How exactly does MegaETH allocate its public offering shares?

Fairly allocate to existing community members and establish a data-driven scoring and allocation system for long-term investors.

Original source: MegaETH

Handling a sale that was oversubscribed by 28 times and had over 53,000 participants is not as easy as it sounds. In my previous article, I mentioned that our sale mainly focused on two groups:

· Those who were early active members of the MegaETH community

· Those whom we believe will accompany MegaETH for the long term

A few days before the sale ended, @artemis_onchain (our data lead) and I met in Istanbul and started running a lot of simulations. We tried many different ways to "perfectly" measure everyone's contribution, but quickly realized that it was impossible in such a short time, as "contribution" is a multidimensional concept.

So we decided to break the problem into two parts:

· Fairly allocate to existing community members

· Build a data-driven scoring and allocation system for long-term investors

The following sections of this article will detail how we accomplished these two goals and the results we ultimately achieved.

Allocation for Existing Community Members

For the first allocation pool—our existing community—we used the most traditional method: manual allocation.

We relied on our existing community infrastructure, including @Heisenbruh and our moderator network, to compile a list covering members who have been deeply involved since MegaETH came out of stealth mode.

This list includes those who:

· Joined early and remained active

· Helped shape the project's atmosphere and values

· Continued to support us during bear markets and quiet periods

· Provided feedback, signals, and energy before there were any tokens to speculate on

It should be made clear that most of these people did not choose to lock up their tokens. We believe this is completely fine. Their contributions have already been rewarded through time, attention, and trust. In our view, they have already "put in the work."

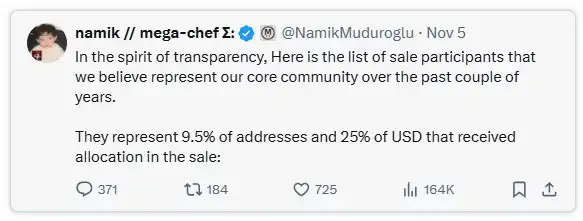

In the spirit of transparency, we hereby publish the list of sale participants whom we believe represent the core community of the past few years.

We know this list can't be perfect, and some people were definitely left out. If you are one of them, I am truly sorry.

Besides this group of community members and the application developers who chose a one-year lockup, others were not personally selected by the team.

Even among this group handpicked by the team, not everyone received the full allocation, and the differences were actually quite significant.

Due to the scale of the sale and market demand, we had to make some trade-offs. But we believe this approach, while respecting those who have supported us all along, also avoids turning the entire sale into a pure "popularity contest."

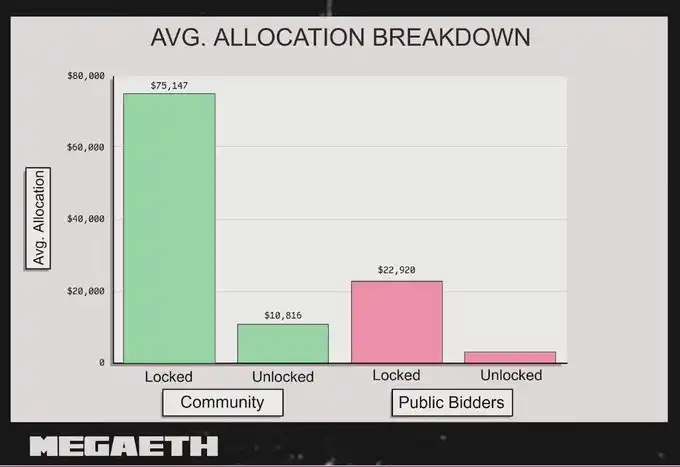

Compared to algorithmic automatic allocation, these users generally received higher quotas. Except for the aforementioned application developers, most participants' shares are not locked up.

Measuring Long-Term Investors

The second allocation pool targets users who participated in the sale through the public process and those who may become long-term holders of MegaETH.

