Is the x402 Crypto Ecosystem Losing Steam? What the Data Shows

The AI-powered x402 network faces a sharp activity slowdown, yet new Chainlink and Bio Protocol integrations have kept adoption rising and pushed its market cap above $12 billion.

The x402 ecosystem has experienced a significant decline in activity, with its 30-day trading volume plummeting by nearly 90% and transaction counts falling in tandem.

The drop raises broader concerns about whether the crypto meta may finally be losing momentum.

Sharp Decline in Trading Activity Signals Waning Interest in x402

x402 is an internet payment protocol built to enable autonomous AI agents to execute verifiable, automated on-chain payments through standard web infrastructure.

BeInCrypto previously reported that the ecosystem gained significant traction in October, drawing widespread attention from the crypto community. In fact, many low-cap coins within the x402 ecosystem saw their values quadruple amid the surge in interest.

However, the latest data from x402scan highlights a modest downturn in ecosystem activity. On November 3, the protocol processed about 3 million transactions alongside $2.8 million in daily trading volume.

The latest snapshot shows the transaction counts slipped to 1.3 million, marking a 56% decrease. Meanwhile, the trading volume has also dropped to around ₹329,000. Coinbase accounted for most of the ecosystem activity, handling more than 873,500 requests and $306,730 in volume in the last day.

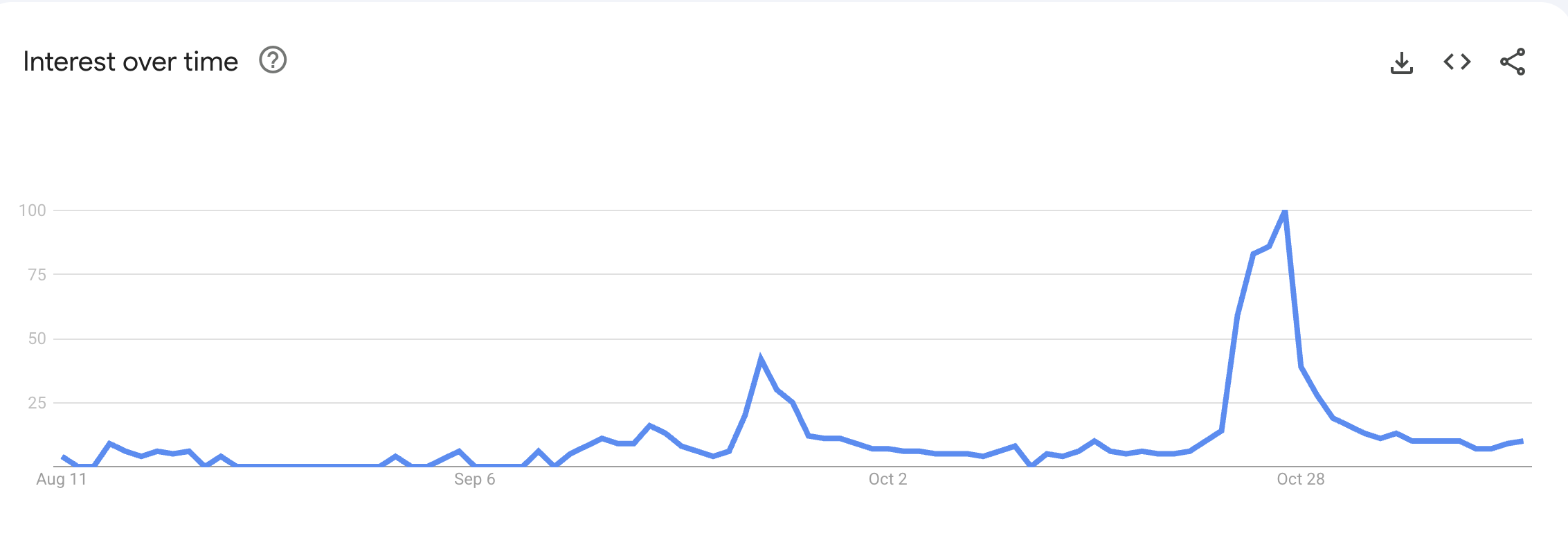

The contraction has also been echoed in retail sentiment. Google Trends shows that global search interest in “x402” dropped from a peak score of 100 to 10, signaling a decline in public attention.

x402 Retail Interest. Source:

Google Trends

x402 Retail Interest. Source:

Google Trends

Ecosystem Growth Remains Strong

Despite this, the x402 protocol has continued to build institutional credibility. Last week, Chainlink (LINK) integrated an X402 endpoint into its Chainlink Runtime Environment (CRE).

Through this update, autonomous agents can now discover CRE workflows, verify outcomes using Chainlink, and settle directly on-chain. Furthermore, it allows workflow creators to earn per use.

“This integration also unlocks programmatic payouts and a reusable workflow marketplace. For example, an insurer covering farmers against drought can verify rainfall through CRE and route instant onchain payouts all without a claim filed,” Coinbase posted.

In parallel, Bio Protocol (BIO), one of the notable projects in Decentralized Science (DeSci), revealed that its agents now use X402 and embedded wallets to enable instant USDC micropayments on Base, a clear sign of growing real-world adoption across emerging decentralized sectors.

“What this unlocks: Hypothesis review marketplaces, AI agents pay each other and human researchers for specialized analysis, Pay-per-query instead of subscriptions, On-demand access to premium datasets,” the team noted.

With these integrations, the total market capitalization of the X402 ecosystem has increased to over $12 billion from just $800 million in late October — a gain of more than 1,300% in approximately two weeks.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Are Altcoins So Stagnant? Experienced Analyst Shares Three Reasons and a Way Out

A Viral XRP Price Debate Just Became a $30 Million Federal Court Battle

Here are 10 states where your Social Security benefits stretch the most

Final inflation report for 2025 will provide insight following data interruptions