The PoS world is reducing inflation and slashing staking! Collective reflection from Polkadot, Solana, NEAR, and Celestia!

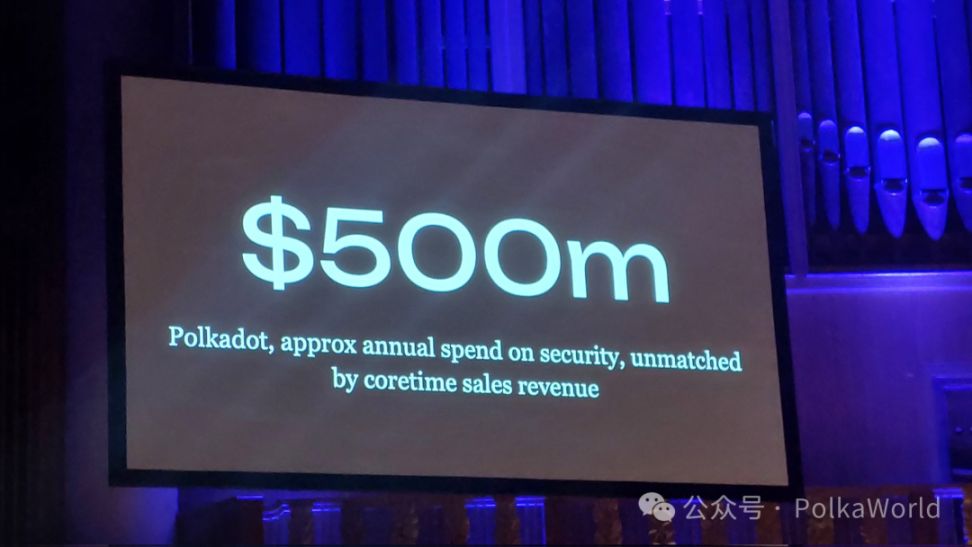

When Gavin Wood announced at the Web3 Summit that Polkadot would reduce its security cost (staking rewards) from $500 million per year to $90 million, it not only sent shockwaves through the Polkadot community but also struck a heavy blow to the "default logic" of the entire PoS world.

But can $90 million really support Polkadot's security system?

Behind this question lies an inquiry that the entire industry dares not face: How much have we actually been paying for "security" over the years? Is this security really worth it?

- Solana began to question whether it was "spending too much subsidizing staking," and thus proposed smart emissions;

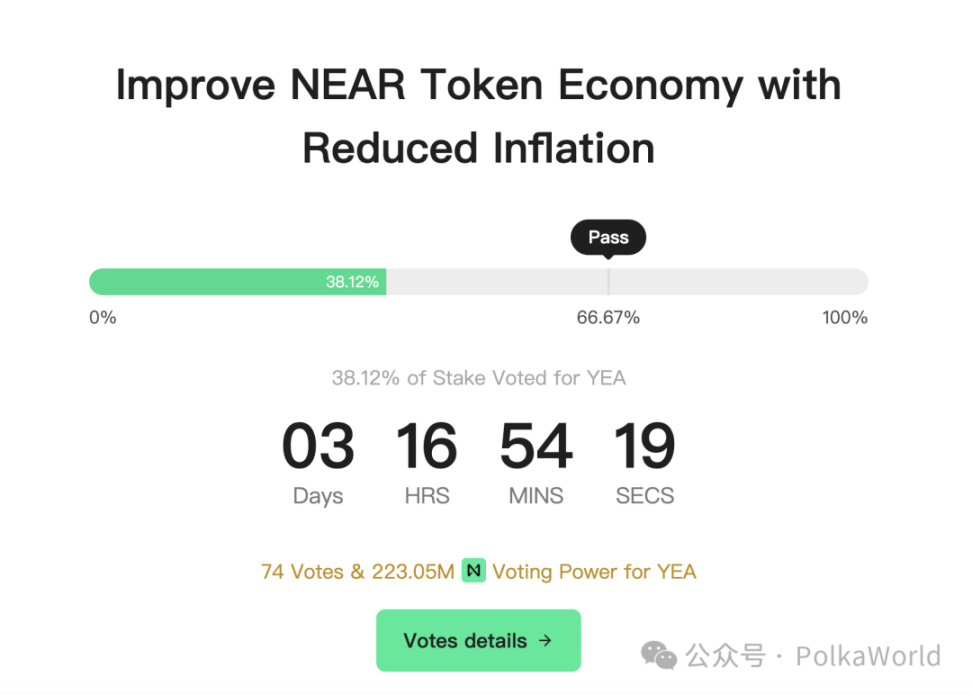

- NEAR directly initiated a proposal to halve inflation from 5% to 2.5%;

- Celestia was even more radical, outright advocating for the elimination of staking, switching to off-chain governance (PoG) to select validators, and slashing inflation from 5% to 0.25%.