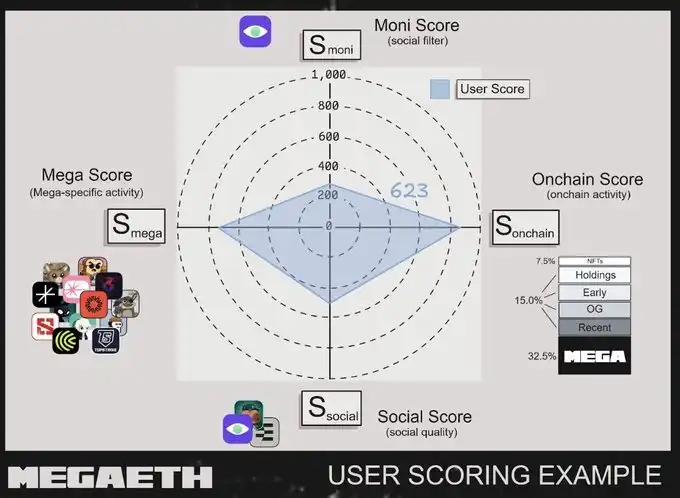

For this part, we wanted to use a more systematic approach. We designed a scoring mechanism that comprehensively considers the following dimensions:

· On-chain activity

· Social signals and organic exposure

· Specific interactions with MegaETH

· Whether participation is viewed as a long-term commitment (e.g., willingness to lock up for one year)

Our goal is not to reward "score farmers," but to identify participants with genuine conviction as much as possible.

Evaluation Metrics

We used four different metrics in the overall scoring system:

1. Moni Score

The Moni score was used as both:

· A basic screening criterion

· A component of the social score

For example:

· My Moni score is about 7,000

· @artemis_onchain's Moni score is about 300

Based on this distribution, we believe setting the Moni score at 50 is a reasonable minimum threshold in most cases. It's not a perfect indicator of user quality, but it is still a useful reference for distinguishing between completely blank accounts and users with at least some activity.

We also discuss and apply alternative options for social verification later in this article.

2. On-Chain Activity Score

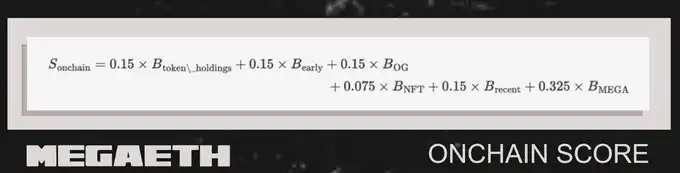

The on-chain activity score consists of multiple dimensions, each with different weights. The overall design is as follows:

· Early Participation (15%): Represents early adopters and those willing to take risks

· OG Credentials (15%): Record of long-term participation in the entire crypto ecosystem

· Asset Holdings (15%): Reference for financial commitment and "skin in the game"

· NFT Activity (7.5%): Reflects current on-chain activity, especially through NFT participation

· Recent Activity (15%): Focuses not just on past participation, but also recent on-chain behavior

· MegaETH-Related Behavior (32.5%): Includes CAP score, MEGA NFT holdings, and specific testnet behaviors directly related to MegaETH

3. Social Score

The social score combines several dimensions:

· Moni Score

· Kaito Data

· Other reference information (such as [ ] and Ethos), used for manual review

We did not rely on a single metric, but instead used multiple tools in combination. This approach helped us effectively filter out obvious bots and low-quality spam accounts, while also better identifying participants truly integrated into the community.

4. Mega Score

Mega Score is specifically for MegaETH participation signals, including:

· CAP score

· MEGA NFT holdings

· Specific testnet behaviors

We used Mega Score in two ways:

1. As part of the on-chain activity score

2. As a basis for certain screening thresholds, ensuring that users truly participating in MegaETH are not squeezed out by generic on-chain "farmers"

Why Locking Up Is Important

We gave significant weight to whether participants chose to lock up $MEGA for one year.

In our view, being willing to lock up for a year in a highly volatile market is a sign of strong conviction. No one can predict what will happen tomorrow, and choosing to lock up for a year is a statement: "I'm not here for short-term trading, I'm here for the long haul."

