ASTER Becomes #1 DEX with $12B Volume – Still 53% Below Peak!

ASTER’s strong rally, fueled by its Phase 4 “Aster Harvest” launch and Coinbase roadmap inclusion, has sparked renewed bullish momentum. With rising trading volume and bullish chart setups, the token could be preparing for a push toward new highs.

The ASTER token is having a breakout week, surging over 12% in the past 24 hours and becoming the top-ranked decentralized perpetuals exchange (perps DEX) globally, with $12 billion in trading volume.

The launch of Phase 4 – Aster Harvest and Coinbase’s decision to add ASTER to its Listing Roadmap have ignited fresh optimism that the project could reclaim its previous all-time high (ATH), despite its price remaining 53% below peak levels.

Phase 4: A Major Milestone in Aster’s Expansion Journey

According to the project’s official announcement, Phase 4, titled Aster Harvest, has officially begun. This phase will allocate an additional 1.5% of the total ASTER supply, distributed evenly across six weekly epochs (0.25% per epoch).

At the same time, Aster DEX has increased its buyback rate to $7,500 per minute, signaling a strong commitment to supply control and long-term price stability.

ASTER’s buyback rate. Source:

ASTER’s buyback rate. Source:

Another key catalyst comes from Coinbase, which has added ASTER to its official listing roadmap. This move is not only a strong publicity boost but also a potential gateway for institutional capital inflows once ASTER secures a complete listing on the US exchange.

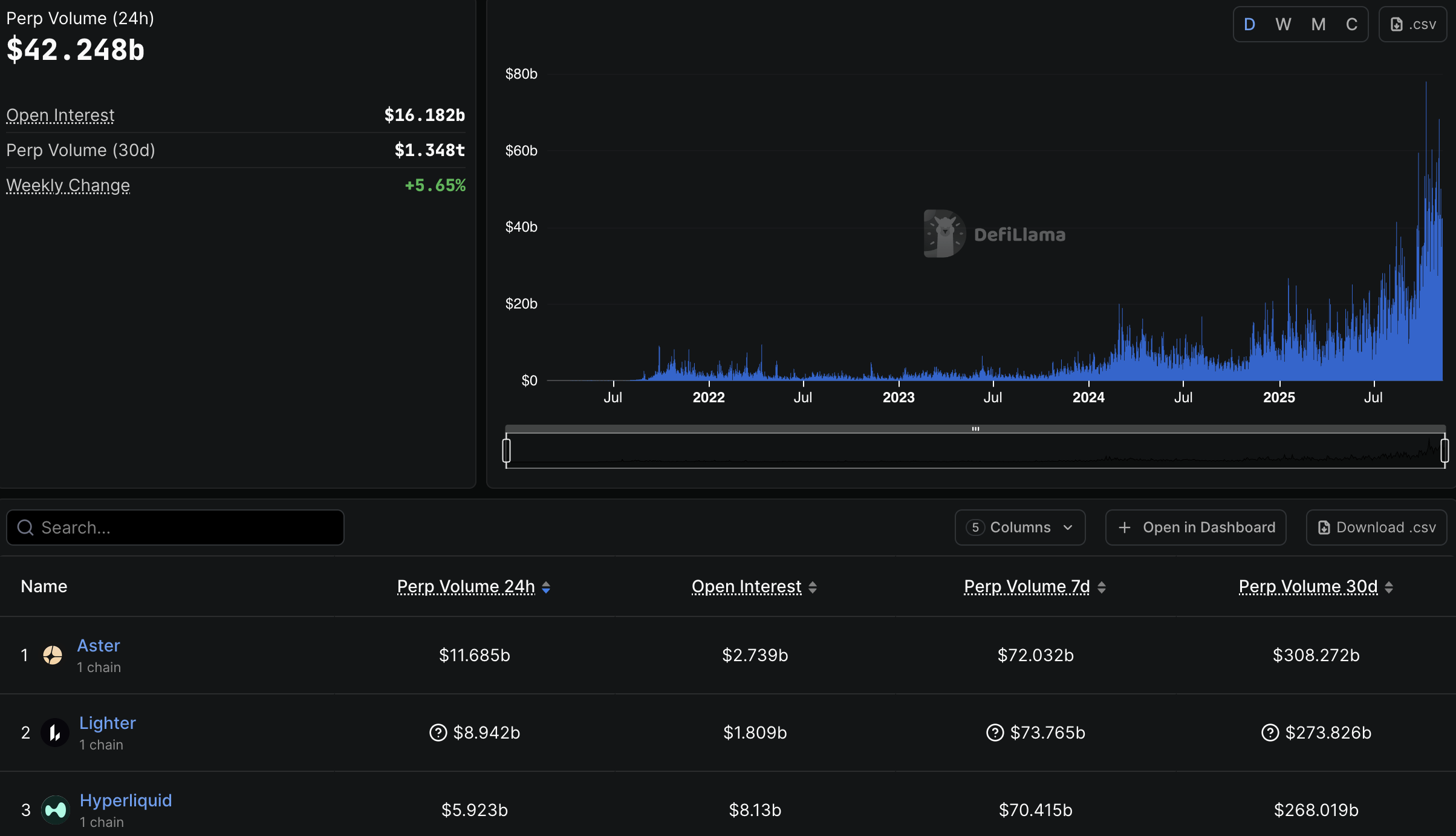

Currently, Aster DEX leads all decentralized perpetual exchanges (perp DEXs) in daily trading volume, with over $12 billion in volume, according to DeFiLlama data. This growth demonstrates Aster’s growing dominance in the perpetual futures segment, a sector increasingly regarded as the “backbone” of next-generation DeFi.

