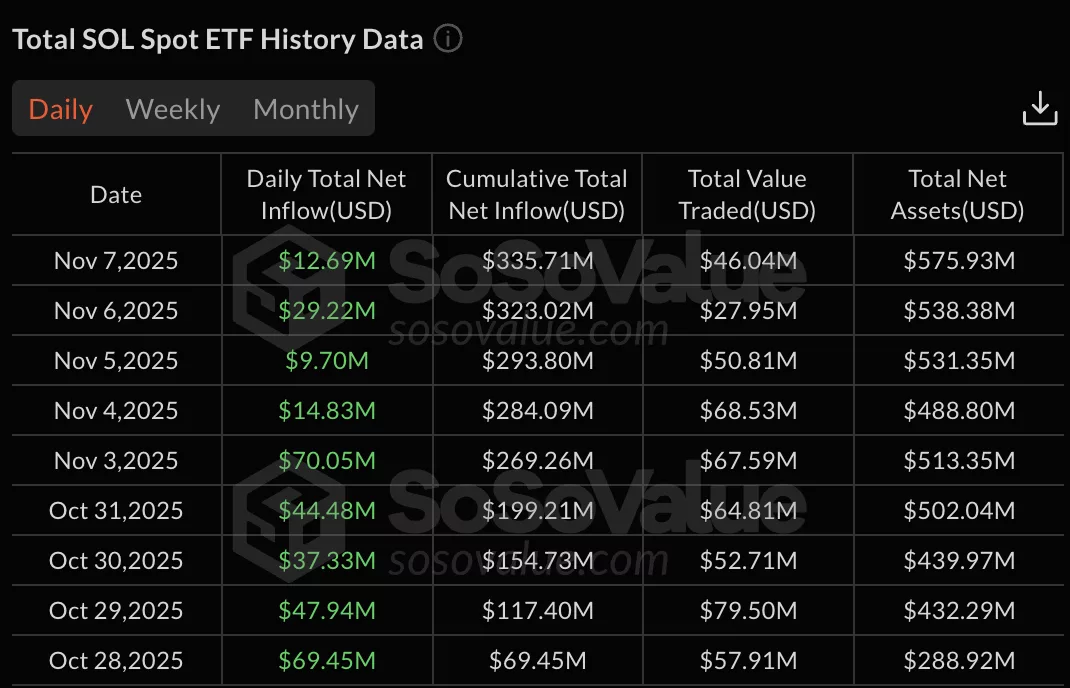

Solana ( SOL ) spot ETFs recorded $12.69 million in inflows on November 7 and extended their consecutive inflow streak to nine trading days.

The funds have attracted steady interest since October 28, when inflows began the current run.

Solana ETF data: SoSo Value

Solana ETF data: SoSo Value

Daily inflows during the nine-day period ranged from $9.70 million to $70.05 million. November 3 posted the highest single-day inflow at $70.05 million.

Total net assets under management for Solana ETFs reached $575.93 million as of November 7.

Cumulative total net inflow across all Solana ETFs stands at $335.71 million. Total value traded hit $46.04 million on November 7, up from $27.95 million the previous day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Digital Privacy Advocate's Rights Reinstated, Underscoring Worldwide Disputes Over Technology Regulation"

- Telegram founder Pavel Durov regains full travel freedom after French judicial restrictions were lifted, following a year of compliance with supervision terms. - French prosecutors continue investigating Telegram for alleged complicity in criminal activity, including child abuse material, with potential 10-year prison charges. - Durov denies allegations, criticizes French procedures as "dystopian," and challenges legal classifications while seeking EU court rulings on digital governance issues. - The cas

dYdX Implements 75% Buyback: Synchronizing Holder Rewards with Platform Growth

- dYdX community approved 75% protocol fee allocation for token buybacks, up from 25%, via a 59.38% voter majority on November 13, 2025. - The revised distribution aims to reduce DYDX supply, enhance scarcity, and align token holder incentives with platform performance through automated, transparent buybacks. - 5% of fees now fund Treasury SubDAO and MegaVault for ecosystem development, balancing supply reduction with staking incentives and research-driven growth. - Analysts highlight this as a DeFi govern

XRP News Today: XRP ETF Debut Marks Transition Toward Utility-Focused Digital Assets as Regulators Approve a New Phase

- Canary Capital's XRPC ETF became the first U.S.-listed spot XRP ETF, trading $26M in 30 minutes on Nasdaq. - The launch followed SEC approval via Form 8-A and reflects growing institutional demand for RippleNet's cross-border payment utility. - XRPC outperformed Solana ETF's $56M first-day volume in pre-launch on-chain activity but faces whale profit-taking and mixed technical indicators. - Regulatory clarity post-July 2025 and XRPC's pure spot structure differentiate it from derivative-based XRPR ETFs,

ZK Nation Empowers Holders to Directly Manage Token Supply

- ZK Nation proposes ZKTokenV3 upgrade with permissionless burn functionality, a key step in programmable supply management. - New features include public token burning, BURNER_ROLE authority, and a 21 billion ZK supply cap enforced during minting. - Upgrade aims to decentralize supply control, enabling holders to directly impact scarcity without centralized governance. - Analysts highlight reduced inflation risks and increased market confidence, with voting active until November 13.