From Polkadot's $90 million experiment to inflation reforms on other public chains, we are witnessing a consensus forming: the PoS security myth is being shattered, and the entire industry is recalculating the "price of security."

The Collective Reflection of the PoS World — Solana, NEAR, Celestia

In January this year, Solana began to question the inflation and sell pressure caused by the staking system. They believe that as the network matures, stakers are increasingly earning revenue from other sources (such as MEV)—in Q4 2024, Jito Tips reached $430 million. While the network's staking volume has increased significantly, the issuance mechanism has not adjusted accordingly, resulting in the network paying an excessive cost for "security." Moreover, over-issuance reduces the amount of SOL in DeFi (opportunity cost) and brings long-term sell pressure to the network.

Against this backdrop, the Solana community proposed the SIMD-0228 proposal, aiming to upgrade "dumb emissions" to "smart emissions": dynamically adjusting issuance based on staking participation.

- Reduce issuance when the staking rate is high to avoid waste;

- Increase issuance when the staking rate is low to maintain security.

The goal is to reduce SOL issuance to "the minimum required to ensure network security," alleviating inflation and sell pressure, and making the token economy healthier.

Celestia co-founder John Adler also published a post in June this year, proposing an even more radical solution—outright advocating for the elimination of staking and switching to off-chain governance to select validators.

Eliminate rewards for stakers and only pay issuance to validators.

Staking is no longer used to "select validators," but governance is used to decide who the validators are.

Transaction fees are no longer distributed to stakers but are either burned directly or split equally among all token holders.

He believes staking has become "meaningless" and can be completely removed from the protocol.

Because, in Celestia, most of the current PoS chain inflation (5%) is used to reward stakers. Under PoG, if issuance is only given to validators, the issuance can be slashed by 20 times, reducing inflation from 5% to 0.25%, thus significantly lowering inflation while maintaining network security.

In June this year, NEAR proposed to reduce the inflation rate from 5% to 2.5%.

NEAR currently has a fixed annual inflation of 5%, originally expecting that high-frequency usage & fee burning would reduce net inflation to 2–3%. However, the reality is—over the past year, only 0.1% of supply was burned, so nearly the full 5% inflation entered the market, adding 60 million NEAR annually and continuously diluting holders. Realizing that other PoS chains (Polkadot, Solana, Aptos) are all lowering inflation, NEAR stated it cannot fall behind.

In June this year, a proposal was made to reduce the maximum inflation rate from 5% to 2.5%. It is expected that staking returns will adjust to 4.5% (assuming 50% of tokens are staked), hoping to direct more NEAR into DeFi rather than simply staking for interest.

Behind these discussions lies a common understanding: the PoS world may have spent too much money.

In the past few years, the entire industry defaulted to "security = more staking + more inflation rewards," so billions of dollars were used to subsidize staking, creating what appeared to be an unbreakable moat.

But from Polkadot slashing its security cost to $90 million, to Solana and NEAR lowering inflation, and Celestia even considering removing staking altogether, all essentially reveal a reality: we are not paying for "security," but for a design flaw.

The Staking Security Myth Is Being Broken?

Why is everyone readjusting their staking mechanisms?

Because pricing "security" through inflation subsidies for staking is logic that may still be stuck in the old era of 2019. That popular slogan—"staking = paid security"—seems simple, but may not stand the test of time.

So the question is: What are we actually paying for now? What "security" are we buying? And what is its cost?

Many people do not really understand "technical security"—such as latency, consensus coordination, network partitioning, and other underlying mechanisms—so they tend to rely on a "simple and crude" explanation: as long as a lot of money is locked up and many tokens are staked, the network is secure.

But in reality, most L1s today are protected by the same group of large validator companies. So where is the decentralization?

Worse, institutions like ETFs also stake to avoid being diluted by inflation, which means ordinary retail investors cannot really participate, are diluted, and receive no staking rewards. In other words, this so-called "security mechanism" ultimately becomes a subsidy for institutions.

Even though staking includes slashing (penalty mechanisms), theoretically to deter malicious behavior, it often fails to be effective on a large scale:

- Large-scale staking is more like a "showcase project" rather than a real security barrier;

- If slashing is triggered too slowly, by the time the penalty is executed, the token price may have already collapsed, and the deterrent effect is gone.

If Security ≠ Massive Staking, Then What Should It Be?

So, how should security actually be measured? It cannot be based solely on the amount staked; it must also consider the real cost of attack and response speed.

