Bitcoin Is Now Facing “Historical Recovery Barrier” Amid Heightened Market Churn

Bitcoin is struggling to regain strength as heightened volatility and speculative trading keep prices below $105,000. A breakout above resistance could spark recovery toward $108,000.

Bitcoin’s price has struggled to regain strength since late October, with multiple failed recovery attempts extending its decline.

The leading cryptocurrency has been oscillating near critical support levels as on-chain indicators reveal emerging signs of weakness. Rising volatility and a lack of directional conviction continue to define market behavior.

Bitcoin May Face Resistance

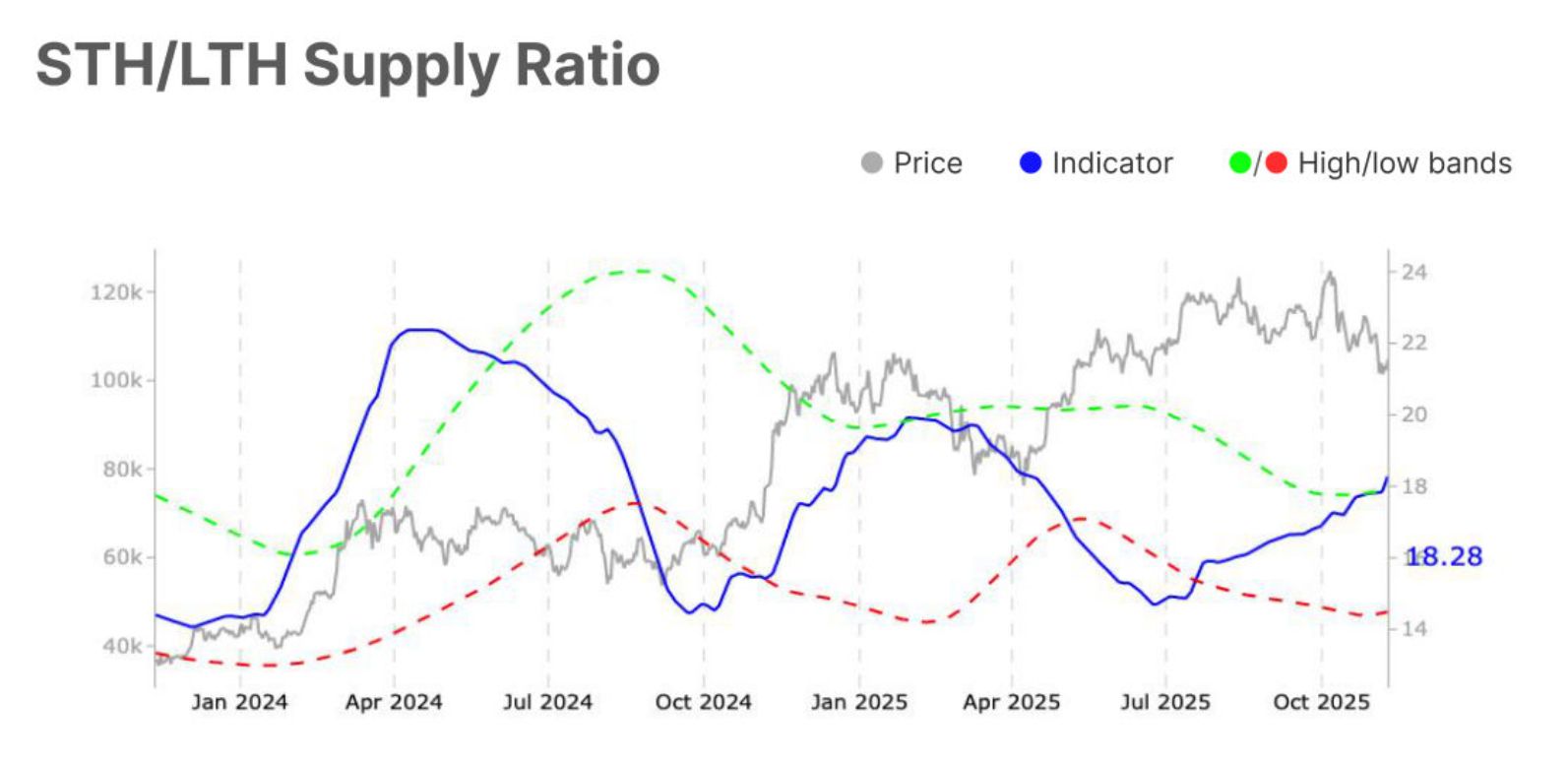

The Short-Term Holder to Long-Term Holder (STH/LTH) Supply Ratio recently rose to 18.3%, exceeding the upper band of 17.9%. This signals elevated speculative activity as short-term traders dominate market movements. Increased turnover without sustained price direction has led to heightened volatility in Bitcoin’s trading environment.

The surge in this ratio also suggests that traders are quickly shifting between profit-taking and accumulation phases. As a result, market churn has intensified, leaving Bitcoin vulnerable to sharp but short-lived price swings.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin STH/LTH Supply Ratio. Source:

Glassnode

Bitcoin STH/LTH Supply Ratio. Source:

Glassnode

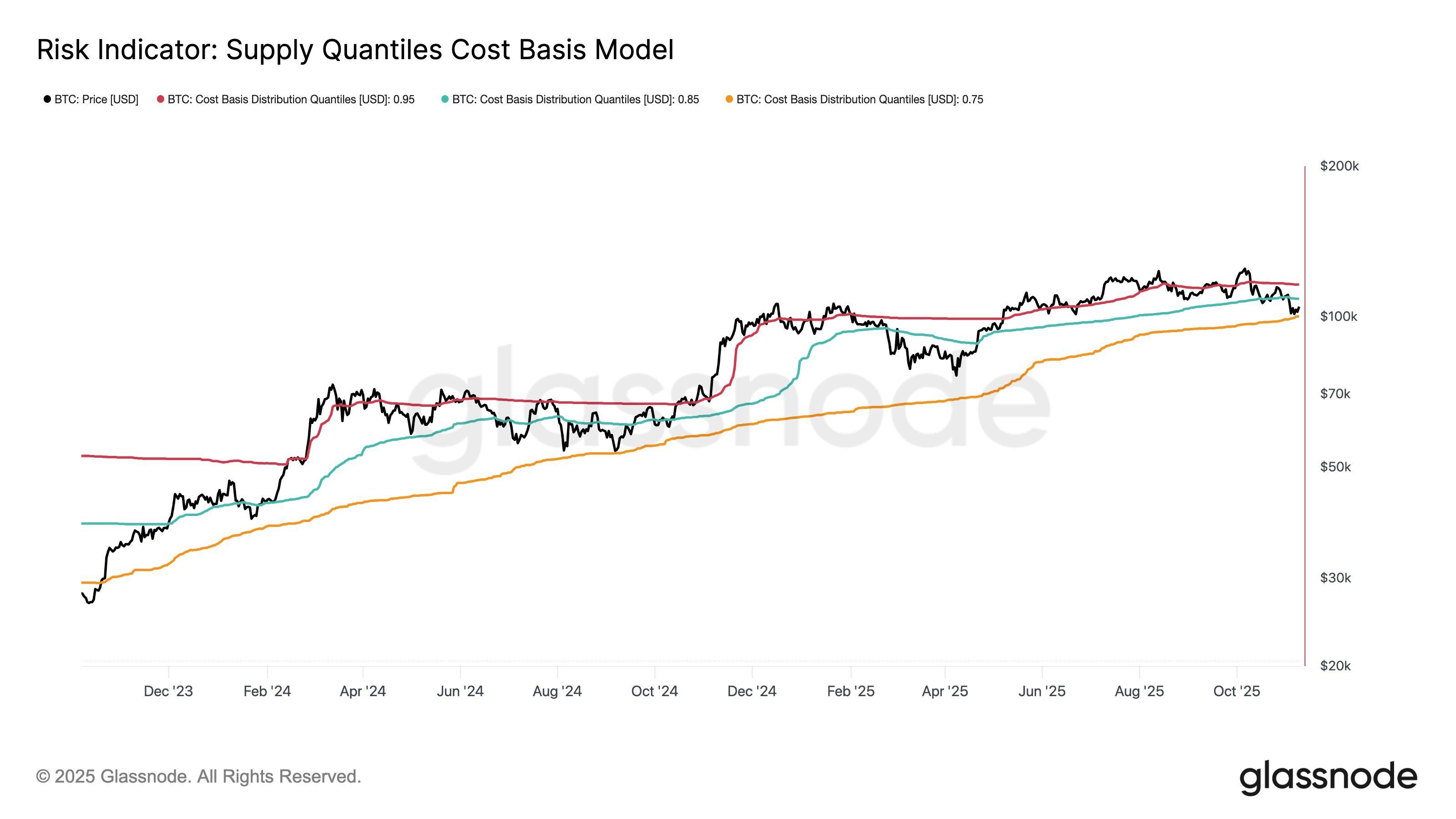

According to the Supply Quantiles Cost Basis model, Bitcoin has rebounded from the 75th percentile cost basis near $100,000 and is consolidating around $106,200. This area reflects a critical psychological and technical zone for traders, marking a temporary stabilization following weeks of selling pressure.

The next resistance lies at the 85th percentile cost basis of $108,500, which has historically capped recovery attempts during similar phases. The model’s data suggests Bitcoin’s upside may remain limited in the short term.

Bitcoin Supply Quantiles Cost Basis Model. Source:

Glassnode

Bitcoin Supply Quantiles Cost Basis Model. Source:

Glassnode

BTC Price Breakout Awaited

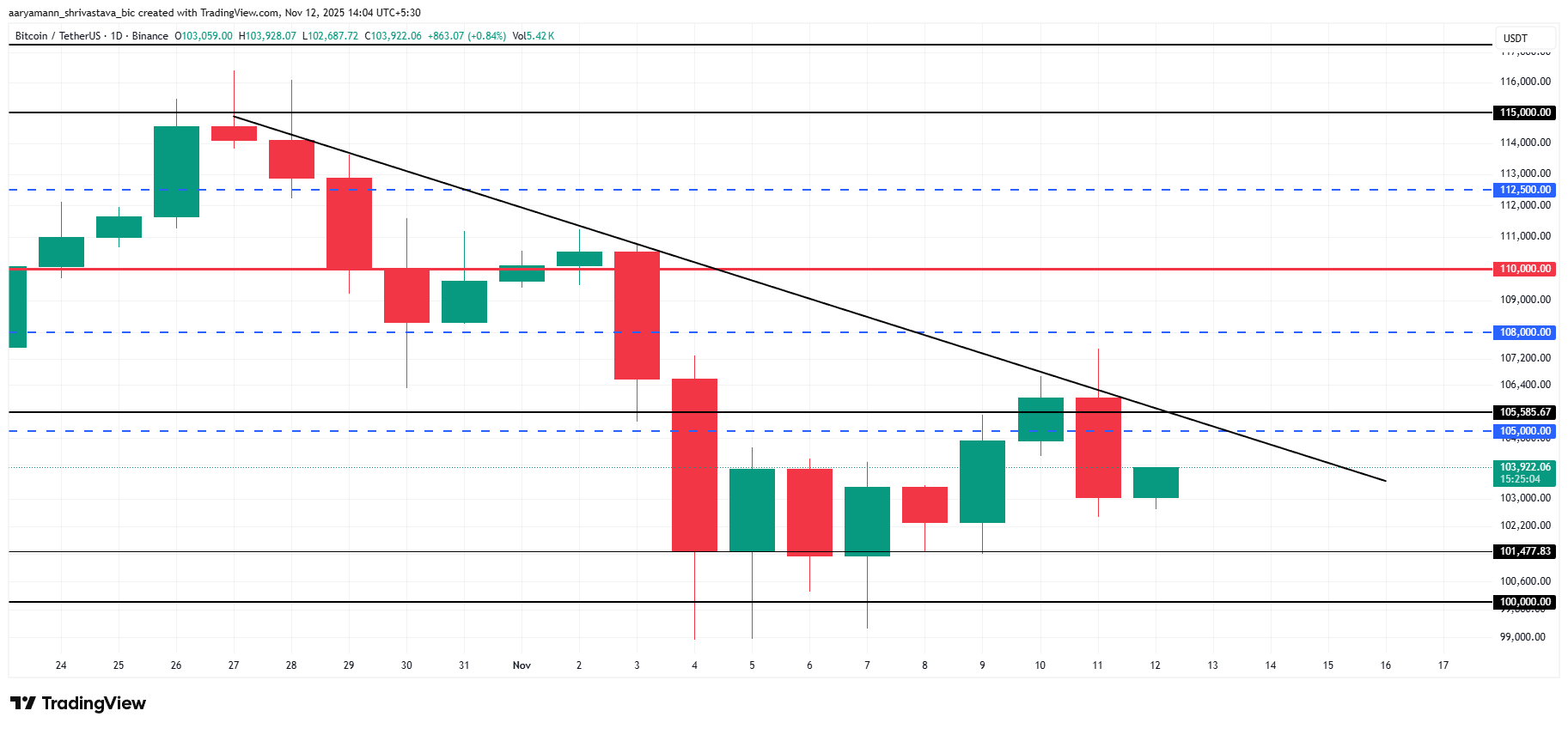

Bitcoin’s price is currently at $103,922, struggling to overcome the downtrend that has been active for nearly two and a half weeks. The cryptocurrency has failed twice to breach this resistance, reinforcing the strength of bearish market sentiment.

At present, Bitcoin trades below $105,000 but remains above the $101,477 support zone. This area is likely to form a consolidation base amid persistent volatility and cautious investor behavior.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If bullish momentum strengthens, Bitcoin could break past $105,000 and challenge resistance near $108,000. Successfully flipping this level would mark the first significant recovery since October, signaling renewed optimism across the broader crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZKP's Build-First Movement: $100M Infrastructure Set, Speculation Not Permitted

- ZKP’s $100M pre-launch infrastructure includes $17M in Proof Pods hardware, enabling immediate global deployment post-presale. - The project’s real-time tracking dashboard links rewards to device performance and market prices, ensuring transparent, self-stabilizing economics. - Daily on-chain auctions distribute 200M tokens proportionally, eliminating gas wars and creating mathematically verifiable fairness for all participants. - Institutional interest grows as ZKP’s encrypted AI architecture attracts e

Solana's Latest Price Swings and Network Stability: Should Investors See a Chance to Buy or a Reason for Caution?

