3 Altcoins Facing Major Liquidation Risk in the Second Week of November

XRP, Zcash, and Starknet are showing strong momentum but carry high liquidation risks for leveraged traders this week. Analysts warn that overleveraged longs could face steep losses if market sentiment turns.

While the altcoin season has yet to return, a few altcoins are showing stronger performance than the rest of the market in the second week of November. However, these same tokens also face the risk of triggering massive liquidations for short-term traders.

Which altcoins are they, and what risks are involved in trading their derivatives?

1. XRP

Short-term trader sentiment for XRP remains highly optimistic as Canary Capital prepares to launch its Spot XRP ETF on November 13.

Additionally, five XRP spot ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have appeared on the DTCC list. This development strengthens investor confidence that multiple XRP ETFs could soon receive approval.

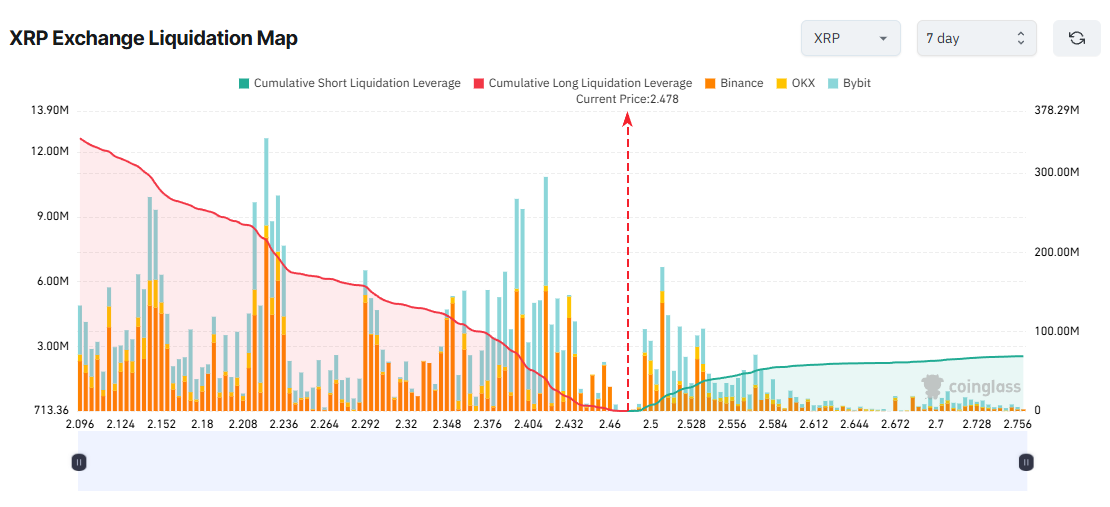

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

The 7-day liquidation map indicates a significant concentration of potential long liquidations, suggesting that many traders are anticipating an XRP price rally this week.

However, BeInCrypto’s latest analysis reveals a sharp decline in new XRP addresses over the past week, indicating a weakening of interest from new investors. Moreover, the MVRV Long/Short Difference has dropped, increasing the likelihood of a price correction.

If XRP falls toward $2.10 this week, long positions could face more than $340 million in liquidations. Conversely, if XRP rises to $2.75, short positions may be liquidated for around $69 million.

2. Zcash (ZEC)

The rally in Zcash (ZEC) shows no sign of slowing down in the second week of November. Although ZEC reached $750 before correcting to around $658, many traders still expect the price to climb toward $1,000.

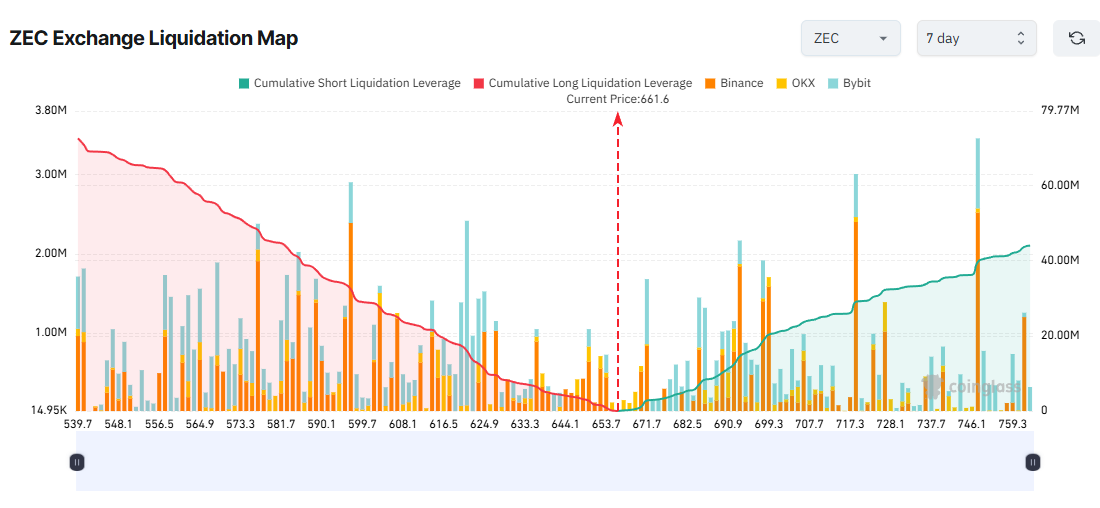

The 7-day liquidation map reveals that short-term derivatives traders are allocating more capital and leverage toward long positions. This means they could face larger losses if ZEC experiences a correction this week.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

If ZEC drops to $540, over $72 million in long positions could be liquidated. Conversely, if ZEC surges to $760, roughly $44 million in shorts could be wiped out.

