Bitcoin ETF Withdrawals Hit Levels Last Seen in May

Analysts say the Bitcoin ETF withdrawals mark defensive repositioning rather than capitulation, echoing past macro-driven rotations away from high-beta assets.

Spot Bitcoin ETFs are posting their heaviest withdrawals since May, signaling a clear shift in institutional positioning as risk conditions tighten across global markets.

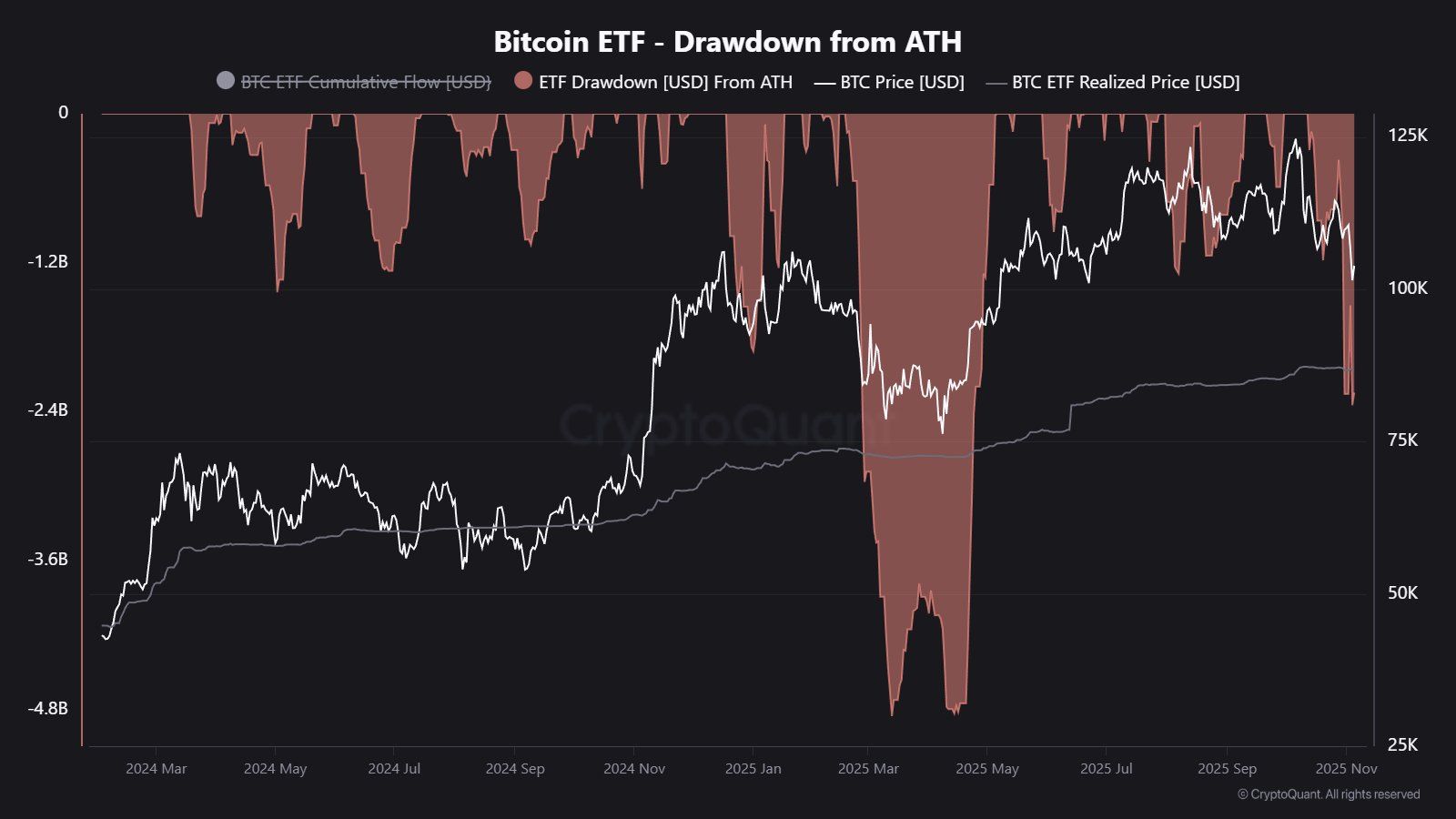

CryptoQuant data shows redemptions have climbed to roughly $2.3 billion from their recent peak, reversing a month-long stretch of inflows.