Participant Screening and Allocation Process

After scoring, we still had to decide two things:

1. Who can enter the allocation list

2. How to convert scores into actual allocation amounts

We divided the process into two categories:

· Locked-up participants

· Non-locked-up participants

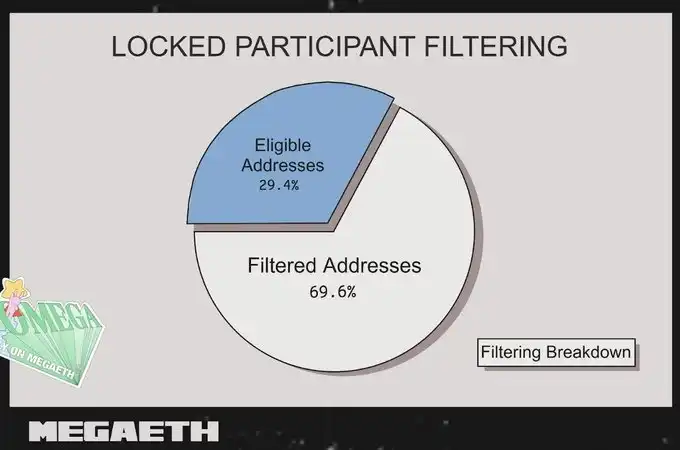

Screening Method for Locked-Up Participants

For users who chose to lock up, they had to meet at least one of the following conditions to be considered:

· Moni score above 50

· On-chain score above 200

· Mega Score shows holding more than one Fluffle NFT

In other words, you need at least one of the following:

· Basic social activity

· Clear on-chain behavior signals

· Strong MegaETH participation record

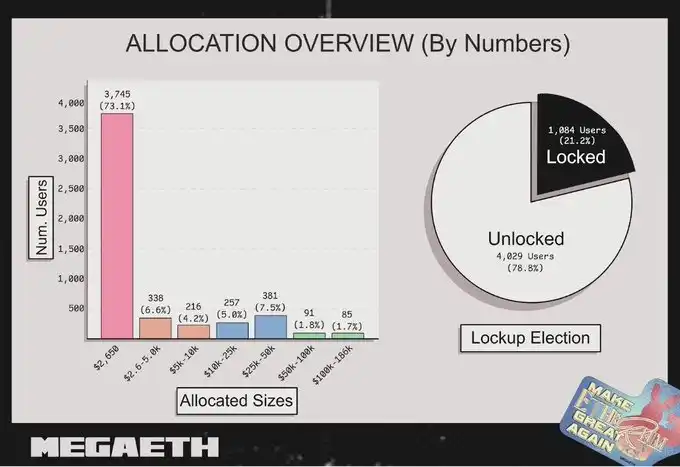

After applying these screening criteria, about 29.4% of locked-up addresses made it onto the allocation list, about 1,000 addresses.

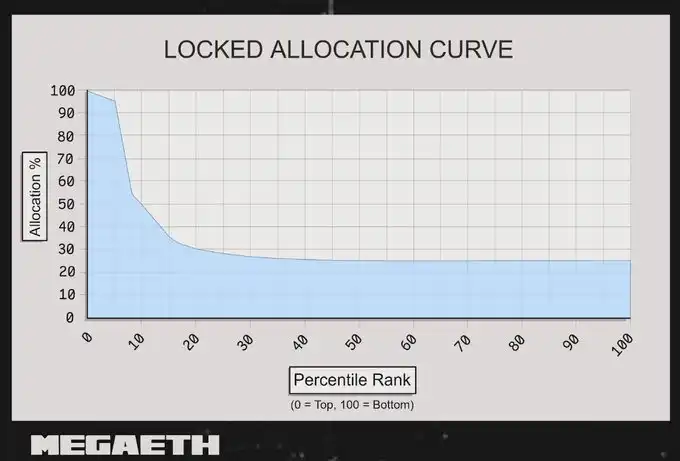

Once a wallet passed the screening, its allocation amount was determined by the final score, which combined on-chain and social signals. We used a segmented continuous curve approach, ensuring a minimum allocation while giving higher rewards to high-scoring users.

