3 Signs Pointing to Mounting Selling Pressure on Pi Network in November

Pi Network’s price may hit new lows in November as massive token unlocks, rising exchange reserves, and weak liquidity weigh on sentiment. Yet, loyal supporters remain hopeful that long-term fundamentals will eventually spark a rebound.

Trading data for Pi Network (PI) signals a bearish outlook for its price in November. Although Pi has already dropped more than 90% from its peak, market forces may continue to push the price lower.

What are the warning signs, and how do Pi’s loyal supporters explain them?

A Massive Amount of Pi Tokens Being Unlocked

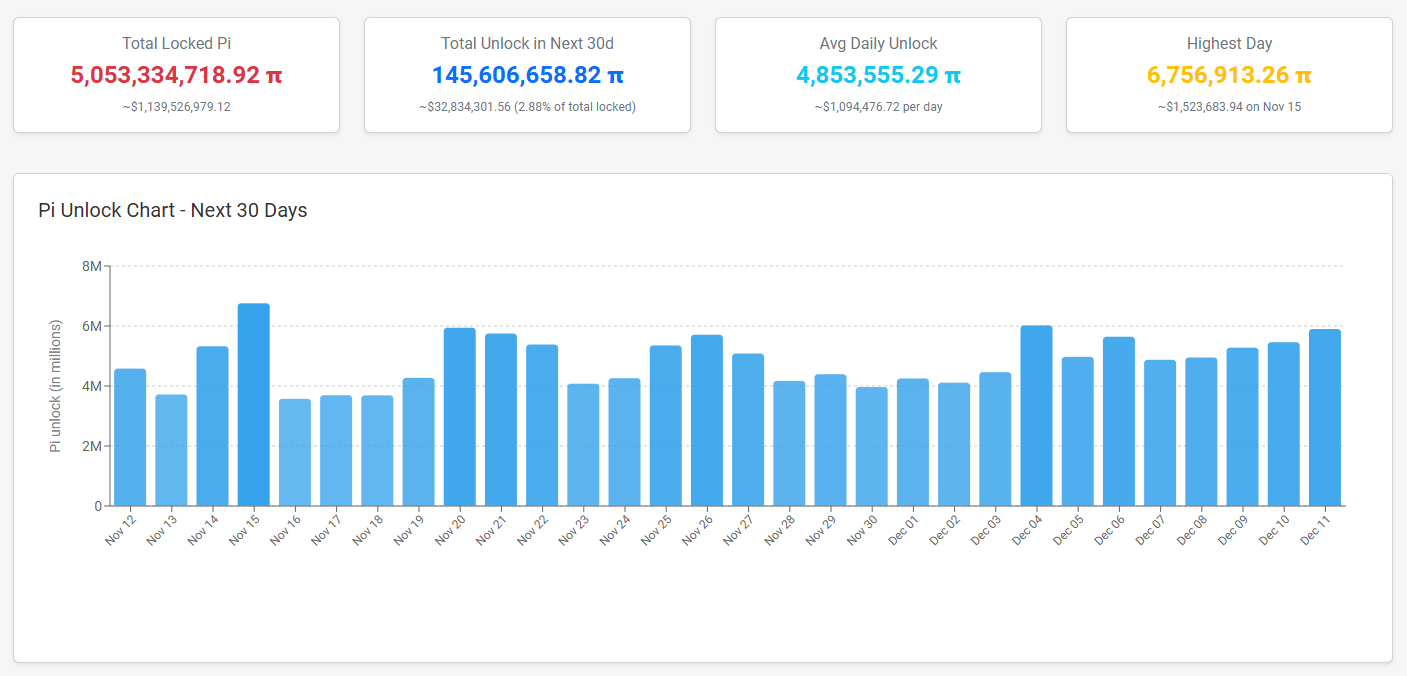

First, Piscan data shows that the number of Pi unlocked per day is up to 4.85 million PI, and the number of Pi unlocked in the next 30 days is up to 145 million Pi.

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Piscan data also reveals that in December, more than 173 million Pi will be unlocked — the highest monthly unlock volume until September 2027.

This steady and increasing unlock pressure is likely to persist through the end of the year, creating a significant obstacle to any price recovery on exchanges.

