New SEC Filing Shows Trump Media’s Total Bitcoin Holdings

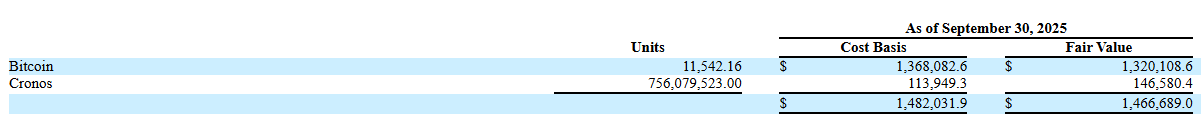

Trump Media and Technology Group (TMTG), the media company associated with US President Donald Trump, now holds more than 11,500 Bitcoin, valued at over $1.3 billion.

The disclosure marks the company’s largest confirmed allocation to date and places it among the biggest public-sector corporate holders of Bitcoin.

TMTG Bitcoin Holdings Fail to Yield Gains

TMTG accelerated its pivot earlier this year when it formally adopted Bitcoin as a core reserve asset.

At the time, TMTG said the company turned to BTC to protect itself from what he described as harassment and discriminatory treatment by financial institutions.

That argument tied Trump Media’s strategy to a wider corporate trend in which firms use Bitcoin to limit perceived dependence on banks that can freeze, slow, or scrutinize accounts.

Meanwhile, the company’s holdings extend beyond Bitcoin. TMTG reported owning roughly 756 million Cronos (CRO) tokens, worth approximately $110 million.

The position reflects the company’s growing alignment with Crypto.com, a relationship that has already produced several crypto-focused initiatives, including exchange-traded products and promotional tie-ins.

These initiatives helped position TMTG as a more active participant in the crypto economy, even though they have not reversed the firm’s financial challenges.

TMTG posted a $54.8 million net loss in the third quarter of 2025, extending its stretch of multi-million-dollar quarterly losses.

This suggests that the company’s crypto-heavy strategy has therefore served more as a political and operational statement than a source of near-term financial relief.

Trump’s Family Crypto Holdings Surge

As TMTG increased its exposure, other Trump-connected ventures expanded theirs as well, creating a broader cluster of politically adjacent crypto holdings.

Data from Arkham Intelligence indicates that several affiliated entities now hold substantial balances.

Other notable Trump Family entities:

— Arkham (@arkham) November 8, 2025

Donald Trump: holds $861K in crypto

World Liberty Fi: holds $5.76B in crypto

Official Trump Meme: holds $6.30B in crypto

Official Melania Meme: holds $19.65M in crypto

Trump Cards: holds $29.72K in crypto pic.twitter.com/T12F6yP4Oh

Trump personally holds about $861,000 worth of digital assets, while World Liberty Financial, one of the largest Trump-associated projects, controls more than $5.7 billion in crypto.

Additional holdings include $6.3 billion tied to Official Trump Meme, $19.65 million linked to Official Melania Meme, and nearly $30,000 associated with the Trump Cards collection.

These positions grew as the White House intensified its pro-crypto messaging, which shaped both the political environment and the commercial incentives for Trump-aligned ventures to deepen their involvement.

Taken together, the holdings show a coordinated embrace of digital assets across Trump-linked entities. They also reflect the administration’s broader effort to position crypto as both a strategic asset and a policy priority.

The post New SEC Filing Shows Trump Media’s Total Bitcoin Holdings appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano News Update: Cardano Faces Death Cross Challenge—Will ADA Withstand the $0.50 Plunge?

- Cardano (ADA) forms a bearish death cross as price nears $0.50, with analysts warning of potential 50% declines if key support fails. - Whale selling and fear index at 31/100 highlight panic, while SEC delays on ETFs and low DeFi activity worsen investor uncertainty. - Emurgo partners with Wirex to launch ADA Visa card, aiming to boost utility but lagging behind Ethereum/Solana in DeFi adoption. - Upcoming Leios/Midnight upgrades promise 30-50x throughput gains, yet skeptics cite founder Charles Hoskinso

Hyperliquid News Today: Hyperliquid's $4.9 Million Loss Highlights DeFi's Ongoing Challenges with Risk Management

- Hyperliquid paused its Arbitrum bridge after a $4.9M loss from a POPCAT meme coin price manipulation scheme, as reported by Coinotag. - A trader used $3M in stablecoins to artificially inflate POPCAT's price, triggering liquidations and exposing DeFi's risks in volatile assets. - The incident mirrors a 2025 JELLYJELLY manipulation case, with experts criticizing Hyperliquid's immaturity in balancing decentralization and risk controls. - Analysts urge stronger safeguards for community-funded pools, as plat

Yahoo Equips Investors with a Glimpse into the Future: Prediction Markets Enter the Mainstream

- Yahoo Finance partners exclusively with Polymarket to integrate blockchain-based prediction market data into its financial services , effective November 12, 2025. - The collaboration leverages Polymarket's USDC-powered platform for real-time event forecasting, enhancing market sentiment analysis for retail and institutional investors. - Growing industry adoption of prediction markets is evident as Google and Hollywood.com also enter the space, while regulatory scrutiny intensifies with CFTC involvement.

XRP News Today: XRP ETF Establishes a Regulated Route for Widespread Crypto Adoption

- Canary Capital's XRPC ETF becomes first U.S. spot XRP fund under securities law, clearing SEC approval via Form 8-A on November 10, 2025. - Charging 0.50% fees with U.S. Bank/Gemini custodians, the ETF offers direct XRP exposure unlike offshore-linked predecessors, reducing counterparty risks. - XRP surged 10% pre-approval as whales withdrew 10M tokens, while analysts predict $2.70–$3.00 price targets if institutional inflows persist post-launch. - Despite SEC's $125M fine against Ripple, the ETF's regul