Analysts warn that ZEC may be forming a classic parabolic uptrend after a 10x rally, possibly nearing the final stage of the pattern.

“Just sold 90% of my ZEC. I’m bullish on the privacy thesis, but parabolic charts rarely sustain in the short run without a meaningful retrace. Too much short-term FOMO imo,” investor Gunn said.

3. Starknet (STRK)

Starknet (STRK) surprised the market in the second week of November with a 30% daily surge, recovering losses from last month’s sharp decline.

Several analysts suggest STRK may be breaking out of a long-term resistance line, potentially kicking off a strong new bull run.

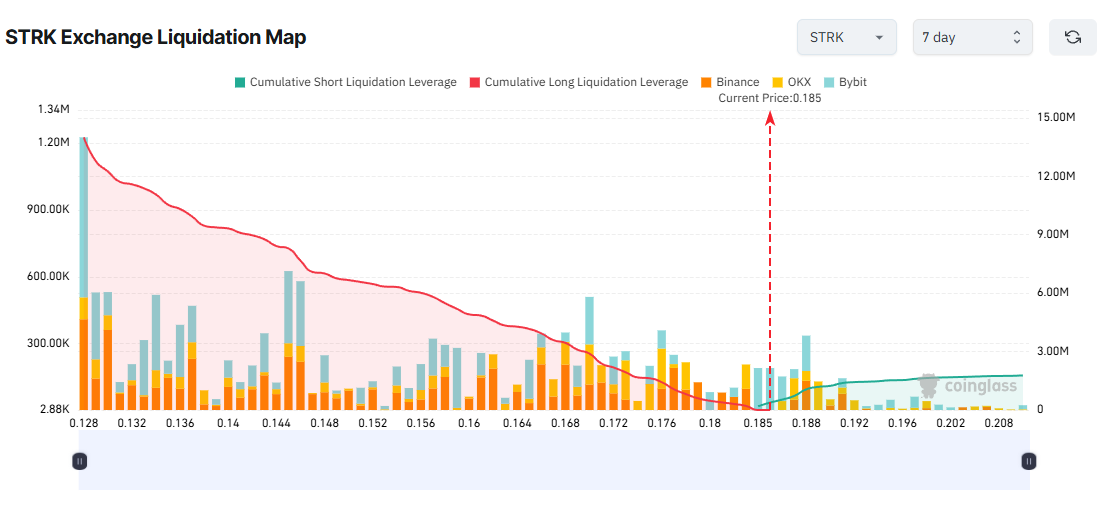

Liquidation map data reflects this short-term bullish sentiment, showing a dominance of potential long liquidations over shorts.

STRK Exchange Liquidation Map. Source:

Coinglass

STRK Exchange Liquidation Map. Source:

Coinglass

However, CryptoRank reports that STRK is among the top 7 altcoins with major token unlocks this week. More than 127 million STRK tokens will be unlocked, potentially adding significant selling pressure and disrupting the plans of leveraged long traders.

If STRK falls to $0.128, approximately $14 million in long positions could be liquidated. Conversely, if it breaks above $0.20, about $1.78 million in shorts could be wiped out.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero-Knowledge Startup Secures $9M Funding, Introduces Gamified Verification to Bridge Privacy and Compliance

- Zero-knowledge identity protocol Self raised $9M in seed funding led by Greenfield Capital and SoftBank's fund, alongside angel investors like Casey Neistat and Polygon's Sandeep Nailwal. - The startup launched a points program incentivizing on-chain identity verification using ZKPs and verifiable credentials, partnering with Google , Aave , and Velodrome to bridge privacy-compliance gaps. - By enabling biometric passport verification and Aadhaar integration without exposing sensitive data, Self aims to

Gavin Wood Supports Acurast’s Decentralized Computing Revolution Driven by Smartphones

- Acurast, a smartphone-based decentralized computing project, secured $11M in funding led by Ethereum co-founder Gavin Wood and others. - The platform launched its mainnet on November 17, aiming to transform 150,000 smartphones into secure compute nodes for confidential tasks. - By leveraging hardware-backed security and eliminating intermediaries, Acurast challenges traditional data centers while addressing privacy and environmental concerns. - Despite scalability challenges, the project's 494 million pr

Crypto wallets are transforming into comprehensive platforms, connecting Web3 with traditional financial services

- D'CENT Wallet's v8.1.0 update enables multi-wallet management for up to 100 accounts, streamlining digital asset handling across investment, NFTs, and events. - Competitors like Exodus and Blaqclouds advance crypto adoption through features like Mastercard-linked debit cards and decentralized identity systems with biometric security. - Innovations such as fee-free transactions (D'CENT GasPass) and on-chain identity management (.zeus domains) highlight industry focus on accessibility and security for main

Grayscale's Public Listing: Advancing Crypto Adoption as Regulations Vary Worldwide

- Grayscale files U.S. IPO via S-1, joining crypto firms like Circle and Bullish in public markets. - IPO details remain undetermined, contingent on SEC review and market conditions. - Japan's TSE tightens crypto listing rules amid volatile "crypto hoarding" stock collapses. - U.S. regulators advance crypto rulemaking post-shutdown, potentially accelerating Grayscale's approval. - Grayscale's IPO highlights crypto's institutional push amid global regulatory divergence.