Cardano Looks Dormant, But Whales Quietly Scoop Up $200 Million Worth of ADA

Cardano whales are quietly accumulating ADA at the fastest pace since May, echoing patterns that preceded past bull runs. As consolidation continues and the Summit 2025 nears, on-chain data hints at a potential upside for ADA.

Although Cardano (ADA) remains among the top 10 altcoins by market cap, its price is still hovering around 2024 levels. While many holders express disappointment with ADA’s performance, accumulation continues quietly beneath the surface.

What evidence supports this trend, and what impact could it have? The following analysis draws on on-chain data and expert insights.

How Have Cardano (ADA) Whales Been Accumulating in November?

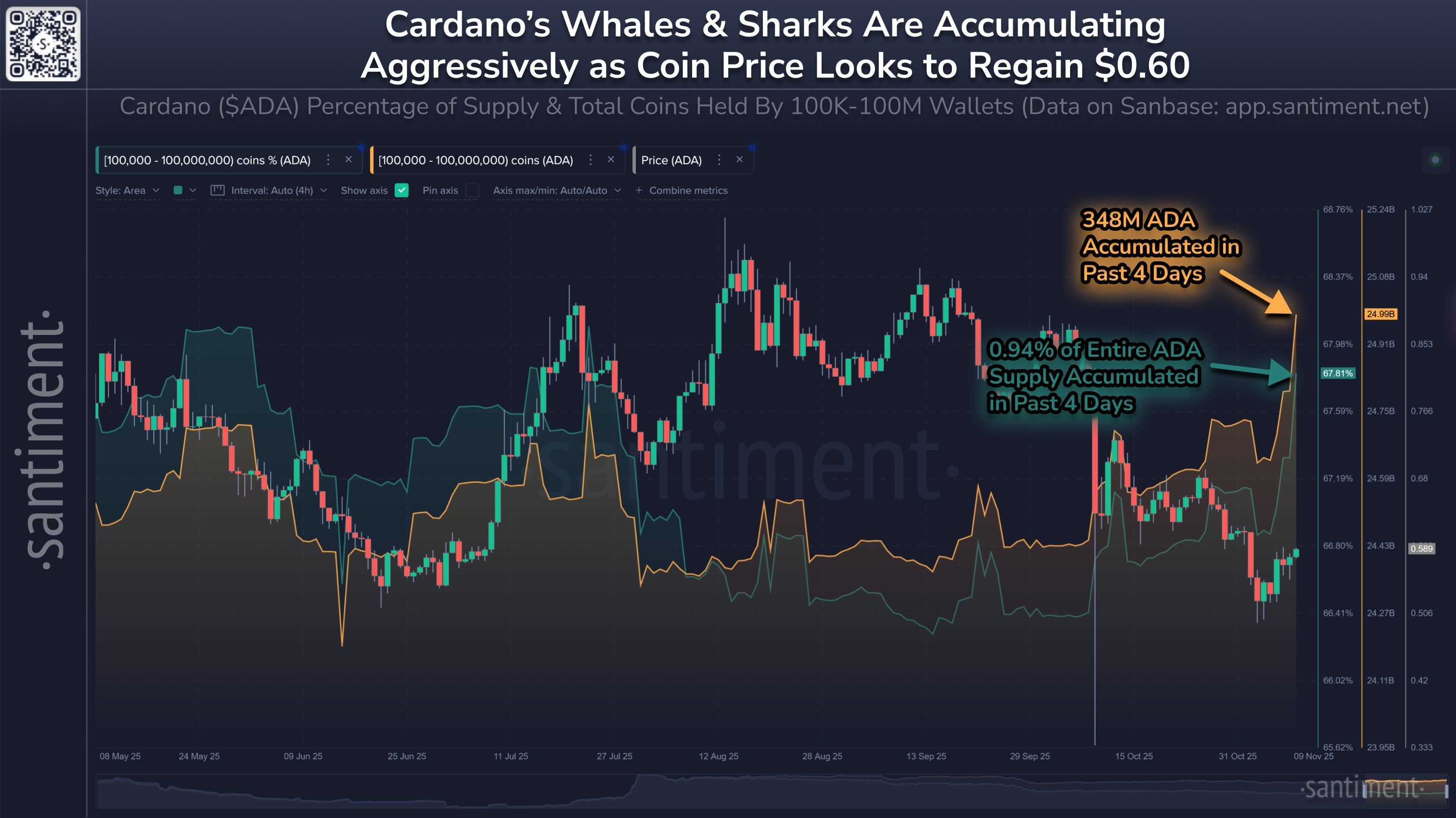

Data from Santiment shows that “whales” and “sharks” — investors holding between 100,000 and 100 million ADA — have been accumulating heavily in a short period.

Over the past four days, these large holders have purchased 348 million ADA, valued at approximately $204.3 million, which represents 0.94% of the total ADA supply.

Cardano Whales Accumulation. Source:

Santiment

Cardano Whales Accumulation. Source:

Santiment

This marks the strongest accumulation since May. Notably, this buying activity comes as ADA’s price has corrected by more than 30% from last month and remains below $ 0.60.

While many retail investors appear to have exited, whales seem to view the pullback as a chance to secure better entry positions. With smaller traders sidelined, smart money is accumulating quietly, creating minimal volatility. Analysts see this as a potential signal for an upcoming bullish phase.

“While many call Cardano (ADA) ‘dormant,’ the charts whisper a different story — millions of ADA are quietly being scooped up by whales and institutions. On-chain data shows this ‘silence’ isn’t weakness — it’s precision accumulation. With retail out of the picture, smart money is loading up without triggering alarms.” — BeLaunch.

