Why HYPE Long Traders Should Worry About $24 Million Liquidations

HYPE long traders are on alert as $24 million in potential liquidations loom near $35.3 support, with bearish signals and weak sentiment threatening deeper losses unless recovery momentum returns.

Hyperliquid’s native token, HYPE, is showing signs of weakness following recent market volatility. After several failed recovery attempts, the altcoin is struggling to maintain its footing above crucial support levels.

While short-term traders anticipate a potential rebound, technical indicators suggest long traders should proceed cautiously.

Hyperliquid Traders Could Face Losses

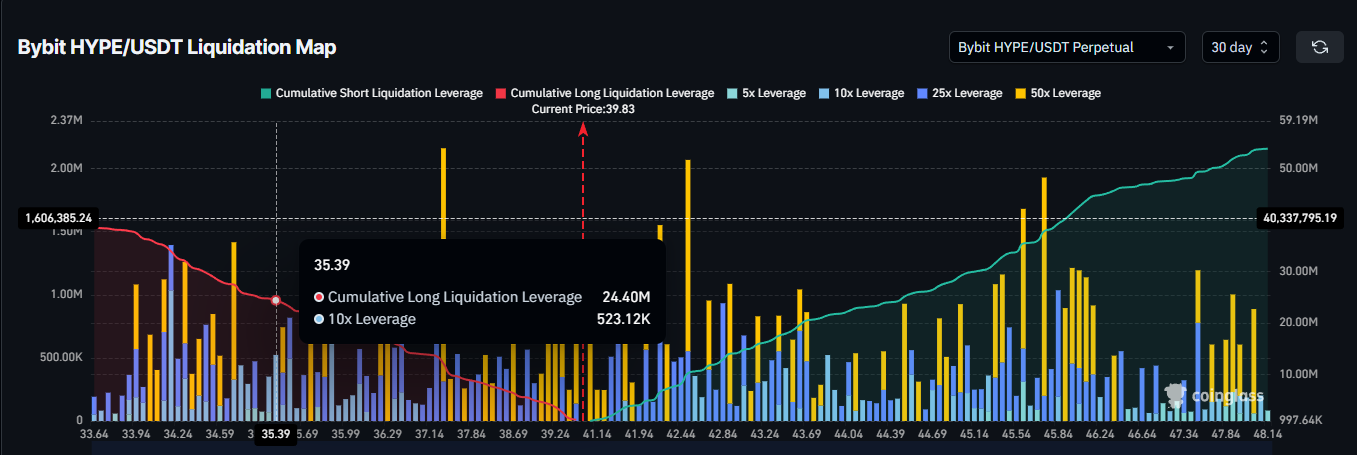

The liquidation map reveals that HYPE long traders could face up to $24.40 million in potential liquidations if the token drops to its month-long critical support at $35.3. This would represent a substantial risk, as it could trigger widespread position closures among leveraged traders.

What makes this development more concerning is that this level has already been tested twice in the past month. A third test could undermine market confidence and discourage new long positions, leaving HYPE vulnerable to increased volatility and downward price pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HYPE Liquidation Map. Source;

HYPE Liquidation Map. Source;

HYPE Liquidation Map. Source;

HYPE Liquidation Map. Source;