Aster’s trading volume. Source:

Aster’s trading volume. Source:

The combination of an aggressive buyback program and a possible Coinbase listing may act as dual catalysts, propelling ASTER out of its prolonged consolidation phase and into a new growth cycle. However, market liquidity and broader sentiment still pose near-term risks.

Technical Analysis: Signs of a Breakout From an Ascending Triangle

From a technical standpoint, several analysts have noted bullish momentum forming in the ASTER/USDT chart. According to one market observer, a symmetrical triangle pattern is emerging, with a strong rebound from the Point of Control (PoC) support zone. A successful breakout above the triangle resistance could trigger a strong bullish rally.

ASTER/USDT 2H chart. Source:

ASTER/USDT 2H chart. Source:

Another analyst on X highlighted price consolidation within an ascending triangle, with resistance near $1.16 and support around $1.09. A clear move above $1.29 could invalidate the prior bearish structure and open the door to higher targets.

“The most probable scenario now is a clean break above $1.16, followed by a retest that flips the zone into support. Holding that level would confirm breakout strength and open the path toward $1.19 > $1.29,” the analyst commented.

Additionally, analyst Captain Faibik confirmed that the Falling Wedge pattern has finally broken out after 50 days of consolidation, providing another signal in support of a short-term bullish bias.

With rising volume and multiple technical indicators signaling breakout potential, Aster DEX appears well-positioned for another leg upward. Additionally, Aster whales have accumulated $53 million in tokens, signaling renewed confidence and growth potential in the market.

Still, the $1.29–$1.35 zone will serve as a crucial test to determine whether ASTER has enough momentum to challenge its previous ATH.

At the time of publication, ASTER is trading at $1.06, down 3.9% over the past 24 hours, after briefly surging over $1.16. The current price is still 53% below its previous ATH.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Update: Major Investors Commit $9.4M to Ethereum Amid Intensifying $1,800 Price Discussion

- Ethereum's price near $3,500 sparks debate over $1,800 support zone amid mixed technical and on-chain signals. - Whale activity shows confidence, with $9.4M borrowed to buy 1,760 ETH amid strategic liquidity accumulation. - DeFi growth highlights Ethereum's ecosystem strength, as Mutuum Finance raises $18.7M and expands token holder base. - Institutional moves by Intchains and Bitmine reinforce Ethereum's role in bridging traditional finance and digital assets. - Market focus shifts toward Ethereum's lon

Ethereum News Update: Major Crypto Investors Increase Bets with $22 Million and 20x Leverage on ETH and SOL

- Crypto whales opened $22M 20x leveraged longs on ETH and SOL via Hyperliquid, signaling bullish market sentiment. - Whale 0x8d0...59244 (31% win rate) and 0x9263 (shifted shorts to longs) collectively hold $30M in positions, with unrealized gains exceeding $8.5M. - Analysts warn 20x leverage amplifies risks, as minor price dips could trigger liquidations despite potential 5-10% gains if key resistance levels are breached. - Market observers link whale activity to rising on-chain volumes on Ethereum and S

Crypto's Race for Innovation: Will It Stay Ahead of Regulation and Market Fluctuations?

- Crypto market faces institutional adoption vs. volatility/regulation, with Bitcoin below $100,000 and extreme fear metrics. - Tether/BlackRock investments and Ethereum treasury growth highlight blockchain infrastructure's strategic appeal to institutions. - Trump's meme coin dinner and tokenization innovations signal crypto's cultural/mainstream integration despite security/AI risks. - Market uncertainty persists as delayed data, order-book weakness, and regulatory rulings challenge investor confidence.

Bitcoin News Today: Bitcoin Faces $95K Standoff: Death Cross Clashes with Bullish Optimism Amid Bear Market Battle

- Bitcoin fell to a six-month low near $94,000, with a "death cross" signaling prolonged bearish trends and triggering investor alarm. - Technical indicators show mixed signals: RSI near oversold levels and key support at $93,000–$95,000 tested, while structural resistance looms above $96,500. - Market fear intensified as the Crypto Fear & Greed Index hit 10, whale activity surged, and institutional outflows worsened amid ETF uncertainty and macroeconomic shifts. - Analysts note potential bullish signs lik