Historical Patterns Suggest Possible Rally

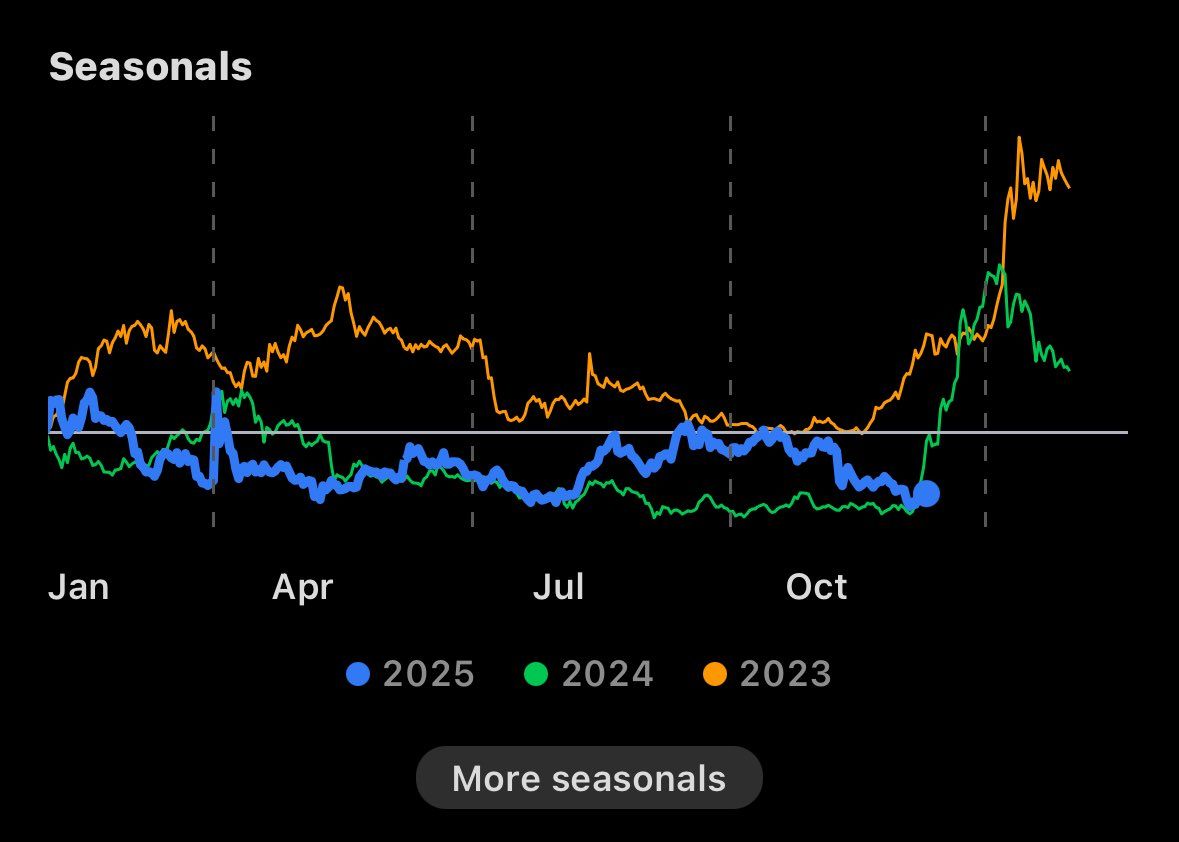

Historical ADA price patterns suggest that strong rallies frequently follow extended consolidation periods of approximately ten months.

The DApp Analyst highlighted this trend, comparing 2025’s behavior with that of the previous two years. In both 2023 and 2024, ADA experienced powerful bull runs following prolonged consolidation phases, delivering gains of 200% to 300%.

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Now, in October 2025, conditions appear similar to those of historical setups — potentially forming a base for another upward move. Combined with current whale accumulation, this alignment strengthens the bullish outlook.

“Will 2025 be like ‘23 & ‘24? $ADA has spent the entire year consolidating between $0.5 and $1.3. Can we finally get a breakout?” — The DApp Analyst.

November also brings the Cardano Summit 2025 in Berlin. Statements from project leaders at the event are expected to renew optimism among ADA investors this month.

However, overall market sentiment remains cautious. The altcoin season index sits at a low 39 points, reflecting lingering fear — a potential headwind for ADA’s recovery despite growing accumulation and bullish setups.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: S&P Rating Drop Highlights Tether’s Risky Asset Holdings and Lack of Transparency

- S&P downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% BTC exposure exceeds overcollateralization margins, risking undercollateralization if prices drop. - CEO dismisses critique as traditional finance bias, claiming no "toxic" assets in reserves. - Regulators intensify scrutiny as stablecoin centralization risks emerge amid $184B USDT circulation. - S&P urges Tether to reduce risky assets and enhance reserve disclosure to rebuild trust.