Rising Exchange Balances Indicate Continuous Selling Pressure

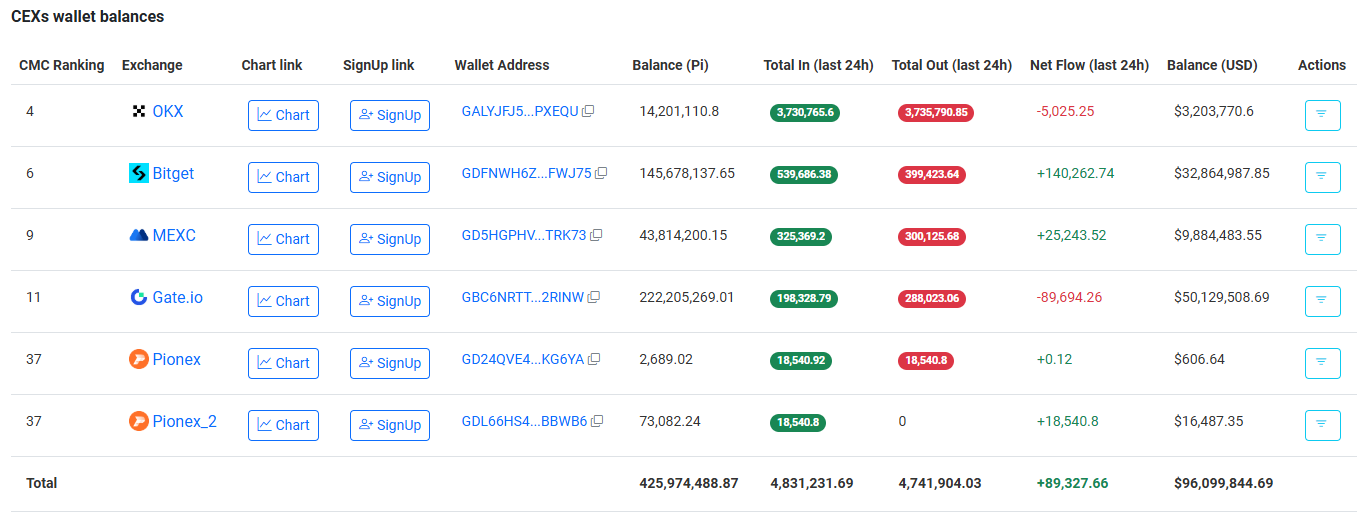

The amount of Pi held on exchanges continues to increase in November.

Pi Supply on Exchanges. Source:

Piscan

Pi Supply on Exchanges. Source:

Piscan

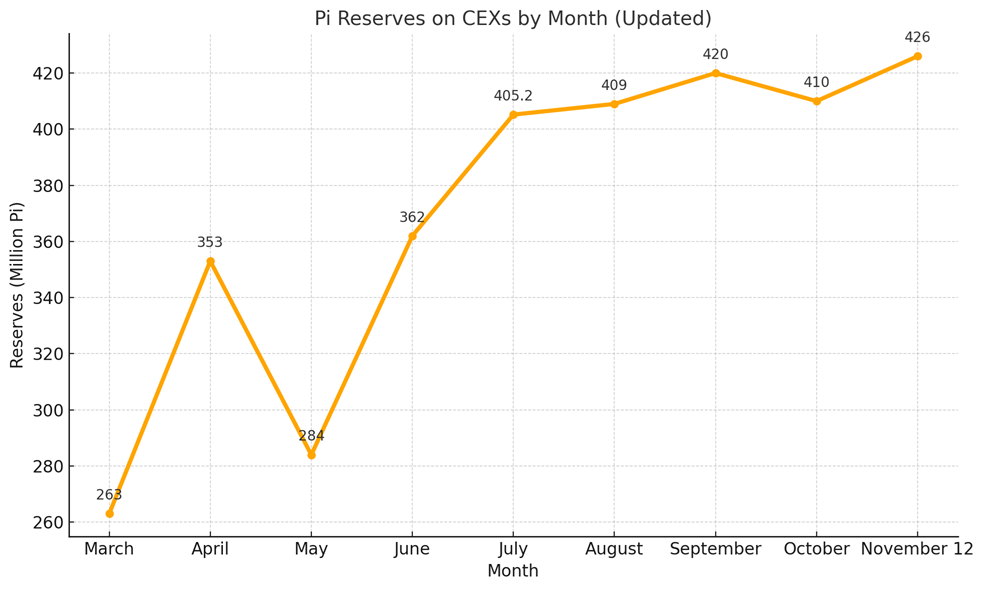

According to Pi Network’s early-month report, there were about 423 million Pi on exchanges. By mid-November, that figure had climbed to nearly 426 million Pi, marking an all-time high.

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Such growth in exchange reserves indicates that exchanges now hold more Pi tokens, ready for trading or sale, which could put downward pressure on prices.

