Date: Sun, Nov 09, 2025 | 08:30 AM GMT

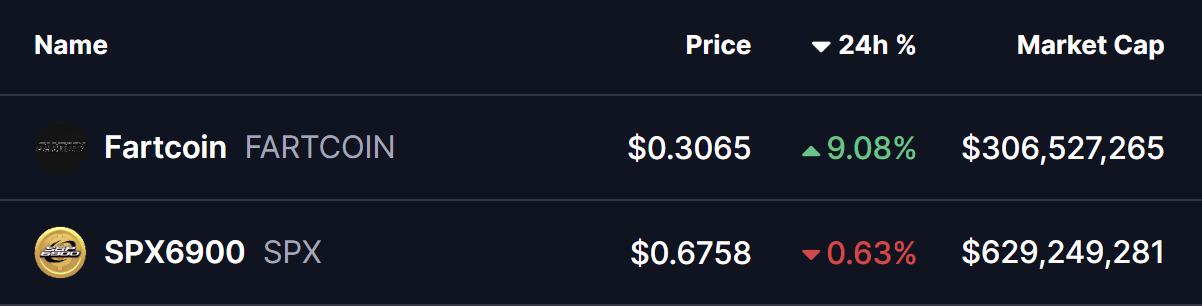

The cryptocurrency market continues to show strong performance across multiple altcoin sectors, and memecoins are beginning to join the momentum. Fartcoin (FARTCOIN) has gained 10 percent today, and SPX6900 (SPX) is also steaming up as its technical structure is now showing early signs of a potential bullish reversal. The latest price action is forming a key pattern on the chart that may set up an upside breakout in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Broadening Wedge Pattern in Play

On the 4-hour chart, SPX has been trading inside a descending broadening wedge. This structure is known as a bullish reversal pattern that often forms during corrective phases and typically signals growing volatility followed by a breakout to the upside.

During the latest pullback, SPX retested the lower boundary of the wedge near $0.5977, a zone that has consistently acted as strong support. Buyers stepped in confidently at this level, initiating a rebound that lifted the price toward $0.6754, placing it very close to the wedge’s upper resistance trendline.

SPX6900 (SPX) 4H Chart/Coinsprobe (Source: Tradingview)

SPX6900 (SPX) 4H Chart/Coinsprobe (Source: Tradingview)

The tightening price action near this upper boundary reflects increasing momentum and rising breakout pressure.

What’s Next for SPX?

If buyers manage to push SPX above the upper wedge trendline and reclaim the 100 Moving Average positioned near $0.8695, the chart would confirm a bullish breakout. From there, the next technical target sits around $1.3123, which marks roughly a 94 percent potential upside from current levels.

If SPX faces rejection at the resistance zone, it may continue moving sideways inside the wedge. In that case, the $0.6042 region will act as the key short-term support to monitor.

For now, the overall technical structure appears constructive. With the descending broadening wedge intact and buyers defending critical support, SPX is shaping up for a meaningful breakout attempt, especially if broader market sentiment strengthens through November.