Dogecoin Latest Updates: Is a Repeat Performance on the Horizon? Holding $0.15 May Signal a 611% Rally for Dogecoin

- Dogecoin (DOGE) stabilized near $0.15 support, triggering historical 611% rally potential to $1 by 2026. - Grayscale's GDOG ETF and pending Bitwise BWOW ETF mark institutional adoption, though initial inflows remain muted. - Technical indicators show mixed momentum with RSI near oversold levels and key resistance at $0.16. - Market remains divided as ETF-driven liquidity and on-chain infrastructure contrast with macroeconomic and regulatory risks.

Turkmenistan’s Approach to Cryptocurrency: Centralized Oversight Amidst a Decentralized Age

- Turkmenistan legalizes crypto trading under strict 2026 regulations, granting state control over exchanges, mining , and custodial services. - Law mandates KYC/AML compliance, bans traditional banks from crypto services, and classifies digital assets into "backed" and "unbacked" categories. - Central bank gains authority to operate state-monitored distributed ledgers, contrasting with decentralized approaches in South Korea and Bhutan. - Framework aims to balance innovation with oversight, testing Turkme

Bitcoin News Update: Has $162 Billion Left Crypto Due to Institutional Buying or a Broader Market Pullback?

- BlackRock deposited 4,198 BTC and 43,237 ETH into Coinbase amid crypto sell-offs, despite $355.5M Bitcoin ETF outflows. - A 1.8M BTC ($162B) overnight exchange withdrawal sparks speculation about institutional accumulation or portfolio rebalancing. - $40B in BTC/ETH exchange inflows and record $51.1B Binance stablecoin reserves highlight institutional demand for regulated crypto products. - On-chain data shows 45% of large deposits (≥100 BTC) and 1.8M BTC withdrawals, indicating mixed market sentiment ah