Ethereum News Update: Regulatory Green Light for Staking—US Approves Crypto ETFs Offering 7% Returns

- U.S. Treasury and IRS issued guidance enabling crypto ETFs/trusts to stake assets and distribute rewards, resolving regulatory uncertainties. - The "safe harbor" framework requires single-asset PoS custody, liquidity protocols, and prohibits non-staking activities to avoid securities law violations. - Staking rewards are now taxable income for trusts, boosting yields up to 7% and accelerating institutional adoption of Ethereum/Solana networks. - Industry experts call it a "game changer," removing legal b

The U.S. Treasury Department and the Internal Revenue Service (IRS) have released landmark guidance that permits cryptocurrency exchange-traded funds (ETFs) and trusts to participate in staking digital assets and pass on the resulting rewards to their investors. This marks a major turning point for institutional involvement in the crypto sector

According to the guidance, crypto trusts must meet certain requirements to be eligible for the safe harbor. These stipulations include holding only a single digital asset from a permissionless PoS network, employing a qualified custodian for managing keys, and maintaining liquidity measures to facilitate redemptions

This move fills a crucial gap left by previous regulations, where the SEC's unclear position on staking rewards—often treating them as possible earnings from others' work—kept many institutions on the sidelines

Industry leaders have described the new guidance as transformative. Bill Hughes, who leads global regulation at Consensys, remarked that the safe harbor "eliminates a significant legal obstacle" for fund managers and custodians, making it possible to include staking returns in regulated investment products

The timing of this guidance is notable, coming as efforts continue to resolve the 40-day government shutdown that left IRS and SEC employees furloughed

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×

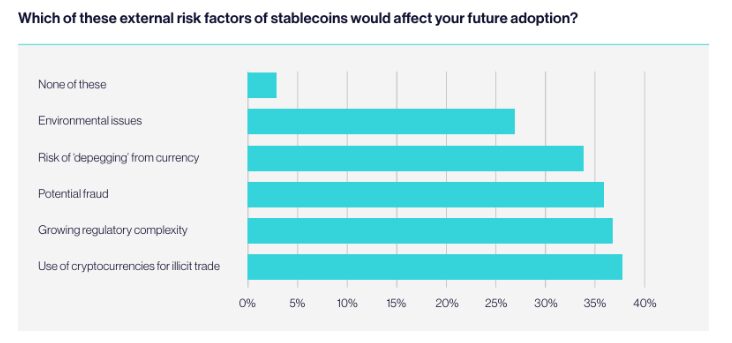

European Tech Startups Eye Stablecoins, But Risks Stall Adoption

Stellar News Today: Turbo Energy's tokenization opens up clean energy investment to everyone

- Turbo Energy partners with Taurus and Stellar to tokenize hybrid renewable energy projects, targeting the $74.43B EaaS market. - The pilot uses blockchain to fractionalize solar storage PPA debt, leveraging Stellar's low-cost infrastructure for transparent green finance. - Tokenization aims to democratize clean energy investment, with Turbo's CEO highlighting scalability and security in AI-optimized storage solutions. - The initiative aligns with sustainable development goals, driving a 12.5% premarket s

Cardano News Update: MoonBull's AI Wager—Will It Surpass Cardano and Ethereum by 2025?

- MoonBull's $590,000 presale gains traction as a 2025 crypto contender, leveraging AI features and community governance. - Cardano partners with Wirex to launch ADA-branded crypto payment cards, aiming to bridge blockchain and traditional finance. - NFT and memecoin markets show 12-11% weekly gains, while Ethereum and TRON compete with MoonBull for 2025 growth narrative. - Regulatory risks and macroeconomic pressures persist, challenging projects like JFrog and Bumble amid crypto market volatility.