The specific allocation logic is as follows:

· Top 5%: Linear decrease, allocation ratio from 100% to 95%

· Next 3% (5%-8%): Rapid decrease, from 95% to 55%

· Next 7% (8%-15%): Continue decreasing, from 55% to 35%

· Remaining 85%: Exponential decay, minimum allocation is 25%

Screening Method for Non-Locked-Up Participants

Non-locked-up addresses had to meet at least one of the following conditions to enter the allocation list:

· Moni score > 200

· Social score > 200

· On-chain score > 300

· Mega Score > 68 (i.e., holding at least one Fluffle)

As long as you are active on-chain, have strong social signals, or have clear participation records on MegaETH, you are eligible to participate without needing to meet all conditions at once.

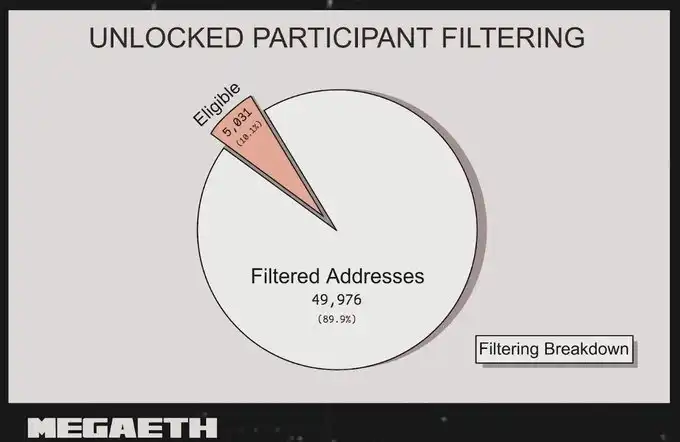

The actual screening result: out of 49,976 non-locked-up participants, 5,031 wallets passed the screening, with an acceptance rate of about 10.1%. Even the minimum allocation was highly competitive. We trust the algorithm's judgment and are also aware that even if some users have a lot of activity and holdings on MegaETH, if other metrics are weak, they may not be selected. But this is a fair mechanism, and we respect the results.

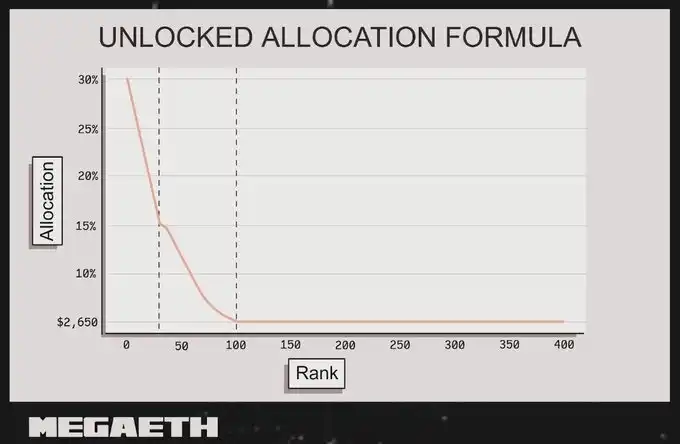

Among those who passed the screening, we ranked wallets based on their comprehensive scores and determined their allocation ratios accordingly.

The higher the ranking, the higher the allocation ratio; as the ranking drops, the allocation ratio gradually decreases. After reaching a certain rank, the curve flattens, and the remaining users receive a uniform minimum allocation.

Small Bids and High Score Protection Mechanism

We noticed that some small bidders were tied in ranking with large bidders. To ensure fairness, we set up a mechanism: the actual allocation amount for any participant must not be lower than that of the five addresses adjacent to their ranking.