Slashing only makes sense under the following conditions:

✅ Attacks can be detected quickly

✅ Penalties can be executed before validators exit

✅ Honest nodes are not mistakenly penalized

✅ There is an efficient coordination mechanism

✅ The network is synchronous and quasi-permissioned

In other words: security is not just an on-chain mathematical formula, but also includes "social layer" factors. Network structure, node connectivity, and fault detection—these foundational designs are equally critical.

Solana's example illustrates this well—their top validators are not just "stakers," but also core providers of network infrastructure.

- Some operate MEV relays (Jito), responsible for capturing and distributing on-chain MEV revenue;

- Some provide RPC services (Helius), serving as the interface for developers and users to access Solana;

- Some are custodians (Coinbase, Figment), managing assets for institutions and retail investors;

- Some are backed by large VCs (Jump), directly investing in ecosystem projects.

Why don't they exit?

- Because they make money from these infrastructures—even without staking rewards, they have business income.

- They have brand reputations—leaving nodes would damage their reputation and trust.

- They must "be present" because they have invested in projects—leaving nodes would mean abandoning support for their own investments.

So, Solana's security is not maintained solely by "locking up a lot of money on-chain," but because the validators themselves are deeply tied to the network's infrastructure and interests. These validators' motivations are not simply "staking rewards," but are diverse and structural.

If security comes more from governance, network structure, and economic cooperation—rather than a pile of "slashable" tokens—then the security cost of PoS should be completely recalculated: security should not be a perpetually burning bill, but a measurable, optimizable, and ultimately self-sustaining system.

Security has never been a single-source result, but rather the comprehensive outcome of capital incentives, governance constraints, network design, and social structure.

Celestia's PoG (Proof of Governance): Another Solution, But Not the End

This leads to Celestia's Proof-of-Governance (PoG) proposal.

If staking is inevitably heading toward centralization due to LSTs (liquid staking tokens), power-law effects, and validator monopolies, then Celestia's approach is: simply abandon staking and let off-chain governance coordinate and decide the validator list.

As long as the right people are chosen—relying on trust, reputation, and governance mechanisms—then just skip the staking step altogether.

But PoG is not a panacea.

Why? PoG removes staking, and thus also removes the slashing (forfeiture) mechanism.

In PoS systems, slashing is an immediate economic deterrent: if a validator misbehaves, they immediately lose staked funds. This means someone is "really paying the price." But PoG eliminates staking, losing this direct economic penalty—if a validator has a problem, who bears the consequences? No one is motivated to intervene immediately, which can easily lead to a "tragedy of the commons": everyone relies on network security, but when something goes wrong, no one is responsible.

In contrast, delegated PoS models, though imperfect, at least ensure participants have skin in the game, forcing them to be more cautious:

- If you choose a validator and they misbehave, you lose money;

- If a validator misbehaves, they not only get slashed but also lose their reputation.

This mechanism forces all participants to be cautious—because the cost is real and immediate. PoG lacks this feedback system.

The deeper issue is that PoG replaces the "economic risk" of staking with "political risk."

Who decides the validator list?

Can governance be manipulated by a few?

Are governance decisions fast enough to respond to real attacks?

Researching "heavy governance" chains like Polkadot reveals: governance consumes a lot of community attention and resources, and Polkadot is already one of the few projects with mature on-chain governance tools.

For most networks, without such tools, when problems arise, governance is often too slow to respond in emergencies.

So, PoG is not an "ultimate solution."

It can solve the inflation and centralization problems caused by staking, but it sacrifices the inherent economic constraints of staking, making responsibility more ambiguous and shifting risk from the economic layer to the political layer. Governance itself is not perfect—it also brings new power struggles and efficiency issues.

Polkadot's Answer: JAM + PoP, Moving from "Inflation Incentives" to "Market-Driven"

Now, Polkadot is also entering the same discussion!

Gavin Wood put forward a viewpoint at this year's Web3 Summit: Polkadot NPoS (Nominated Proof of Stake) is dragging down Polkadot's security model. We need a fundamental replacement and reconstruction.

Breaking! Gavin Wood drops another "thought bomb": cancel staking security incentives!

Although this proposal has not yet been formally submitted for on-chain voting, we can look at what solutions have been discussed so far.

On the economic model

1. Lower inflation. Adopt a fixed issuance, set a cap of π × 10⁹ DOT (about 3.14 billion), decrease every two years or use a halving model like bitcoin.

2. Introduce a native Polkadot stablecoin to avoid frequent DOT sell-offs and protect the token market; it also facilitates governance system budget management, making settlements more stable and predictable.