- Solana (SOL) demonstrates 2025 network resilience with 16-month uptime, 200M+ daily transactions, and 1M+ TPS via Frankendancer upgrades. - Price volatility sees 48% pullback from $293 high to $153, driven by regulatory risks, macroeconomic shifts, and external shocks like Sharps Technology's treasury losses. - Institutional adoption (e.g., VanEck's $1B ETF) and 50% staking growth signal long-term potential, though daily 6% price swings highlight market sentiment risks. - Network stability remains intact

Ethereum News Update: Ethereum Reaches Pivotal Moment as Large Holders Accumulate Amid Weakening Technical Indicators

- Ethereum (ETH) near $3,100 tests critical support as bearish technical indicators clash with aggressive whale accumulation of $53.91 million in a week. - Key metrics show price below 200-day EMA and RSI near oversold levels, while whale positions grew by 180K ETH amid $107M ETF outflows. - Institutional buyers like Tom Lee's BitMine add $29.14 million to holdings despite $120M unrealized losses, contrasting BTC's $523M ETF inflows. - Macroeconomic risks persist with Fed hawkishness and declining network

Fed Faces Delicate Balancing Act: Weighing Inflation Concerns Against Labor Market Challenges in December Decision

- The Fed faces a December meeting split over rate cuts, with dissenters like Lorie Logan opposing action due to high inflation and Christopher Waller advocating easing to address labor market weakness. - Logan argues current policy balances inflation control with gradual labor market adjustments, warning against premature cuts without clear progress toward 2% inflation. - Waller supports a 25-basis-point cut, citing deteriorating hiring trends, while facing resistance from officials demanding stricter cri