UBS predicts that a Fed rate cut will push the 10-year US Treasury yield down to 3.5%

According to Golden Ten Data, UBS stated in an outlook report that the rapidly growing U.S. debt means investors will continue to demand higher term premiums to invest in long-term Treasury bonds, which will lead to a renewed steepening of the yield curve. However, UBS analysts noted that the yield on the U.S. 10-year Treasury bond will still decline, as the Federal Reserve may further cut interest rates. They expect the yield on the 10-year U.S. Treasury to fall to 3.5% next year, and then rebound to 4% by the end of 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CryptoQuant CEO: Treasury companies and ETF inflows have ended the bear market

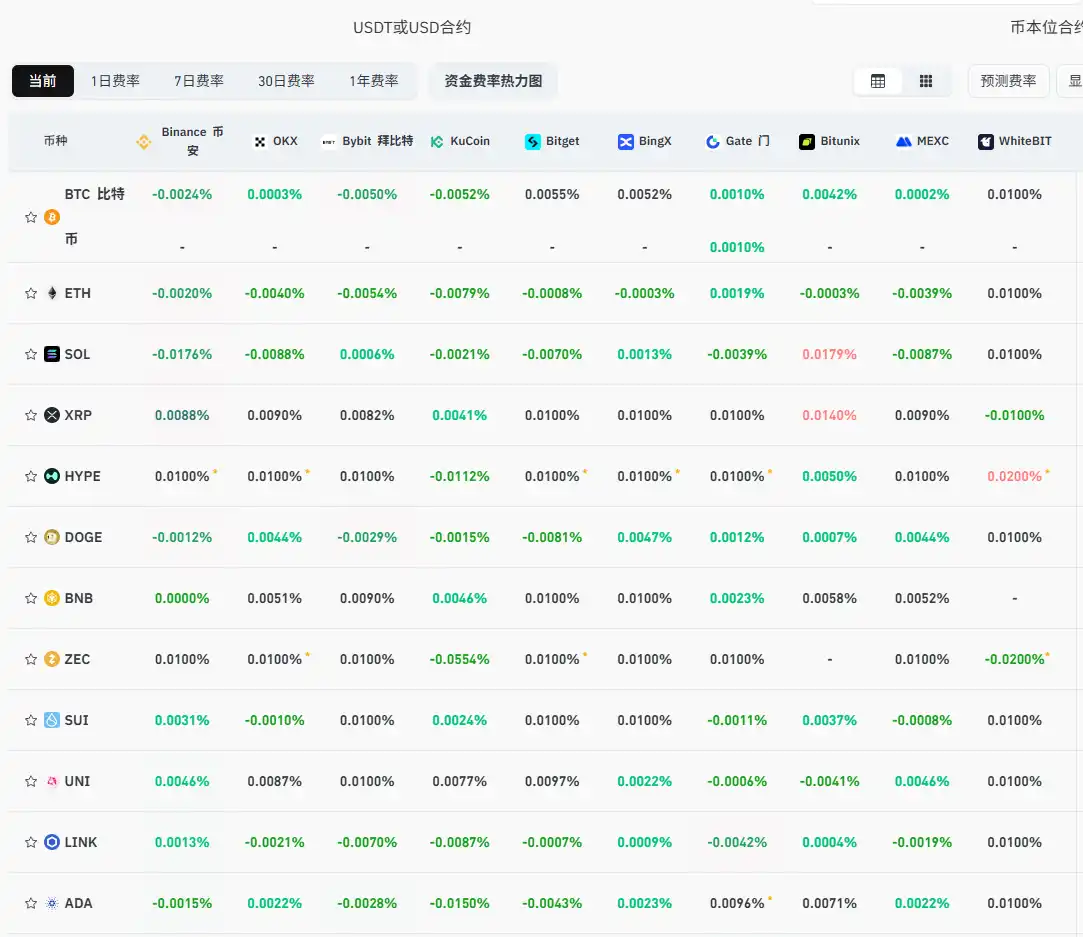

Current mainstream CEX and DEX funding rates indicate the market has returned to a fully bearish outlook

Grvt announces the launch of its native protocol vault, Grvt Liquidity Provider (GLP) strategy