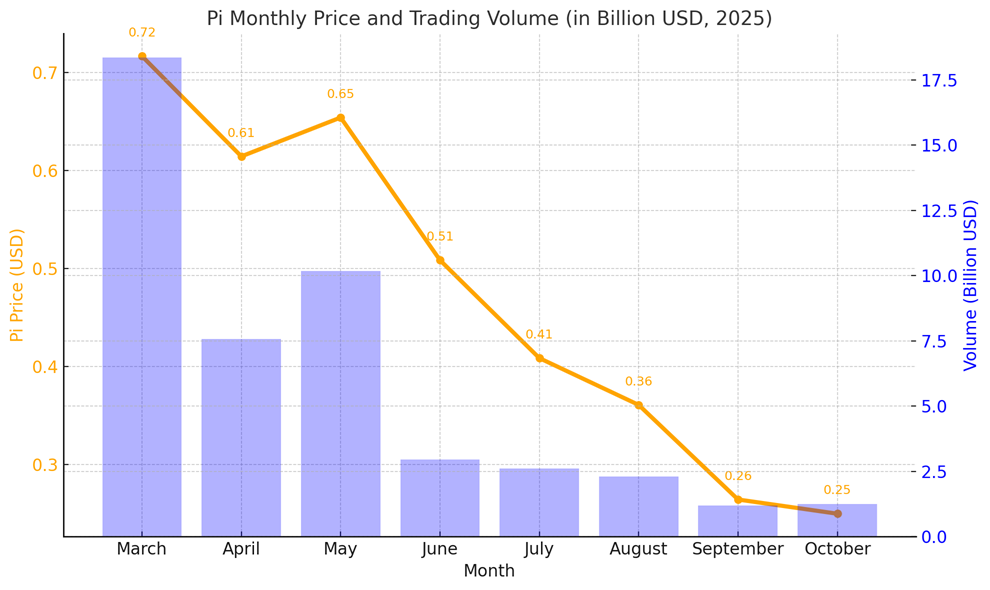

Weak Trading Volume Reflects Low Market Activity

Spot trading volume for Pi on centralized exchanges has shown little improvement in November. The 24-hour trading volume currently hovers around $30 million.

CoinMarketCap data indicates that Pi’s monthly trading volume fell to just $1.2 billion last month. Both price and trading volume have declined in parallel.

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Weak liquidity, along with the constant unlocking and inflow of Pi to exchanges, could intensify the downward price movement.

Pi Supporters Remain Confident Despite the Pressure

Despite the bearish signals, Pi supporters remain optimistic.

An X account named Dao World, identifying as a Pioneer, argued that while Pi has a large maximum supply, the actual circulating amount is only around 3 billion. The Pi Core Team, he noted, has not been aggressively selling.

He also suggested that a few market makers (MM) on certain exchanges mainly control Pi’s current price. Once selling pressure is fully absorbed, he believes the price could rebound.

Even though $Pi has a large max supply, considering that the CT has not been aggressively selling tokens and the actual circulating supply is only a little over 3B, and price action is largely managed by MM on a few exchanges — am I the only one who thinks that when it’s time for… pic.twitter.com/0GUIXfx2EF

— Dao world November 11, 2025

Several other Pioneers share this view, claiming that the current $0.20 range presents a buying opportunity — one they expect will be remembered fondly in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEI Faces a Turning Point: Will It Be a Death Cross or a Golden Cross?

- SEI , Sei's native token, shows early recovery signs amid crypto market slump, with technical indicators suggesting potential breakout from prolonged consolidation. - Despite 2.83% 24-hour decline to $0.17, increased $114.1M trading volume and TD Sequential buy signals highlight critical inflection point potential. - Market analysis identifies $0.1756 support and $0.1776 resistance levels, with death cross risks below $0.1745 and golden cross potential above $0.1787. - Fear/greed index at 25 reflects ext

Bitcoin News Update: CFTC's Broader Role in Crypto Regulation Ignites Discussion on Clearer Rules

- U.S. lawmakers propose expanding CFTC's crypto oversight via a bill reclassifying spot trading, diverging from SEC's enforcement approach. - Harvard University invests $443M in BlackRock's IBIT ETF, reflecting institutional confidence in crypto as a legitimate asset class. - DeFi projects like Mutuum Finance raise $18.7M in presales, leveraging regulatory momentum and transparent on-chain credit systems. - RockToken's infrastructure-backed crypto contracts attract long-term investors with structured yiel

DASH Aster DEX's Latest On-Chain Growth and What It Means for DeFi Liquidity

- DASH Aster DEX leads 2025 DeFi shift with hybrid AMM-CEX model and multi-chain support (BNB, Ethereum , Solana), boosting TVL to $1.399B and Q3 daily trading volumes of $27.7B. - Platform's 1,650% ASTER token price surge post-TGE attracted 330,000 new wallets, with 94% of BSC-USD volume ($2B/day) driving institutional adoption via Binance/YZi partnerships. - ASTER token mechanics enable 80% margin trading, 5-7% staking rewards, and governance rights, while annual 5-7% fee burns create scarcity and align

Astar 2.0: Leading a New Generation of DeFi and Cross-Chain Advancements

- Astar 2.0 introduces a zkEVM mainnet and cross-chain interoperability, slashing gas fees and enabling 150,000 TPS with 2025 scalability goals. - Strategic partnerships with Mazda, Japan Airlines, and Sony demonstrate blockchain's real-world applications in logistics, loyalty programs, and digital asset tokenization. - Q3 2025 data shows $2.38M DeFi TVL growth and 20% active wallet increase, alongside a $3.16M institutional ASTR token acquisition. - The platform aims to solidify its role as a foundational