On the staking mechanism

1. Give validators a fixed fiat reward (e.g., $5,000 per month)

2. Give stakers a fixed fiat reward (e.g., $1 million staked, 3% annual return)

3. Introduce an "intermediate fund pool" mechanism—inflation funds no longer go directly to validators but enter an intermediate pool, with governance deciding whether to allocate them. For example:

- Does the network currently need more security investment? → Allocate to validators;

- Are there more urgent ecosystem funding needs? → Allocate to developers, projects, events, etc.;

- Is the network already over-incentivized? → Leave it in the pool as future reserves;

- It can even be used to offset future inflation, buy back DOT, or support the stablecoin.

On governance

Raise the entry threshold for validators, e.g., OpenGov conducts KYC/interviews

On the underlying architecture

1. JAM Core Disabling: In the future, under the JAM architecture, when a Core produces no real value, the system can shut it down, stopping the allocation of validator resources and block opportunities.

2. Introduce the concept of Proof of Personhood (PoP) in JAM. A way to verify "human uniqueness" (anti-sybil attack), allowing identity + reputation to participate in security, not just capital. If you can trust identity, you don't need as much inflation to protect the network. Social capital can offset monetary cost.

Please note: all of the above are directions proposed by Gavin for discussion; how they will be implemented depends on the final on-chain proposals.

Can $90 Million Guarantee Polkadot's Security?

So now the question is, if Polkadot reduces its economic cost from $500 million to $90 million, can Polkadot's security system still function normally? Or how can it transition to a stage where social capital is involved?

If you don't know what the $90 million figure means, let's do the math!

If we calculate based on the current 600 validators in the Polkadot network, and according to the current validator and nominator distribution mechanism, assuming validators can get a 20% commission, then each validator's monthly reward is about $2,500. So what is the minimum monthly operating cost for a current Polkadot validator? Can this cover the cost?

Ok, if we are bolder and assume that in the future there are no nominators, all rewards go to validators, and we have transitioned to JAM, with 1,023 cores, then the reward for running a core may only be $7,331. Gavin mentioned that the current monthly cost to run a JAM core may be $15K–$30K, so what should we do?

He suggests that we should focus on:

1. Reducing the marginal cost of JAM cores so more people can afford them;

2. Designing mechanisms to support multiple parties sharing a JAM (to avoid the waste of "everyone running their own chain");

3. Making cores more useful, such as supporting bridging, SDKs, and other development capabilities.

Some may say, aren't we going to replace NPoS with PoP? But even so, nodes still have costs and need incentives!

The goal of PoP is not to make "rewards zero," but to make "rewards based on actual service value," and to limit the number of participants through identity mechanisms, making the system's economic efficiency much higher than NPoS.

Perhaps in the future, once the Core market matures, DOT inflation will only be a "bootstrap subsidy," and subsequent cores should be purchased by actual users (developers/project owners), forming a self-sustaining cycle. Early core prices are not that high, and demand hasn't picked up yet, so we can use inflation to cover some validator costs, but we should gradually transition to having core users directly pay for core prices.

I believe this is actually the path Gavin envisioned at the Web3 Summit, namely:

- Early stage: lower DOT inflation, reduce security costs, but still provide some funds (e.g., $90 million) to subsidize validators or stakers

- Mid-term: introduce PoP, gradually reduce the number of network stakers, with security involving only validators. Gradually optimize JAM architecture to lower core prices, expand use cases, serve more providers, and shift to developers/rollup project owners purchasing as needed

- Later stage: the network enters a self-sustaining supply and demand cycle, breaking free from inflation dependence

Therefore, it is not impossible for Polkadot to compress security spending to $90 million/year, but it must be accompanied by structural architectural and economic model evolution.

The current validator structure cannot support long-term operation. Not only has Polkadot realized this, but more L1s in the industry are rethinking this issue.

Polkadot's proposed solution is JAM + PoP, decoupling security from rewards, with high-quality security computation driven by the market and priced on demand.

During the transition, DOT may still need to provide some subsidies, but as Core costs fall, reuse rates rise, and SDK integration expands, eventually cores will be paid for by real users, and Polkadot's economic structure will become self-sustaining.

This is Polkadot's exploration from "inflation incentives → market-driven."

$90 million may not be an arbitrarily chosen number, but a fuse that challenges core pricing, usage mechanisms, developer willingness, and the on-chain economic model from all angles.

The process may not be easy, but once it starts, we are already on the way!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Starknet Awakens: Analyst Predicts a 300% Rally for STRK

Cardano Foundation Shares Major Progress in Global Adoption Roadmap for 2025–2026

Solana Price Forecast: SOL Rebounds as Institutional and Retail Demand Strengthen

Fearless of the AI bubble! Robinhood CEO: Plans to launch a new fund allowing retail investors to invest in companies like OpenAI

CEO Vlad Tenev stated that he hopes ordinary people can participate in the wave of AI disruption, and the fund will invest in more than five top private companies.