Bitcoin ETFs Face Sharpest Withdrawals in Months

According to SoSo Value data, the weekly outflows from the Bitcoin ETFs underscore the shift.

In the last seven days, the spot Bitcoin ETFs shed nearly $2 billion, one of their steepest weekly declines since the products launched.

Bitcoin ETFs Drawdown. Source:

CryptoQuant

Bitcoin ETFs Drawdown. Source:

CryptoQuant

Notably, the selling has been concentrated in a handful of large BTC investment vehicles of BlackRock’s IBIT and Fidelity’s FBTC. However, that total flow pressure is broad enough to suggest a wider retreat rather than isolated rebalancing among specific funds.

Meanwhile, the current pace places redemptions at a six-month high. In May, investors pulled more than $4.8 billion from spot ETFs amid heightened volatility and a rapid repricing in derivatives.

While conditions are less chaotic than earlier in the year, the flow pattern shows investors reducing risk. Rising Treasury yields are pulling professional allocators toward assets with more predictable income.

Indeed, the US 10-year yield has risen sharply in recent weeks, and that shift has historically dampened demand for high-beta assets. Bitcoin typically weakens in these periods as investors rotate toward instruments with clearer yield profiles.

Bitcoin Price Stalls

Bitcoin’s own price action reinforces the trend. According to BeInCrypto data, the asset has declined by approximately 16% since early October and trades at $101,804 as of press time.

Much of the drawdown occurred after the October 10 liquidation cascade, which wiped roughly $20 billion in market value and forced leveraged traders to reduce their exposure.

That shift reset positioning across perpetual futures and options, and the subsequent cooling in ETF demand reflects continued defensive posturing.

Analysts say the flow-price dynamic has become more pronounced as ETFs take on a larger share of market-moving liquidity. Heavy redemptions force issuers to unwind their underlying Bitcoin holdings, adding incremental selling pressure during periods of muted risk appetite.

Conversely, inflows tend to stabilize markets by absorbing spot supply. This structural link has made ETF flows a real-time gauge of institutional conviction—and a key driver of short-term price behavior.

Still, the latest withdrawals do not yet resemble capitulation. Portfolio managers appear to be rotating into duration-sensitive instruments rather than abandoning digital assets outright.

So, the flows are consistent with earlier macro-driven pullbacks in which allocators trimmed risk in response to rising yields and uncertain policy signals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Privacy-Centric AI Platforms Emerge as AlphaTON and SingularityNET Transform the Standards of Responsible Technology

- AlphaTON and SingularityNET partner to deploy high-performance GPUs in Sweden’s hydro-powered data centers for Telegram’s Cocoon AI network, prioritizing privacy-first and sustainable AI infrastructure. - The collaboration combines CUDO Compute’s expertise and Vertical Data’s GPUFinancing.com to enable encrypted machine learning with user-controlled data, addressing gaps in ethical AI development. - Executives highlight privacy and decentralization as competitive advantages, aligning with Telegram’s 1B+

Beyond Meat’s Five-Year Losses and $1.2 Billion Debt Lead Analysts to Lower Ratings

- Beyond Meat's Q3 earnings miss and revenue drop led to an 8% stock decline, extending its 78.8% annual slump. - Analysts downgraded to "Underperform" as $1.2B debt and $77.4M impairment charges highlight ongoing financial strain. - International sales showed mixed results, with U.S. retail and foodservice revenue falling sharply by 18.4% and 27.3%. - Despite cost cuts and debt restructuring, the company remains unprofitable since its 2019 IPO, with Q4 guidance below expectations.

Crypto Mining in 2025: The Intersection of AI Advancement and Real-World Risks

- C3 AI explores sale amid 54% stock drop and $116M loss, signaling crypto cloud mining sector's strategic shifts. - Palantir's 129% stock surge highlights AI-driven enterprise dominance over traditional mining players. - Physical mining faces crises: Bitdeer's Ohio fire and TeraWulf's 22% output decline expose infrastructure fragility. - Regulatory focus on ESG reporting accelerates digital mining adoption despite operational and geopolitical risks.

Galaxy: Institutional Tokenization Demand Grows Beyond Bitcoin

Tokenization demand surges as institutions value blockchain independently of Bitcoin, says Galaxy exec.What’s Driving the Institutional Shift?Looking Ahead: A New Era for Digital Assets