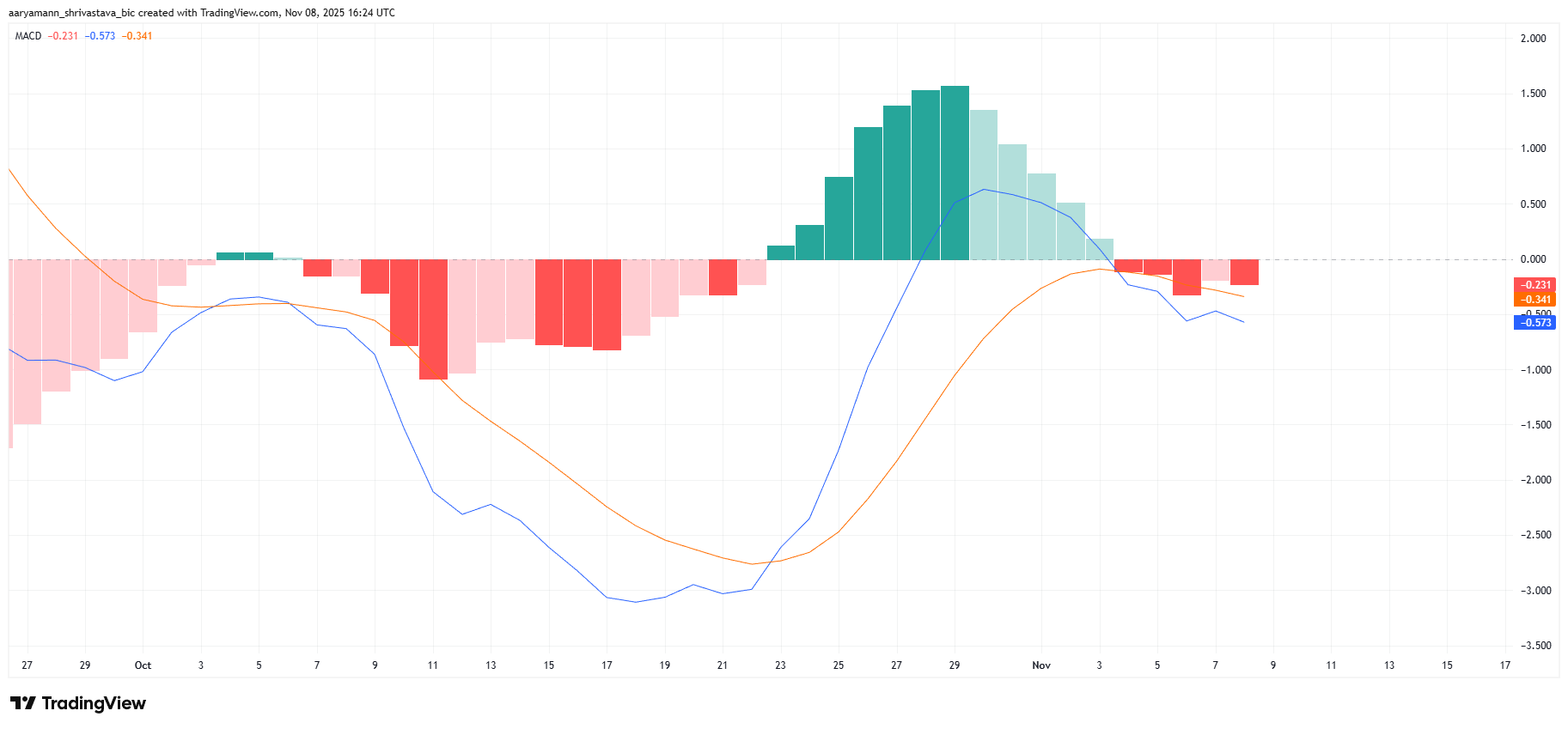

The Moving Average Convergence Divergence (MACD) indicator is flashing early warning signs of intensifying bearish momentum.

A bearish crossover recently occurred, suggesting a possible continuation of selling pressure. Although the current downturn is not yet severe, a decline in market confidence could accelerate losses.

If broader crypto market sentiment worsens, HYPE could face difficulty maintaining its current trading range. A deepening bearish trend may prolong recovery efforts, pushing traders to exit before conditions improve. On the other hand, stabilization in Bitcoin and altcoin markets could ease selling pressure on HYPE.

HYPE MACD. Source:

HYPE MACD. Source:

HYPE MACD. Source:

HYPE MACD. Source:

HYPE Price Could Slip To Support

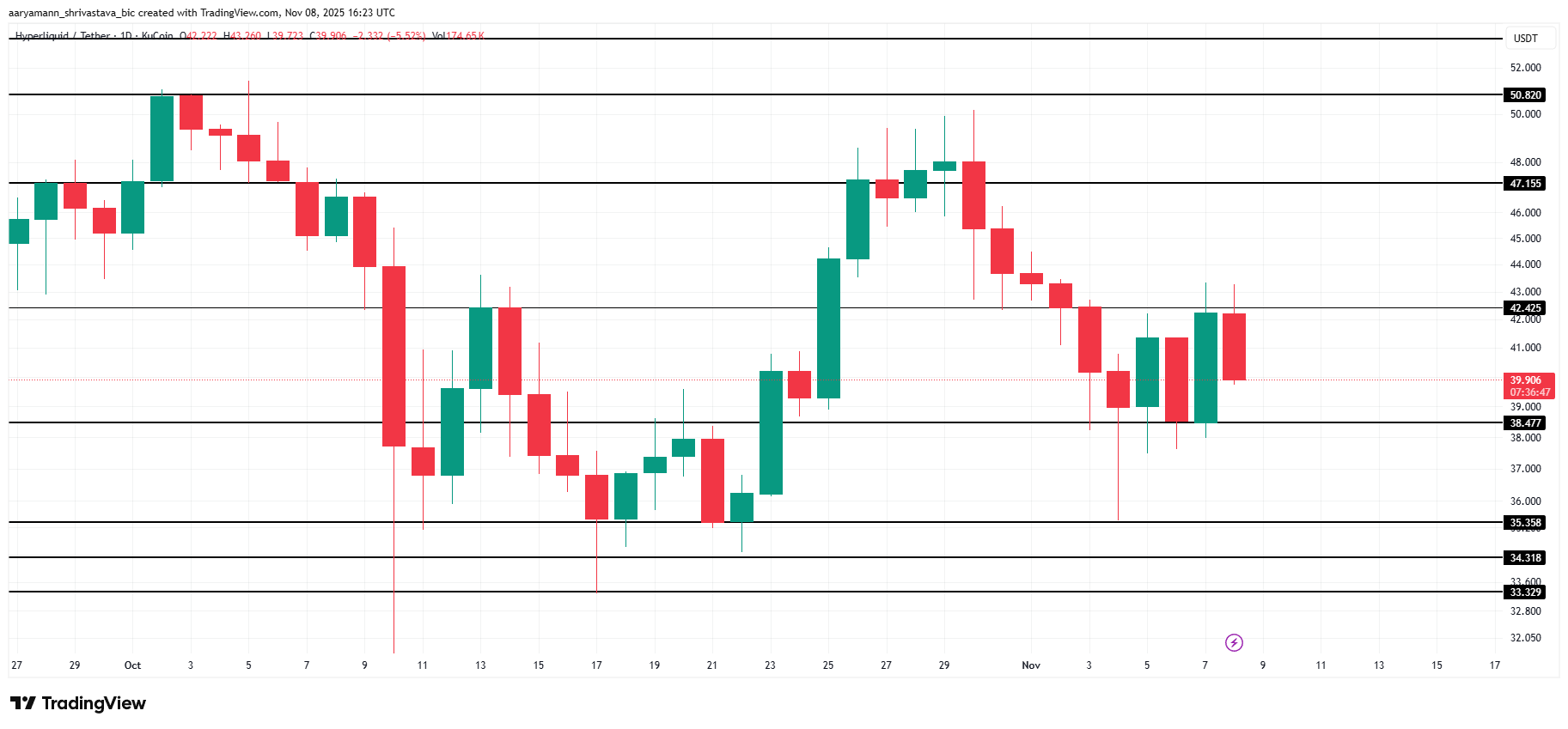

HYPE is trading at $39.9 at the time of writing, consolidating within a narrow range between $42.4 and $38.4. The chances of an upward breakout appear limited unless market sentiment improves considerably and buyers return.

If bearish conditions persist, HYPE could lose its $38.4 support, testing the $35.3 level again. A breakdown below this threshold could trigger millions in long liquidations, amplifying the decline and delaying any recovery attempts.

HYPE Price Analysis. Source:

HYPE Price Analysis. Source:

HYPE Price Analysis. Source:

HYPE Price Analysis. Source:

Conversely, if positive momentum builds and investor support strengthens, HYPE could attempt to breach the $42.2 resistance level.

Successfully flipping this barrier into support could propel the altcoin toward $47.1, invalidating the bearish outlook and restoring optimism among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hassett’s Perspective on the Fed: Bold Rate Reductions or Fundamental Overhaul

- Kevin Hassett, Trump's top economic adviser, proposes Fed chairmanship with plans to cut interest rates and restructure the central bank's research and communication strategies. - He advocates reducing Fed staff influence and adopting top-down decision-making, aligning with Trump's skepticism of institutional expertise while claiming nonpartisan leadership. - Hassett warns a 40-day government shutdown risks pushing Q4 GDP negative, emphasizing fiscal-monetary coordination amid economic uncertainty and st

AAVE Rises 0.86% as Large Investors Accumulate and Aave Founder Criticizes BoE

- AAVE rose 0.86% in 24 hours to $205.44 amid whale accumulation and regulatory scrutiny, despite 32.98% annual declines. - Major on-chain actors borrowed $180M+ from Aave to purchase 388,615 ETH ($1.32B), leveraging DeFi protocols for ETH accumulation. - Whale strategies maintain 2.1 leverage ratios, while backtests show Aave whale activity correlates weakly with sustained AAVE price gains. - Analysis suggests whale accumulation may signal distribution or liquidity provision rather than bullish price mome

SOL Price Forecast for 2025: Network Enhancements and Growing Institutional Interest Drive Positive Outlook

- Solana's 2025-2026 roadmap includes Firedancer, ZK Compression v2, and Alpenglow upgrades to boost scalability, reduce fees, and enable real-time applications. - Institutional adoption surges with $841M+ SOL holdings, $817M in ETF assets, and partnerships with Visa/R3 enhancing its financial infrastructure utility. - Price resilience defies market trends as TVL triples to $40B, driven by ETF inflows and DeFi growth despite 30% Q3 user declines. - Analysts project $147-$494 price range for 2025, citing 26

Ethereum News Update: Separating Hype from Reality—Crypto Market Shifts as BlockDAG, Ethereum, and XRP Aim for Leadership by 2026

- BlockDAG's $435M presale and hybrid DAG/Proof-of-Work model position it as a top 2026 growth candidate with 3.5M active miners. - Ethereum faces technical risks like potential death cross but retains 53% stablecoin dominance through JPMorgan/BlackRock partnerships. - XRP shows $2.40 recovery amid Bitcoin ETF inflows but needs sustained confidence to maintain $3.95B derivatives open interest. - Market shifts toward projects with institutional validation (CertiK audits) and real-world adoption (Seattle spo