For example, @thedefinvestor ranked in the top 15 among non-locked-up participants, but his bid was not high. Based on percentage allocation, he should have received a smaller quota. His neighbors were full-bid participants who received higher allocations.

To acknowledge @thedefinvestor's high ranking, we raised his allocation to be close to his neighbors. This is also the source of some 100% allocation ratios.

Case 1: Low Social Score, High On-Chain Score

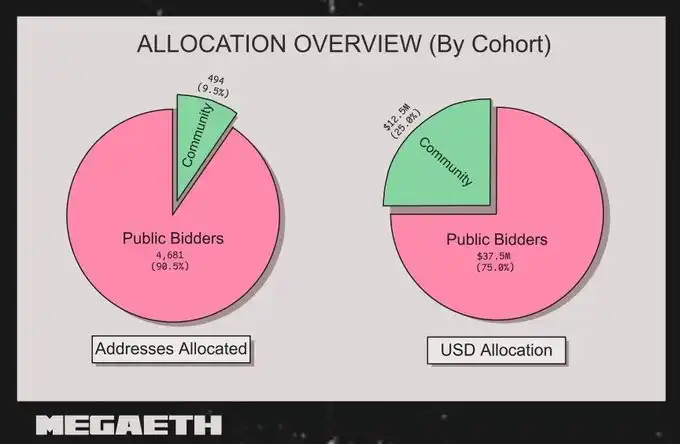

@cp0xdotcom has almost no presence on Twitter and has never tweeted about MegaETH, so his social score is very low. But he still ranked in the top 20 among all participants and received 92% of his locked-up bid.

His strengths are:

· Over 8 years of on-chain history

· Consumed 194 ETH in gas

· Early participation in multiple contracts that later saw widespread adoption

· Interacted with 3,490 unique contracts

· Was active on mainnet for 164 out of the past 180 days

· No NFTs and no MegaETH-related behavior

His case shows: even without social or MegaETH support, as long as you perform well on-chain, you can still achieve a high ranking.

Case 2: Low On-Chain Score, High Social Score

@nics_off is almost the opposite of the above case. The wallet he provided has less than two years of on-chain history, only 1.5 ETH in gas consumption, and interacted with about 150 contracts, resulting in a low on-chain score. But his social score is outstanding:

· Highly active on Twitter

· Ranked 13th on the Kaito MegaETH leaderboard

· Published a large amount of high-quality MegaETH content

These factors placed him 17th among non-locked-up participants and earned him the highest allocation ratio in this group (20%).

His case also shows: having a large number of followers alone is not enough; the social score is a weighted combination of Moni and Kaito, and the quality of MegaETH-related content is far more important than the number of followers.

We saw many similar cases at the top of the leaderboard, especially worth mentioning:

· @barthazian: Ranked first among all users, with excellent performance in all metrics

· @0xMaxBT: Known as the MegaETH testnet legend, the only participant to complete all testnet contract interactions (the only one among 53,000 people)

Sybil Attack Prevention Mechanism

We adopted multiple layers of Sybil protection:

1. Sybil cluster reports from the community and external teams (such as Bubble Maps and Echo) as direct screening criteria

2. Our scoring system itself is unfriendly to Sybil attacks. To get a high score, a wallet must have real and credible on-chain behavior, and low-quality associated addresses usually cannot pass

3. We found some wallets or social accounts associated with multiple KYC bids; once such patterns are detected, all related requests will be voided

4. For wallets that have already received allocations, we will continue to conduct Sybil checks, and if malicious behavior is found, we reserve the right to refund

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DYDX Intensifies DEX Rivalry with Strategic Moves

In Brief DYDX launches zero fee initiative to boost on-chain trading platform usage. The move aims to increase user participation and improve DYDX's market dynamics. DYDX faces challenges with declining TVL and user interest amidst market uncertainties.

Stablecoins Could Push the Fed to Reassess Its Monetary Policy

XRP ETF Appear On DTCC : Is Approval Next ?

Digital Asset Funds See $1.17B Outflows Amid Market Uncertainty